Bitcoin ETF is getting close to approval! Eleven spot bitcoin exchange-traded funds (ETFs) are moving closer to approval by the U.S. Securities and Exchange Commission (SEC). Proposed rule changes to list and trade all 11 spot bitcoin ETFs on stock exchanges have been filed with the SEC. “It’s basically done,” an ETF analyst said, adding that the securities regulator is “trying to line everyone up for Jan 11th launch.”

Bitcoin ETF Decisions Loom: Analyst Says ‘It’s Basically Done’

Proposals to list and trade 11 spot bitcoin exchange-traded funds (ETFs) flooded for the U.S. Securities and Exchange Commission (SEC) Friday amid heightened speculation regarding the imminent approval of spot bitcoin ETFs by the securities regulator.

“The [SEC] staff had no additional feedback on the paperwork for several of the firms after the latest amendments,” Bloomberg reported, citing two people familiar with the matter. Form 19b-4 is used to propose rule changes to allow spot bitcoin ETFs to be traded on stock exchanges.

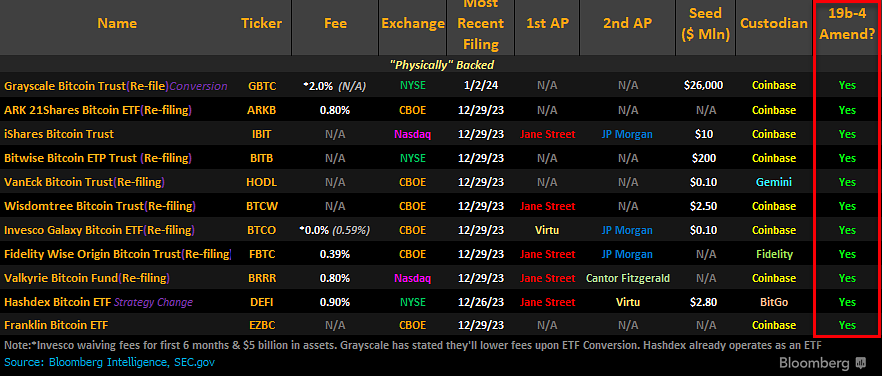

Bloomberg analyst James Seyffart shared a list on X Friday afternoon, revealing that amended 19b-4 forms have been submitted to the SEC for all 11 spot bitcoin ETF applicants. “All 11 of these bitcoin ETF filers are still in the Cointucky Derby,” he wrote.

11 Spot bitcoin ETFs awaiting SEC’s approval. Source: Bloomberg analyst James Seyffart

11 Spot bitcoin ETFs awaiting SEC’s approval. Source: Bloomberg analyst James Seyffart However, the analyst cautioned: “We’re not over the finish line yet. But we are damn close … We need to see approvals on these amended filings (which should come next week). And then we need the S-1 documents to go effective (which could also happen next week). Then it’s a done deal.”

Commenting on Friday’s development, senior Bloomberg ETF analyst Eric Balchunas opined on X:

It’s basically done. Latest I’m hearing (from multiple sources) that final S-1s are due 8am on Monday as SEC is trying to line everyone up for Jan 11th launch.

“That said, I still want to hear it from the SEC to call it official,” he noted. S-1s are prospectus documents for spot bitcoin ETFs.

The SEC commissioners are expected to vote on the exchange-rule filings next week, Bloomberg reported, citing another person familiar with the process. The publication explained that once the SEC approves the 19b-4 filings and issuers sign off on their final S-1 filings, spot bitcoin ETFs could begin trading as soon as the next business day.