Just_Super

Welcome to the Vanadium miners news.

January saw vanadium pentoxide prices flat and a sharp increase in ferrovanadium prices (especially in Europe). We also saw some signs of increased vanadium demand from China.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart - Europe = USD 6.00/lb, China = USD 4.95/lb

![Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart](https://static.seekingalpha.com/uploads/2024/1/29/37628986-17065781300069566.png)

Vanadiumprice.com

Europe and China Ferrovanadium [FeV] 80% one year price chart - Europe = USD 28.75/kg, China = USD 28.75/kg

![Europe and China Ferrovanadium [FeV] 80% one year price chart - Europe](https://static.seekingalpha.com/uploads/2024/1/29/37628986-17065781899150457.png)

Vanadiumprice.com

Vanadium demand versus supply

In 2017, Robert Friedland stated: "We think there’s a revolution coming in vanadium redox flow batteries...."

An April 2021, Wood Mackenzie report stated (emphasis added):

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

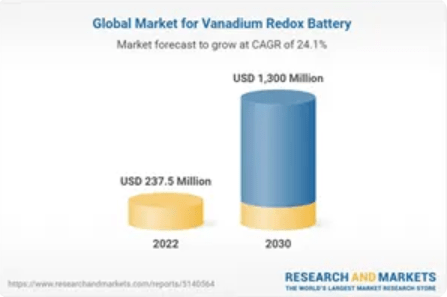

ResearchAndMarkets forecasts VRFBs to grow from US$237.5M in 2022 to US$1,300M by 2030 (source)

ResearchAndMarkets

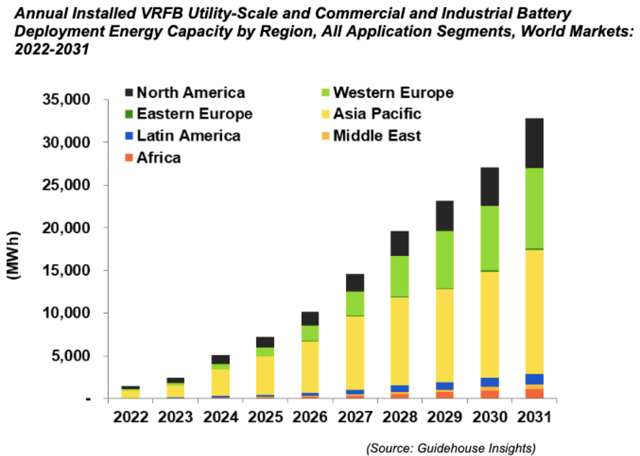

Global VRFB forecast growth by region 2022-2031

Guidehouse Insights

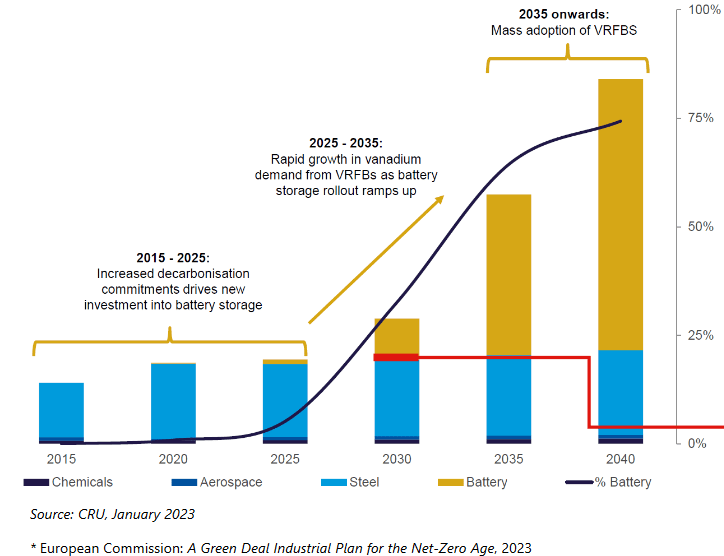

CRU forecasts vanadium demand to double by 2032 mostly due to VRFB's (source) (As of January 2023)

CRU

Large scale global deployments of VRFB's are becoming more common (source)

Technology Metals Australia company presentation

Vanadium market news

On December 19, P-V Magazine reported:

German decommissioned nuclear plant to become 800 MW/1,600 MWh battery. PreussenElektra has revealed plans to potentially develop Europe’s largest battery storage facility at the decommissioned Brokdorf nuclear power plant site in Germany, with 800 MW/1,600 MWh of capacity. The site operator now needs to secure approval to dismantle the nuclear plant.

