Mathieu Dion, Bloomberg News

Gildan Activewear Inc.’s former chief executive officer lashed out at the clothing manufacturer’s board, saying it fumbled when it failed to consult investors about the CEO succession process — and major shareholders are backing him up.

Five investment firms that hold stakes in the Canadian company have now denounced the board’s decision to fire CEO Glenn Chamandy and name former Fruit of the Loom executive Vincent Tyra as his replacement.

The unhappy investors include major holders Jarislowsky Fraser Ltd., Pzena Investment Management Inc. and Cooke & Bieler LP. Collectively, the five firms own about 25 per cent of Gildan’s shares, according to data compiled by Bloomberg.

“Shareholders should decide the future if they’re not happy with the CEO,” Chamandy, 62, said in a phone interview. “The process was flawed, and they didn’t really have a very good plan.” He added that he wasn’t ready to retire and was “excluded completely” from the board’s process.

Representatives for the company didn’t respond to requests for comment.

Gildan’s board on Monday announced Chamandy’s departure and the appointment of Tyra, sending the stock plunging. “He has no manufacturing experience, and he has been out of the industry for 20 years,” Chamandy said about Tyra. “His track record is not the greatest.”

Jarislowsky Fraser, a unit of Bank of Nova Scotia, said Gildan Chairman Donald Berg should resign and heaped criticism on the board for its handling of the CEO change. Charles Nadim, Jarislowsky’s head of research, said the abrupt management shuffle was “concerning.” He accused directors of misleading the market with its announcement and failing to perform proper due diligence when it chose Tyra.

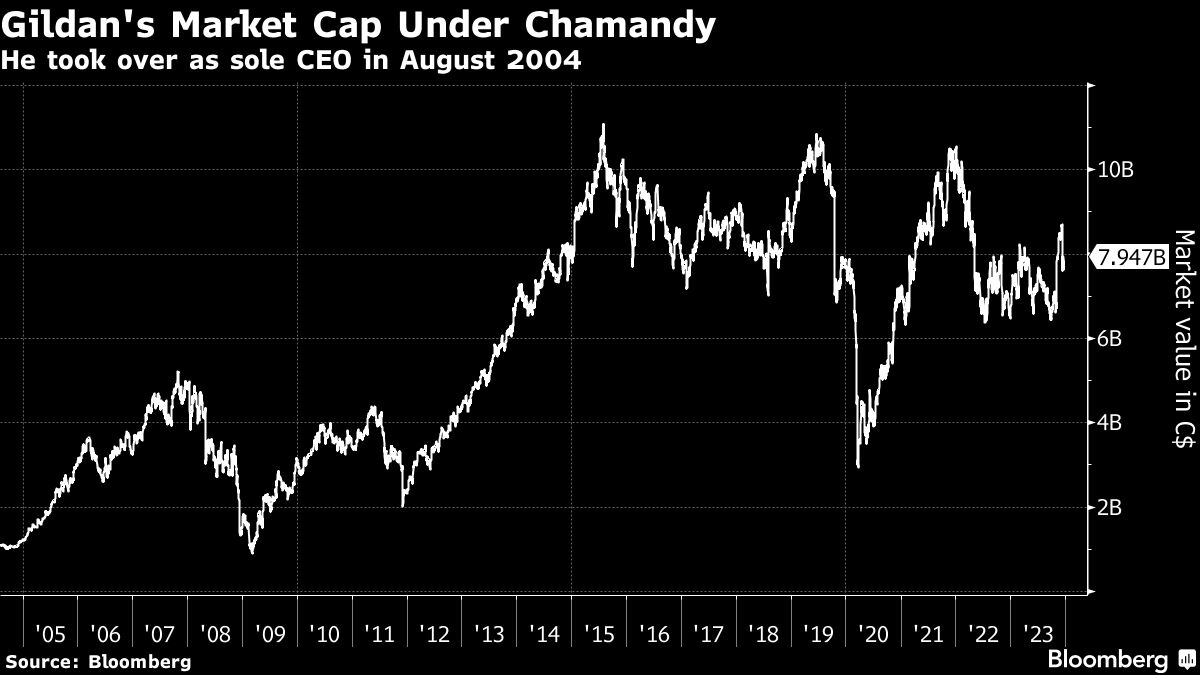

Gildan shares jumped Friday on Bloomberg’s report about Jarislowsky’s comments, closing at $46.15 in Toronto, up 4.1 per cent from the previous day. Still, the stock fell 7 per cent for the week, shrinking the company’s market capitalization to about $8 billion (US$6 billion).

The company’s fourth-largest investor, with 5.8 per cent stake, Cooke & Bieler LP, also came to Chamandy’s cause.

“We enthusiastically support Mr. Chamandy’s reinstatement as CEO, and we do not see that tenable with Mr. Berg on the board,” portfolio manager William Weber said in a phone interview.

Gildan says it’s one of the world’s largest vertically-integrated makers of t-shirts, underwear, and socks. The Montreal-based company made headlines in 2017 when it bought American Apparel for US$88 million in a bankruptcy auction. It also holds an exclusive distribution of Under Armour socks in the US and Canada.

The Chamandy family has been in the clothing sector since the 1940s. In 1984, Glenn Chamandy and his brother, Greg, turned the family firm into an integrated company with a knitting manufacturing business called Gildan Textiles.

In 2004, Greg stepped down as co-CEO, leaving Glenn to run it until the latest management shuffle.

Chamandy acknowledged “it’s been a tough week” and that he can’t do more to win back his seat.

“I’m on the sidelines,” he said. “It’s up to the shareholders to decide ultimately what they want.”