streetwise report - copper Copper

UGH!

One week ago, I posted a chart that was absolutely beautiful with a "Golden Cross," a bullish MACD crossover, and an MFI "buy signal" for copper and walked — no — strutted away with the cockiness of a teenaged porn star. I had a serious "swing" going on, fully expecting that I was witnessing a developing major breakout in copper prices, and then WHAM!

Copper got walloped from $3.94 to $3.68 in seven — count them — SEVEN trading sessions. If I did not know better, I would have thought the chart was that of gold or, even better — SILVER — but neither gold, silver, nor copper could get out of the way of the disinflationary juggernaut that is the USD.

As I approach my 71st birthday, I reflect back on the moments in my life when crying is most common. It occurs when you are a helpless infant and continues on and off in varying frequencies and intensities until you reach puberty and then gradually recedes until your first girlfriend gives you the boot, at which point you are three-years-old once again, wailing uncontrollably as your heart shatters on the floor, screaming for mummy to make the pain go away.

Once recovered, the average mature male seldom cries over the next forty years (with the exception being deaths in the family and tax audits) until he reaches the stage in life where the tear-preventing testosterone begins to dissipate, leaving the rapidly-aging stallion no defence.

Watching the copper price do a seven-day non-stop dive like this is pure agony. It actually makes me CRY. No amount of equine majesty can remove the pain of watching the U.S. dollar manipulators as they direct prices to a political objective.

Since the last election, the Biden Administration has orchestrated the price of oil from $130/bbl. to under $70/bbl. by emptying the SPR in an attempt to sabotage the Russian economy, which has NOT happened. They need inflation to remain "contained" in order to control interest rates, so they instruct the futures traders at the NY Fed to "MAKE DAMN SURE" that there are no adverse movements in ANY of "THEM DAMN METALS." Traders like me get up from our vibrating, stress-resilient chairs and stare at our quote screens and blather incoherently as we watch stocks like NVidia gap higher day upon day upon day and try upon try to understand what it is that we are missing.

The answer while elusive lies in the graphic posted to the left. The "Thundering Herd" is alive and well on Wall Street, and NO ONE is going to stop them. It is said that "Bull markets never end with a "BANG;" they end with a "WHIMPER."

If you are a fireworks fan (as am I) and you love to watch the trajectory of a lit rocket ascend into the night sky (especially over Lake Rosseau in 1997), you cannot help but notice the moment when it is the brightest and the loudest which is the precise moment of its last hurrah and the moment where the nitrates fizzle out and the propellant leaves the projectile. It then stops the upward ascent; it pauses; it rolls over; and then it disappears in its mortal descent to the ground where it simply lands with a "THUD" and with no honour, dignity, or respect. That final flare-out is how all markets top out.

Copper has had nothing "mania-like" since the run in 2022 when it briefly got through $5.00/lb. only to get blasted back under $4.00/lb. It has garnered zero love from the investment community for as much as a nanosecond despite the fact that the legendary Robert Friedland is pumping its tires left, right, and center.

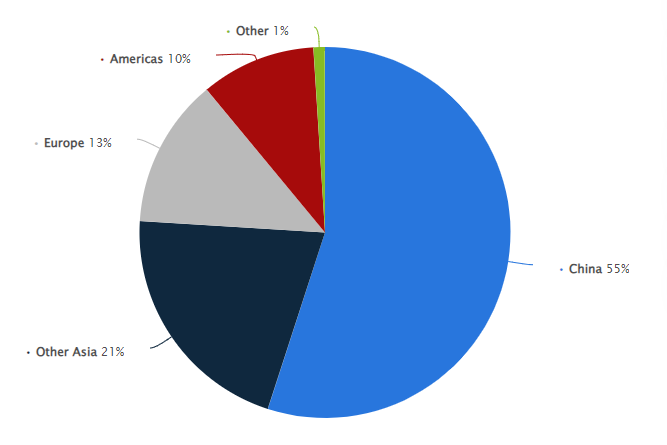

The price of copper has been tracking the Shanghai Stock Exchange nearly tick for tick for the past five years. The chart below would suggest that only recently has copper stabilized despite Shanghai losing 46.8% in the last nine months. The pie chart shown below is an awe-inspiring illustration of China's complete dominance of the global copper market in terms of consumption.