On January 4, Fastmarkets reported:

Market optimism boosts Chinese vanadium prices. Chinese vanadium pentoxide and vanadium nitrogen prices continued to rise on improved sentiments in the week to Thursday January 4, with downstream steel users starting to pre-stock before the Spring Festival, sources said...

On January 23, Yahoo Finance reported:

The Global Vanadium Redox Battery Market, renowned for driving advancements in reliable and efficient energy storage solutions, has witnessed significant growth and is set to project robust expansion through 2028, according to a comprehensive analysis of the industry. The market, which held a valuation of USD 360 Million in 2022, is experiencing a compound annual growth rate [CAGR] of 22.1%, spurred by burgeoning demands for energy storage in the integration of renewable energy, grid stabilization, and the electrification of various sectors...Large-scale energy storage applications are increasingly leveraging the unique advantages of vanadium redox flow batteries, spotlighting their relevancy in utility-scale renewable energy projects. The residential sector is revealing a growing appetite for vanadium redox batteries, propelled by the appeal of energy independence and sustainable living.

Note: Bold emphasis by the author.

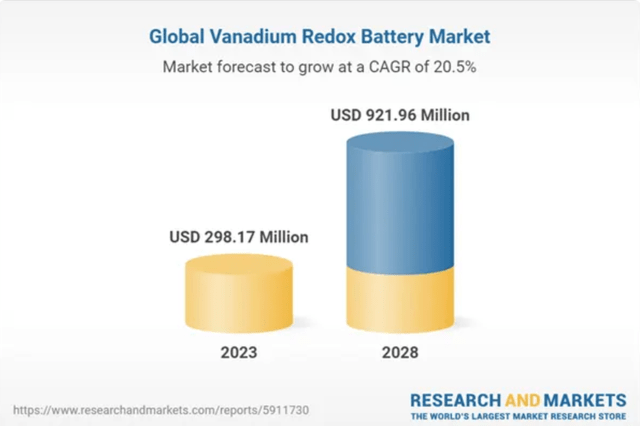

ResearchAndMarkets forecasts the global VRFB market to grow from US$298m in 2023 to US$921m in 2028, at a CAGR of 20.5% (source)

ResearchAndMarkets

On January 25, Fastmarkets reported:

China’s December vanadium pentoxide imports up 12% on restocking ...Customs data showed that imports of ferro-vanadium came to 61 tonnes in December, up by 20 tonnes, 48.78%, year-on-year.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On January 12, Glencore announced:

Glencore (the Company) announces that, following the purchase of shares announced today, the Company has successfully completed the second part of the share buy-back programme announced on 08 August 2023. Between 08 August 2023 and 12 January 2024, the Company repurchased 215,395,000 ordinary shares for treasury...

AMG Critical Materials N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process. In January 2023, AMG announced plans to build a Vanadium Electrolyte plant in Germany with production expected to start at the end of 2023.

On December 27, AMG Critical Materials N.V. announced:

AMG LIVA Power Management Systems GmbH acquires the Redox Flow Battery Activities from J.M. VOITH SE & CO. KG...Volker Klln, CEO of AMG LIVA, commented, “This acquisition is an important building block for LIVA to further expand the attractiveness of the VRFB technology. By integrating the VOITH IP, we can improve the energy efficiency of electricity storage while reducing system costs. Highly efficient and reliable mass energy storage systems are the key to the energy transition in industry and for grid management applications.”

