Ilmenite The new 2024 revenue stream which is the sale of Ilmenite would be a good development for Largo if management can deliver. What Paulo Misk had promised about the Ilmenite project in Nov 2022 speaks volumes about the poor performance of the management team as a whole (no wonder Misk was fired 3 months later). The question is: Can management deliver the new modest Ilmenite production/sales guidance for 2024? Another “over promise & under delivery”?

Q3-22 CC Transcript

Paulo Misk: Yes, the ilmenite concentration plan is our first step of the titanium business. We expect to conclude that plan in Q2, specifically May. So you start we are expecting to have three, four months of hump up until reaching 145,000 tonnes of ilmenite being produced. As we are running about two years with a pilot plant at site with the current material that we have been mining, we have already trained our employees. We have a very good knowledge on all the technical issues. So I'm in a very smooth commissioning and ramp up for this production.

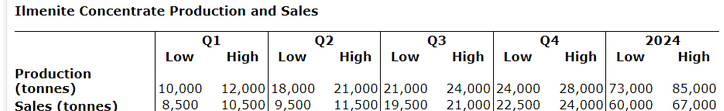

2024 Ilmenite Production / Sales Guidance

Ilmenite Revenue Forecast

Assuming average Ilmenite price = US$280/T

| Average | Q1 | Q2 | Q3 | Q4 | 2024 |

| Sales (T) | 9,500T | 10,500T | 20,250T | 23,250T | 63,500T |

| Revenue (US$) | $2.7M | $3.0M | $5.7M | $6.5M | ~$18.0M |

Note that an average Ilmenite Sales Guidance of 63,500T / year represents merely 44% of the annual nameplate production capacity of 145,000T. Even at such a modest 63,500T/year will Largo be able to meet the 2024 Ilmenite Sales Guidance? Another “over promise”?

DYODD