6 Top Long-Term Stocks On My 2024 Wishlisthttps://seekingalpha.com/article/4660588-6-top-long-term-stocks-on-my-2024-wishlist Medtronic And Quipt Home Medical

Medical device stocks were stymied this year by the idea that weight-loss drugs would hurt the long-term outlook for things like mobility equipment, insulin pumps, diabetes therapies, CPAPs, oxygen machines, etc.

Then, just when I thought I had heard it all, Stifel came out with this gem stating that apparel stocks would benefit. Apparently, Stifel thinks Americans will take a miracle drug and hit the gym in droves.

I understand the logic for each, but they are ludicrous and juvenile in their naivety. Weight-loss drugs are not a magic elixir; side effects are emerging, and the impact on the medical equipment market is wildly overblown. Meanwhile, our population is aging, and diseases like Diabetes affect a large and growing percentage of the population.

This makes Medtronic (MDT) and microcap company Quipt Home Medical (QIPT) compelling.

Medtronic's dividend yields 3.3%, well above its 4-year average of 2.5%, and its valuation metrics are better than industry averages.

Quipt is riskier as a microcap but has significant upside potential. The company is growing through acquisition, expanding to 26 desirable states for respiratory care, and 78% of revenue is recurring.

Earlier this year, a proposed at-the-market (ATM) stock sale to fund acquisitions upset many shareholders. The ATM was canceled after the outcry, but the stock remains out of favor.

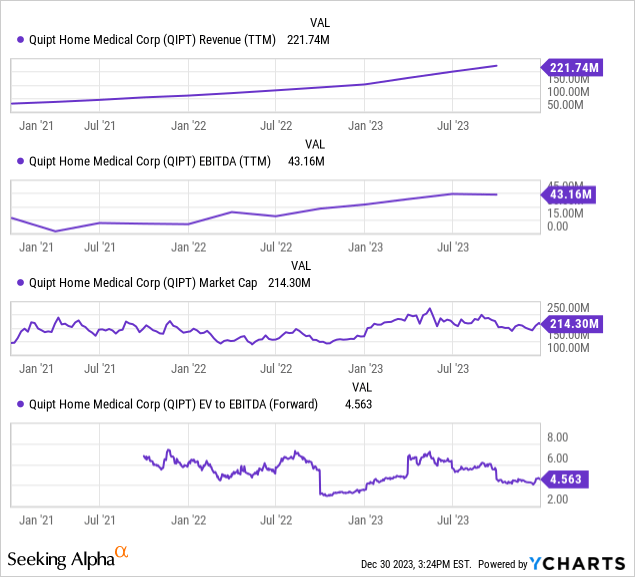

Revenue and EBITDA are ramping up on accretive acquisitions, and the market cap does not reflect the potential, as shown below.

Data by YCharts

Data by YCharts The company has significant debt to manage, mainly a $61 million credit facility, but the risks appear priced in.