Bushveld Minerals Limited [LN-AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On January 19, Bushveld Minerals Limited announced:

Further update on outstanding funds...The Company has today received payment of ZAR40 million (~US$2 million) from SPR which has been provided on an interest free basis and will be repaid once SPR provides Bushveld with the entire US$12.5 million, pursuant to the SPR subscription agreement (the "Subscription Agreement"). Under the Subscription Agreement, SPR was due to transfer the US$12.5 million from an offshore bank account into Bushveld's UK bank account. However, due to the events that have recently transpired, the payment received today has been paid into a Bushveld subsidiary's South African bank account from SPR's bank account in South Africa. If the funds received today were to be used to satisfy SPR's obligation under the Subscription Agreement, approval of the South African Reserve Bank would have been required, which would have resulted in further delays in flow of funds. Until the entire US$12.5 million is received SPR remains in default of the Subscription Agreement.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracs Menchen mine in Brazil as well as a producer of VRFBs.

On January 23, Largo Inc. announced: "Largo reports fourth quarter and full year 2023 operational and sales results highlighted by record quarterly high purity V2O5 production; Provides 2024 Guidance." Highlights include:

Q4 and FY 2023 Highlights

- "Quarterly V2O5 equivalent production of 2,768 tonnes (6.1 million lbs1) in Q4 2023, a 38% increase over the 2,005 tonnes produced in Q4 2022.

- Annual V2O5 production of 9,681 tonnes (21.3 million lbs1) in 2023 vs. 10,436 tonnes in 2022; Within the Company’s 2023 annual production guidance range of 9,000 – 11,000 tonnes.

- Quarterly global V2O5 recovery of 79.4% in Q4 2023, a 6% increase over the 74.7% achieved in Q4 2022; Annual global V2O5 recovery of 80.0% in 2023 vs. 79.1% in 2022.

- Quarterly sales of 2,605 tonnes of V2O5 equivalent (inclusive of 139 tonnes of purchased material) in Q4 2023 vs. 2,774 tonnes in Q4 2022.

- Annual V2O5 equivalent sales of 10,396 (inclusive of 929 tonnes of purchased material) tonnes in 2023 vs. 11,091 tonnes in 2022; Within the Company’s annual 2023 sales guidance of 8,700 – 10,700 tonnes.

- Ramp up of the Company’s ilmenite concentrate production remains ongoing with 8,970 tonnes produced in Q4 2023; Ilmenite production was 814 tonnes in October, 2,546 tonnes in November and 5,610 tonnes in December.

- In October, Largo Clean Energy’s (“LCE”) 6 megawatt-hour vanadium redox flow battery (“VRFB”) deployment for Enel Green Power Espaa (“EGPE”) was validated to operate on test conditions according to EGPE specifications and LCE test procedures.

- The Company’s review of strategic alternatives for LCE to evaluate opportunities to maximize value in the clean energy transition remains ongoing...."

Vanadium Market Update2

- "...Vanadium spot demand was soft in Q4 2023, primarily due to adverse conditions in the Chinese and European steel industries, however, strong demand from the aerospace sector continued; Demand in the energy storage market is anticipated to increase in future quarters, specifically in China..."

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are "the No. 1 uranium producer in the U.S. with a market-leading portfolio," as well as being a small vanadium producer.

No vanadium news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: "The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs."

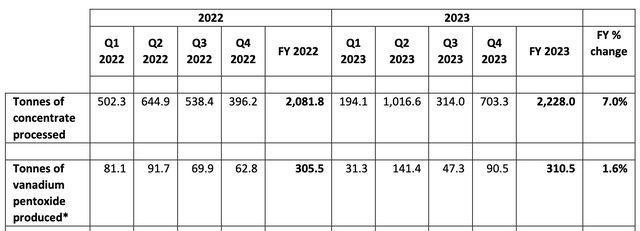

On January 12, Ferro-Alloy Resources announced: "Q4 2023 production results sustained or increased production achieved."

