Crescent Point Energy Corp. (NYSE:CPG) management finally announced that the transition to a cash flow generating juggernaut is over.

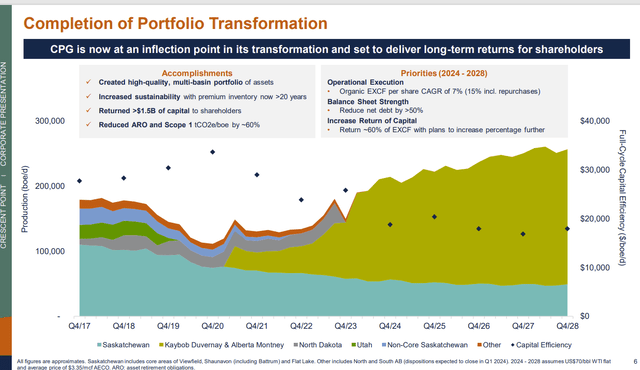

Crescent Point Energy Completion Of Portfolio Transformation (Crescent Point Energy December 2023)

The last article covered the Hammerhead acquisition which a lot of commenters thought was one too many. However, since a successful transition from an essentially zombie corporation (well on its way to the hereafter) to a company with a bright future is very rare, I am inclined to give management leeway as to when they state they are done. This management can now run a company that is likely to provide well above average returns for the foreseeable future. The recent stock price weakness may prove to be the last time this price range happens.

That does not mean that management would not make another deal in thefuture if the right deal came along. It does mean that management is done remaking the company. It also means that comparable results will likely begin about 12 months from now because the last several years involved material sales. For all intents and purposes, it takes at least a spreadsheet (and a fairly complicated one at that) to even try to come up with comparable results for the same operations when there are acquisitions and disposals (constantly).

That will frustrate shareholders that want to hold management accountable with quarterly or even annual results. But the fact was the big oil price decline of 2015 turned a lot of once-viable business strategies into nonviable strategies overnight. Therefore, management needed to "get going" or the shareholders stood an excellent chance of getting wiped out.

I have covered the process that took years to complete from time to time. Several of those years probably looked like finances were not going forward because of the actions of commodity prices. Management can claim forward progress. But declining commodity prices can make that very hard for shareholders to tell (let alone compare with future years when still more transactions happened). From here on in, things should become a lot simpler.

Going Forward

Management began by raising the dividend.

(Note: This is a Canadian company that reports in Canadian Dollars unless otherwise stated.)

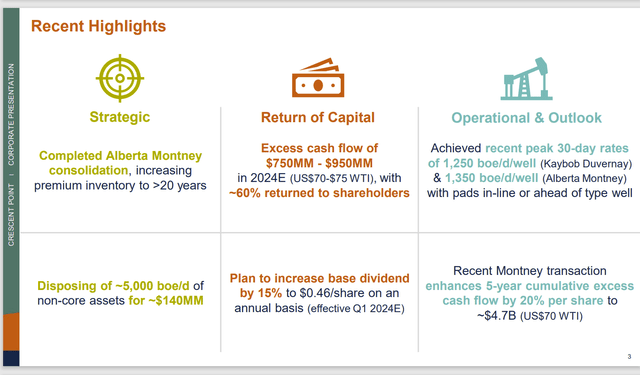

Crescent Point Energy Announcement Of Reorganization End Forward Plans (Crescent Point Energy Corporate Presentation December 2023)

Compare this to the recent article on Vital Energy, Inc. (VTLE) in the United States where management is stating cash will be repaying debt and the production is basically hedged. This tells you that Vital still has a ways to go with the transformation whereas this company is going to begin by increasing the dividend.

The other thing about these deals is shown in the upper right-hand corner. Many of the wells drilled exceed expectations because of the brutal pace of technological innovation. One would almost believe (almost) that this is a high-tech industry from that pace. Any time there is a questionable deal in the eyes of some readers, that technological advance is bailing out the "questionable" part. It usually makes the deal look good in short order because wells often do 20% better than planned within a year or two.

The other way these deals become good deals is that new intervals are constantly becoming commercially productive. Therefore, it's hard to argue that a deal was poor when results within a year or two at the most are pretty good. Of course, it is better when results are accretive right away which appears to be the case here.

Well Profitability

The wells available to drill and complete are unusually profitable.

