SUMMERIZED - 2015 = 90% Gabbs + Sulphides only 10% peridotite )

2015 - PEA with 329 million tonnage should stick

2015 vs 2023 Spot prices ( present spot better ) Palladium - $750/oz way lower than 2024

Platinum - $1,032 close to 2024 prices

Nickel -

$11,831/t way lower than 2024

2015 bulk con = higher recoveries = because of sulphide 2015 bulk con = more payable metals = because bulk con + sulphide recovry After-Tax NPV7.5% of CAD$1.2 Billion and IRR of 24.6%

https://www.nickelcreekplatinum.com/investors/news-releases/press-release-details/2015/Wellgreen-Platinum-Announces-Positive-Preliminary-Economic-Assessment-Update-on-its-Wellgreen-PGM-Nickel-Project/default.aspx

--------------------------------------------------------------------------------------

Phase 2 MET

Only 1/2 the hole was used

= high odds ( silicates / upper )

March 1, 2017 The Massive Sulphides and Gabbro constituting a smaller volume of material than the Clinopyroxenite may be tested during any subsequent metallurgical testing. - Maybe tested.

- All the more support pointing to upper hole silicate intercept cores

sent for phase 2 MET

Sept. 7, 2017

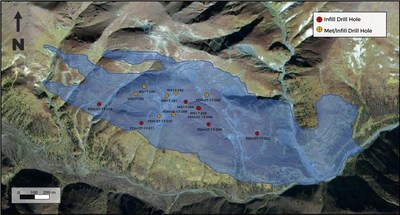

https://www.nickelcreekplatinum.com/investors/news-releases/press-release-details/2017/Wellgreen-Platinum-Provides-2017-Drill-Program-Update/default.aspx

As one can see, phase 2 met drill cores are more central

- upper silcates sent

- lower kept by junior

2023 rolls round - PFS

metals payable is eq to approx 25% recovery

how can this be when 2015 recoveries in bulk con were very high %

Plausable Answer ?

Plausable Answer ? Eng firm applied a 25% metal recovery as if,

entire resource was all silicate = 437 M tonne resource.

yet 329 million tonnes = 90% sulphides + Gabbs

Eng firm should've kept 329 million tonnes separate 2015 sulphide resource ( was already met tested )

Sulphide ore are at deeper depth - lower hole

Phase 2

drill core samples for met

upper holes most likely sent My hunch ? upper silicates represent 70%+ of ore body

suppose silicate tonnage were 1/2 or 50% of sulphides

329 million t ( 2015 ) lower sulphides

329 million t upper silicates

x 25% metals recovery ( 2023 )

= 82,250,000 t upper silicates( or 25% recoverable ) + 329,000,000 t

lower sulphides =

411,250,000 t ( close to 2023 pfs tonnage ) Could a computer program apllied 25% silicate recovery to the

329 M tonne sulphides of 2015 ?

What if ? ( second theory ) 2015 - 329 M tonne sulphides

were kept separate

And what if...

437 million t 2023 pfs was

all the upper silicates ?

x 25% recovery

= 25% metal payables

Answer might be found by

analyzing total tonnage - 1.5+ billion tonnesi

What i am confident with, 329 M tonne 90% sulphide - $1.2 billion NVP if pgm's pulled from magnetite - $5+ billion more Other metal credits + exotics If i had to redo pfs ? I'd keep 2015 ( 90% sulphidev+ 10% peri ) tonnage separate

I'd tack on 74 additional holes ( lower sulphides ) to 329 M tonnes

I'd measure all silicate tonnage and aplly 25% recovery to just silicates

= then combine both for a total

Then,

ind a diff extraction for the silicates similar to fpx's 90% recovery