Q4 Production Results (source)

Ferro-Alloy Resources

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie's Eastern Band is one of the highest grade hard rock titanium deposits globally.

On January 25, Neometals announced: "Quarterly activities report for the quarter ended 31 December 2023." Highlights include:

Corporate

- "Capital raising completed for ~A$12.1 million (share placement for A$9.0 million together with entitlement issue subscriptions for A$3.1 million).

- Cash balance of A$19.5 million, investments of A$24 million and no debt."

Vanadium Recovery (Technology 100% NMT via Avanti Materials Ltd)

- "Technical support provided to Recycling Industries Scandinavia AB (“RISAB”) (72.5% NMT) to commercialise the technology through the development of the Vanadium Recovery Project (“VRP1”) in Finland.

- Advanced testing activities and commercial discussions with potential feedstock providers under technology licensing business model."

Upstream – Mineral Extraction

Barrambie Titanium and Vanadium (“Barrambie”) (100% NMT)

- "Tenement maintenance activities with focus on commercial discussions in relation to product offtake and equity investment."

Australian Vanadium [ASX:AVL] [GR:JT71] (OTCQB:ATVVF) - merger with Technology Metals Australia completed in early 2024

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On January 8, Australian Vanadium announced: "Horizon Power vanadium flow battery arrives in WA." Highlights include:

- "Vanadium flow battery has arrived in Fremantle, Western Australia.

- Battery destined for Horizon Power site in Kununurra, Western Australia.

- Factory Acceptance Testing to be undertaken in conjunction with Horizon Power."

On January 22, Australian Vanadium reported:

Scheme of Arrangement becomes effective...The Scheme is now legally effective, and it is expected that TMT shares will be suspended from trading on ASX from close of trading today (22 January 2024)...It is expected the Scheme will be implemented, and the Scheme Consideration will be issued to TMT shareholders, on Thursday, 1 February 2024.

Technology Metals Australia [ASX:TMT] - merger with Australian Vanadium by to be completed early 2024

The Company's primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia has combined the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On January 19, Technology Metals Australia announced:

Court approves scheme of arrangement...TMT is pleased to announce that the Supreme Court of Western Australia (Court) has made orders approving the Scheme. TMT intends to lodge an office copy of the Court’s orders with the Australian Securities and Investments Commission on Monday, 22 January 2024, at which time the Scheme will become legally effective. TMT expects that the ASX will suspend TMT shares from trading on the ASX with effect from the close of trading on Monday, 22 January 2024.

On January 22, Technology Metals Australia announced: "Scheme of Arrangement becomes effective..."

On January 24, Technology Metals Australia announced: "Quarterly activities report for the three months ended 31 December 2023." Highlights include:

- "....Environmental approval pathways progressing for Gabanintha development envelope.

- Closing cash of $11.9 million on hand as at 31 December 2023."

Tivan Limited [ASX:TVN] (formerly TNG Ltd [ASX:TNG](OTCPK:TNGZF)

Tivan Limited is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. Tivan Limited is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product. Tivan 100% owns the Speewah Mining Pty Ltd (from King River Resources Limited [ASX:KRR]) the owner of the Speewah Vanadium-Titanium-Iron Project in WA.

No vanadium related news.

On January 18, Tivan Limited announced:

Maiden drill program planned for the Sandover Project. The Board of Tivan Limited (ASX: TVN) (“Tivan” or the “Company”) is pleased to advise that the Company is advancing planning for a maiden drill program at its 100% owned Sandover Project in the Northern Territory, with drill targets defined at three initial copper and lithium prospects and drilling anticipated to commence in early Q2 2024...

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 86.49% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No news for the month.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

Vanadiumcorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘Vanadiumcorp-Electrochem Processing Technology’ and "Electrochem globally patented Electrowinning" technology.

No significant news for the month.

Richmond Vanadium Technology [ASX:RVT] ("RVT")

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of

1.8Bt @ 0.36% Vanadium Pentoxide (V2O5). On January 16, Richmond Vanadium Technology announced:

Bankable feasibility study update...Key elements of the Study commenced in the June Quarter 2023...to extend the timeframe for completion of the BFS by 6 months, with an expected completion in the June Quarter 2025. Regulatory approvals and a final investment decision are expected in the September Quarter 2025.

