Euro V2O5 down Euro V2O5

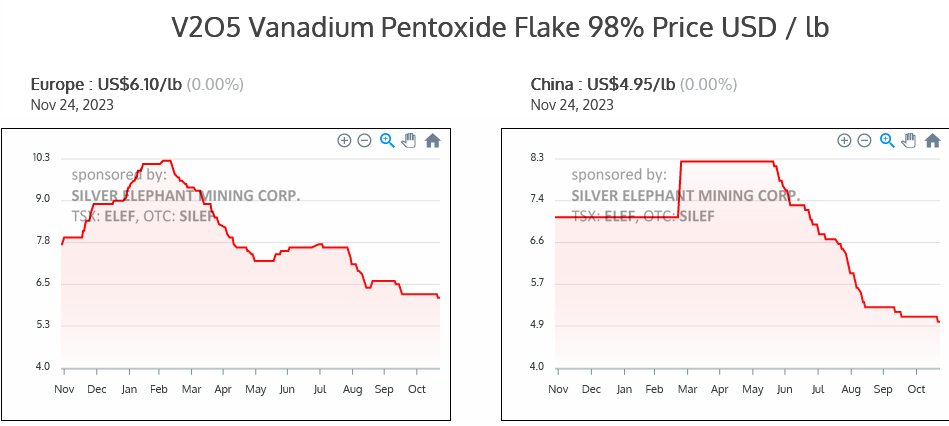

Friday Nov 24 2023: Fastmarket Euro V2O5 min 98 in warehouse Rotterdam, Mid-Price down ~3%. The Current Mid Price must be somewhere in the low US$6.00/lb range, imho. It looks even worse on vanadiumprice.com (see chart below).

It should be noted that our Q3-23 Cash Operating Costs = US$5.44/lb (excl royalties) and US$5.87/lb (incl royalties). In Q3-23 the average benchmark price of V2O5 was US$8.03/lb and our revenues per pound of V2O5 equivalent sold was US$8.34. And Largo had a Net Loss before tax of (US$14.74M).

As the prices of V have gone down so much it doesn't look good for Largo in Q4-23 regardless of management costs control effort, does it?

Btw, Cash Operating Cost Guidance (excl royalties) = US$4.85 - 5.65/lb (about US$5.30 - 6.10/lb including royalties).

https://vanadiumprice.com/