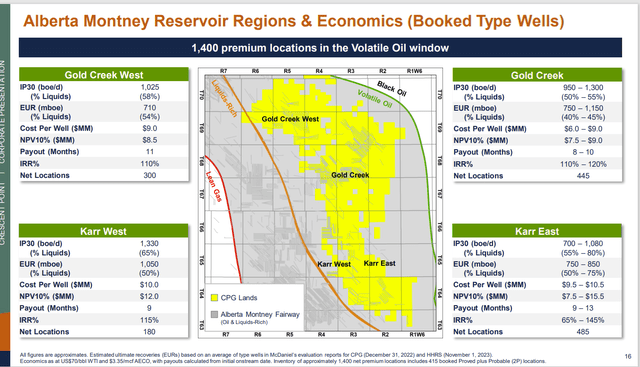

Crescent Point Energy Summary Of Well Profitability By Location (Crescent Point Energy December 2023, Corporate Presentation)

Investors need to remember that most companies want an IRR of at least 40% to overcome business risks before they will drill and complete a well for production. These wells are far past that hurdle. This backs up the initial management claim of some generous cash flow. Now of course management has to demonstrate that they can make the whole thing work as planned. But so far, it looks like the whole process completed in exemplary fashion.

Valuation

The company has a comparatively low valuation because it has no track record as it is currently composed. Therefore, management has to establish an attractive record in the future. If management chose the acquisitions well and the whole company runs well as currently "put together", then this should not be a problem. But that is definitely a risk for the investor to consider.

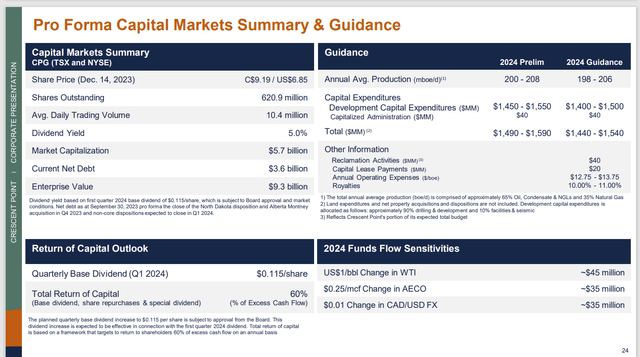

Crescent Point Energy 2024 Guidance (Crescent Point Energy Corporate Presentation December 2023)

The first thing to note is that management has the capital budget plus the previously mentioned free cash flow. This depends heavily on the commodity price assumptions which look conservative. That removes some of the risk to the guidance above.

Altogether, the capital budget plus the expected free cash flow would be about C$2.3 billion (very roughly). Now that would be after taxes and depreciation so we are not talking EBITDA.

That means that the company currently has an enterprise value of 4 times guided cash flow (using an assumed oil price of WTI $70 or so). That is very cheap for just about any industry and it is certainly significantly below historical levels.

A company that is forecasting the kind of cash flow this one is with that generous free cash flow should probably trade for at least 6 times cash flow. Management is planning to grow production. That probably means the valuation could be higher still. The repayment of debt that is planned over the next several years will also help valuation.

This stock could easily be a double over the next few years. It could go higher as the production steadily increases along with (probably) the base dividend.

Risks

These forecasts assume a WTI price of roughly $70. Obviously, if that price is materially different in the future, the results will be materially different.

There is no track record of the company as it is currently made up. Comparisons with the past are handicapped with a lot of acquisition and disposition activities. That makes comparisons impossible and confuses the market. Most acquisitions take about 6 to 12 months for acquisition-related items to decline. Therefore, it will take some time for an "apples to apples" comparison to again be easily available.

Note that the capital budget is fully funded at a considerably lower WTI price in the presentation. The same goes for the budget and the dividend. There is always a risk of a cyclical downturn that could cause a material change in the budget and the dividend.

The debt ratio appears to be conservative enough that it would take a very severe and sustained downturn to hurt the company or impair its future.

Finally

Since this Canadian company is listed on the NYSE, it will likely repurchase stock so that the base dividend has extra cash flow in case there is a cyclical decline in prices. Then the dividend is much easier to defend.

Despite the cyclical nature of upstream, this company is likely to provide a combined long-term return in the teens. It also appears to be well enough run that it may attract a takeover bid.

Going forward, the main long-term story is one of growth and income. For investors, that do not mind a variable distribution entity as a lot of upstream companies are, this will remain a strong buy. The story will be very different going forward as the reorganization is complete. But the part about the company being well-run is very unlikely to change.