Surge in large-scale energy storage deployments predicted VRFBs only need a tiny portion of the surge to have a significant impact on the Vanadium supply & demand scale.

https://www.energy-storage.news/global-surge-in-large-scale-energy-storage-deployments-predicted-this-year-by-energytrend/?utm_source=dlvr.it&utm_medium=twitter

‘Global surge’ in large-scale energy storage deployments predicted this year by EnergyTrend

Excerpt

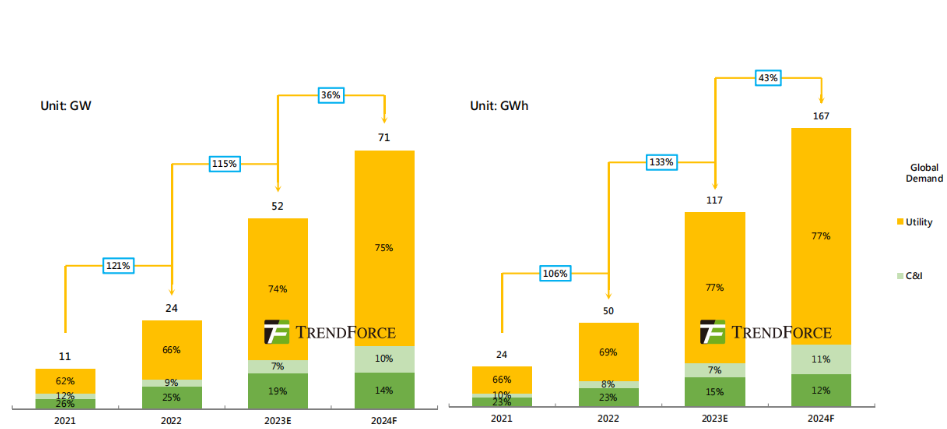

Global energy storage installs, with 2023 expected figures and 2024 forecasts, broken out by market segment. Image: EnergyTrend/Trendforce

Global energy storage installs, with 2023 expected figures and 2024 forecasts, broken out by market segment. Image: EnergyTrend/Trendforce

Analysis firm EnergyTrend has forecast that a “surge” in global large-scale energy storage system deployments is likely in 2024.

The Taipei-headquartered solar and energy storage division of research group Trendforce said yesterday (3 January) that it anticipates huge growth in commercial and industrial (C&I) storage system uptake in the coming year.

However, it is large-scale battery storage that will dominate the sector’s growth narrative in 2024, with EnergyTrend predicting up to 53GW/128.6GWh of utility-scale installations.

For an idea of scale, the firm said in December that it expected to find 52GW/117GWh of new energy storage installed across all market segments in 2023, while the total figure for 2024 deployments, if factoring in residential and C&I storage as well, could reach 71GW/167GWh.

The firm’s forecasting appears far more bullish than BloombergNEF’s recent predictions, which in themselves were hardly conservative and included an expectation for 42GW/99GWh of grid-scale energy storage deployments during 2023.

China estimated to hit 24.8GW/55GWh new installs in 2024

EnergyTrend also offered regional breakouts for how it sees the 2024 market landscape develop, focusing on China and the US as the major demand centres for large-scale storage, and with a narrower regional focus on the UK, as the standout market within Europe today.

Rapid adoption of wind and solar renewable energy, backed by active promotion of energy storage by government entities at national and provincial levels, would also contribute to China holding a leading position.

China’s 2024 installs were estimated by the analysis firm to reach 24.8GW output and 55GWh capacity, and EnergyTrend hinted that moves begun in September by central agencies to promote electricity storage participation in the spot market could bear fruit.

The US market’s appetite for large-scale storage will also be strong in 2024 due to a “highly economical and diversified profitability model,” EnergyTrend said, with a market split roughly 70:30 between co-located and standalone storage assets. As with China, the growth of variable renewable energy (VRE) is a primary driver for storage adoption, but the US also has weak grid integration nationally making the need for storage urgent.

As another research firm, Wood Mackenzie, also noted in recent editions of its quarterly reports on the US energy storage market, EnergyTrend pointed out that US installation figures in 2023 have been well below expectations for a number of reasons.

Those include supply chain disruptions, which during 2020-2022 were largely focused on lithium-ion (Li-Ion) battery supply constraints but during 2023 have been more about long lead items such as high voltage transformers, as Energy-Storage.news has heard from numerous sources including EPC firm Burns & McDonnell in its response to our end-of-year 2023 Q&A series published today.

Grid connection delays – for which the US is hardly unique in experiencing – are also having a major impact, which is being seen in other energy sectors including wind and solar and what EnergyTrend described as the US’ ageing transmission and distribution (T&D) infrastructure is not helping.

Nonetheless, it appears that demand remains firm, helped along by the business models alluded to above, and of course, the impact of government incentives spearheaded by the introduction of the investment tax credit (ITC) for standalone energy storage brought in with the Inflation Reduction Act (IRA) legislation.

EnergyTrend is forecasting that large-scale energy storage installations in the US could reach 11.6GW/38.2GWh in 2023.

Finally, the research firm said it expected the growth rate of European energy storage deployment in 2024 to be slower than during this year, but did not put figures on that expectation in analysis seen by Energy-Storage.news. Despite this slowing that EnergyTrend predicted however, it said growth would be “robust” and at a high rate.

The company did offer its expectations for installation figures in the UK, which is still the leading storage market in Europe. The country’s latest future energy plan published by its government “significantly elevates its short-term energy storage installation goals,” and rapid short-term growth is expected in a market that EnergyTrend said could reach 4.2GW/6.4GWh of new large-scale installs in 2024.

Energy-Storage.news has not yet seen numbers for expected installs in the UK in 2023, but our colleagues at Solar Media Market Research wrote in early 2023 that during 2022, the UK added 800MWh of utility-scale energy storage capacity in the form of Li-Ion battery energy storage system (BESS) assets, again illustrating that rapid growth trajectory.