It is also the reason why copper prices are so closely tied to the Shanghai Stock Exchange. In order for copper to rally, it either needs to decouple from China or react to a massive stimulus program recently announced in Beijing designed to shore up their stock market.

Global Copper Consumption

Global Copper Consumption From TradingEconomics.com: "Copper futures in the US fell to under $3.7 per pound in February, the lowest in nearly three months and sinking more than 5% since the start of the month amid a strong US dollar and pessimistic industrial sentiment in China. Persistent macroeconomic headwinds in China, the world's top consumer, continued to hamper the outlook for base metals. Deflation in the country unexpectedly rose to a 14-year high, while the official manufacturing PMI pointed to the fourth consecutive contraction in January. The developments were consistent with a persistent decline in the Yangshan copper premium as factories refrained from purchasing the metal, while inventories in major Chinese warehouses soared by over 120% year-to-date to nearly 70,000 tonnes."

That summary basically ties the outlook for a copper rally directly with the Chinese manufacturing PMI (Purchasing Manager Intentions) because only an improvement in Chinese demand will be able to work off those excess inventories.

While Chinese economic trends govern the demand side of the equation, it is the global production shortfalls brought on by mine closures and reserve depletion that will act as an offset. The $64,000 question is whether or not production shortfalls will be severe enough to counterbalance the weakness in China. The bulls (like Friedland) point to Chinese industries like military hardware and technology taking up the space that housing and EV's did in 2022. The bears will argue that there is nothing the Chinese leadership can do to solve the problem in the real estate sector, where developers like Evergrande are being liquidated for pennies on the dollar. The bulls have a case, and the bears have a case when it comes to China.

Only time will tell how Beijing deals with its economic issues, but if there is one thing that the leaders cannot abide by, it is unemployment and/or deflation. There are too many people and far too much domestic debt for them to allow either to move in the wrong direction. Chinese leaders know the history of rebellions in their country and it all revolves around keeping 1.4 billion citizens employed and fed. I suspect that a "shock-and-awe" stimulus event will be launched in the next quarter that should take the SSEC back up and rekindle manufacturing activity. That will eliminate the inventory build-up and rebalance the copper market to the point where the supply issues will have an impact on price.

Looking out to the balance of the decade, it is the modernization of the Third World that will accelerate non-Chinese demand, and is at this point that the structural deficits in global copper production are going to ignite prices. The long-term bullish case for copper and the need for new mines and accelerated exploration can only get stronger, and that has nothing to do with the global electrification movement.

Now, add in electrification, and you have to imagine what happens when those 58 new nuclear reactors finish construction (with twenty-two of them in China). They turn on a switch, and suddenly, a mountain of new electrical current is leaving for homes, offices, and factories in distant locations.

How does the new electricity get transmitted to the outer regions of China, India, and Africa?

Copper.

Kilometer after kilometer of heavy gauge copper wiring will be needed to support the infrastructure requirements brought about by the move to nuclear. The bull case for uranium prices and for uranium producers and explorers is, by default, the exact bull case for copper prices and copper producers and explorers, but copper is magnified greatly due to the distances that power must travel.

The same case can be made when the lithium bulls start chortling about how global EV demand is about to dwarf supply, but that argument breaks down when one considers that every lithium-ion battery currently in operation will need to be recycled within five to seven years. In fact, secondary or scrap supplies of lithium are expected to explode by the end of the decade as all these EV's get turned in for scrap. That is not the case for the enormous transmission towers and lines with all that copper wiring that have been in place for years and years and rarely get recycled for scrap.

https://www.streetwisereports.com/article/2024/02/13/to-da-moon-alice.html?utm_source=delivra&utm_medium=email&utm_campaign=TRR2-15-24&utm_id=45815210