On January 25, Richmond Vanadium Technology announced:

Quarterly activities report for the period ending 31st December 2023...As at the end of the December quarter, RVT held $15.613m in available funds of which $14.4m had been placed on Term Deposit including $11m for 4 months, $3m for 3 months and $0.725m for 1 month respectively.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On January 11, Phenom Resources Corp. announced:

Phenom reports Carlin drilling results. Phenom Resources Corp. (TSXV: PHNM) (OTCQX: PHNMF) (FSE: 1PY0) ("Phenom" or the "Company") is pleased to announce results from the reverse circulation drill holes RC23-17 and RC23-18 both planned as a 2,000 foot depth test of the gold system at the Carlin Gold-Vanadium Project in the Carlin Gold Trend of Nevada. RC23-17 was abandoned at 500 feet due to difficult rock conditions. RC23-18 was drilled to a depth of 1900 feet. The two holes were collared 90 metres apart, both near vertical tests and encountered a near-surface mineralized vanadium zone. Hole RC23-17 encountered the 22.86 metres (75 feet) vanadium unit starting at a depth of 74.68 metres (245 feet) and returned an average grade of 0.48% V205. Hole RC23-18 encountered the 15.24 metres (50 feet) vanadium unit starting at a depth of 3.05 metres (10 feet) and returned an average grade of 0.41% V205. True thicknesses of the two intercepts are not known. The nearest neighbour holes to RC23-17 and RC23-18 were R-128 and DDH-4 each about 90 metres away and encountered 13.7m (44 feet) @ 0.51% V205 and 7.0 m (22 feet) @ 0.91% V205%, respectively...

On January 15, Phenom Resources Corp. announced:

Phenom submits concept paper for larger U.S. Federal grant application... The Company plans to make a Full Application Submission by the deadline of March 19, 2024, for a $300 million grant. This larger funding opportunity is part of the second round of funding by the DOE of approximately $3.5 billion to be made available for battery materials processing and battery manufacturing grants.

On January 19, Phenom Resources Corp. announced: "Phenom announces up to $999,600 Private Placement Financing..."

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Blue Sky Uranium [TSXV:BSK] (OTCQB:BKUCF)

- Critical Minerals Group [ASX:CMG]

- Currie Rose Resources Inc. [TSXV:CUI]

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Manuka Resources [ASX:MKR]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE]

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Santa Fe Minerals [ASX:SFM]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Surefire Resources [ASX:SRN]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- UVRE [ASX:UVA]

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

- Viking Mines [ASX:VKA]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF, OTCQX:IESVF)

Conclusion

January saw vanadium pentoxide prices flat and a sharp increase in ferrovanadium prices (especially in Europe).

Highlights for the month include:

- German decommissioned nuclear plant to become 800 MW/1,600 MWh battery. PreussenElektra plans to potentially develop Europe’s largest battery storage facility.

- December 2023 saw signs of increased vanadium demand from China on restocking. China ferro-vanadium December 2023 imports increased 48.78% YoY.

- ResearchAndMarkets - The VRFB market is currently growing at a CAGR of 22.1%. Forecasts the global VRFB market to grow from US$298m in 2023 to US$921m in 2028, at a CAGR of 20.5%.

- AMG LIVA Power Management Systems GmbH acquires the Redox Flow Battery Activities from J.M. VOITH SE & CO. KG.

- Largo Inc. annual V2O5 production of 9,681 tonnes in 2023 vs. 10,436 tonnes in 2022.

- Australian Vanadium merger with Technology Metals Australia Scheme of Arrangement becomes effective.

- Phenom Resources Corp. drills 13.7m @ 0.51% V205 and 7.0m @ 0.91% V205% at the at the Carlin Gold-Vanadium Project in Nevada.

As usual, all comments are welcome.