Many investors are puzzled by the plunging lithium stock prices, especially considering the anticipated long-term demand. Let’s look into why this is the case and what is the market outlook for 2024/25.

The Steep Decline in Lithium Prices

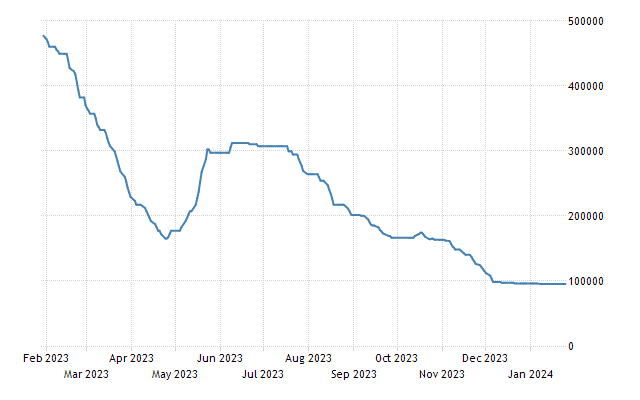

The current decline in lithium prices can be primarily attributed to the slowing growth of electric vehicle sales in China. This is coupled with the broader slowdown in the Chinese economy.

Source: Trading Economics

Source: Trading Economics As demand remains sluggish at previous pricing levels and supply surpasses demand, prices have inevitably fallen.

Lithium carbonate prices have experienced a significant decline in China. They dropped from a record high of $81,360 per tonne in November 2022 to $20,782 per tonne in the current month. This marks the lowest level in two years, reflecting a 67% decrease year-on-year.

In response to the plummeting prices, Chinese refining companies are taking measures such as cutting production or suspending operations.

The sharp decline in lithium carbonate prices represents a nearly 75% correction. Market analysts attributed this to a series of negative catalysts that have suppressed lithium prices.