kasezo

Investment Thesis

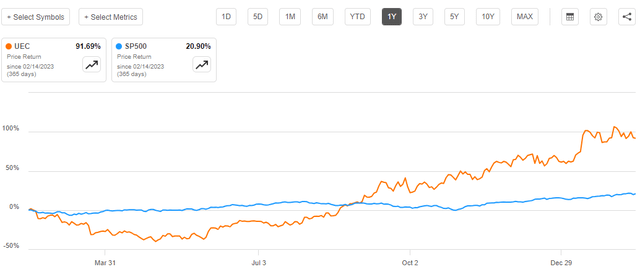

Uranium Energy Corp. (NYSE:UEC) has been on an upward trajectory, gaining about 91.69% over the last years and outperforming the S&P 500 by a margin of 70.79%.

Seeking Alpha

Despite the solid gain, I am bullish on thisstock given its promising outlook backed by strong tailwinds. Further, from the technical standpoint, the upward trajectory is yet to show signs of a reversal, which adds to my bullish stance.

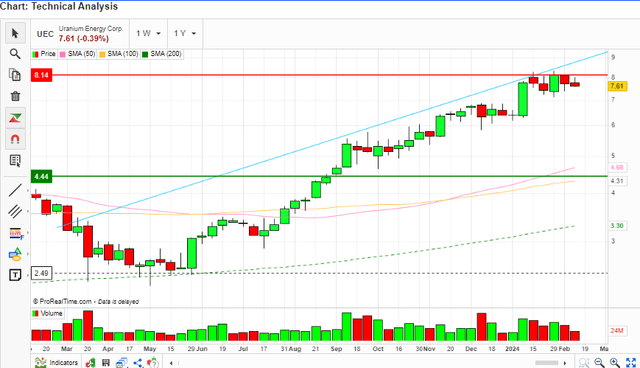

The Technical Approach

Based on technical indicators, I find this stock to be in a strong upward momentum with no signs of a reversal. First off, the stock broke out of the wedge bullish pattern it has been forming since 2022. The breakout happened in July 2023, and it has been very solid, with no signs of a correction or consolidation.

TradingView-Author

Notably, the price broke above the resistance level of $6.55 which is a sign that the uptrend is set to continue.

TradingView-Author

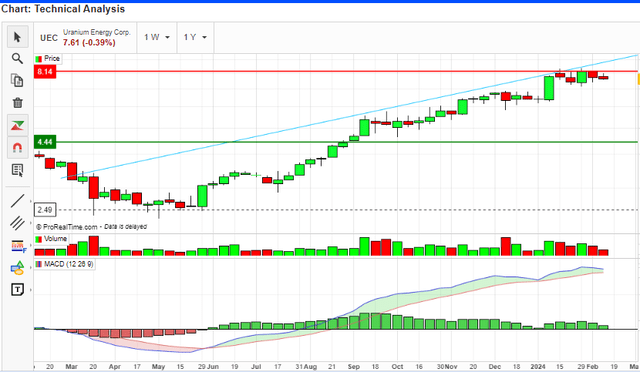

To solidify my bullish view, I draw your attention to the stock's moving averages. The price is trading above the 50-day, 100-day, and 200-day MAs which are all rising, an indication that it is in a strong upward momentum.

Market Screener-Author

Additionally, the MACD is positive at 0.87 and above the signal line of 0.82. Notably, it shows a strong upward movement and divergence with the price, an indication that the upward momentum is very strong.

Market Screener-Author

In conclusion, from a technical perspective, UEC is in a strong upward momentum with no signs of cooling, making it a good momentum pick.

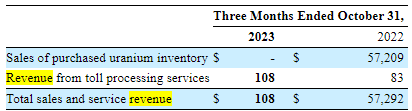

Financials

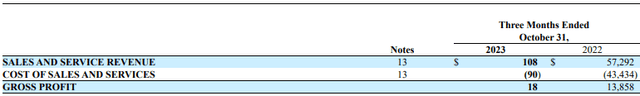

As far as financial performance is concerned, UEC reported weaker MRQ results, with net sales falling from $57.21 million to 0.108 million.

FORM 10-Q

This drop in net sales was also reflected in the profit margins, translating to poor profitability.

Form 10-Q

However, this poor performance was primarily caused by the lack of sales of purchased Uranium inventory for the quarter, which accounted for about $57.21 million in 2022. However, with the bright outlook of the company and the strong tailwinds, I expect the company to rebound strongly in the coming quarters.

As far as its balance sheet is concerned, the company has a strong balance sheet with a total debt of $1.80 million which can be covered 27.9x by its cash balance of $50.24 million. Furthermore, with a trailing total operating expenses of $20.3 million, the company's cash balance can cover it 2.47x, which is a very safe liquidity and solvency position. With this background, this company has a very low debt risk and a strong liquidity position, which gives them a lot of financial flexibility to pursue their growth opportunities.

A Bright Outlook

While I am optimistic about the stock price movement in the future, my rationale is based on several aspects, the company's promising outlook being one of them. The future of this company is very promising based on its revisions. To begin with, according to Seeking Alpha, its revenue consensus estimates for the next three years are very attractive and characterized by consistent growth. The consensus revenue for 2024, 2025, and 2026 are $80.69 million, $93.72 million, and $117.62 million respectively, marking a revenue growth of 45.77% from 2024 to 2026.

To add to the promising outlook, Wall Street estimates that the company's earnings will grow at an annual rate of 33.2% and the EPS will grow at an annual rate of 47.2% for the next three years. This adds to the double-digit growth rate in revenue according to Seeking Alpha. With these attractive projections, it is reasonable to expect a double-digit share growth, especially considering there exists a strong positive correlation between EPS and share prices.

Tailwinds

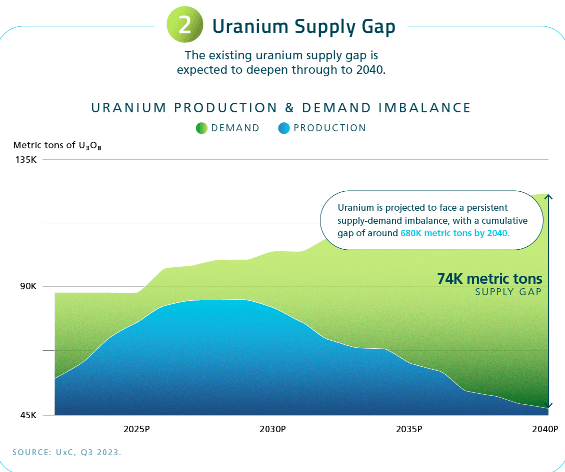

Given the promising prospects of UEC, let us evaluate the favorable growth catalysts that will fuel the anticipated growth. The first catalyst is a strong demand for Uranium. Given that it is a key component for a nuclear power plant that produces emission-free electricity, it aligns with the growing demand for safer energy as measures to combat climate change surge. The demand for Uranium is projected to grow steadily as more countries adopt nuclear energy to curb climate change. Demand is projected to grow by 28% by 2030 and nearly double by 2040. UEC is well positioned to tap into this opportunity because it has the largest ISR resource base in the US with over 75 million Ibs of measured and indicated resources and over 25 million Ibs of inferred resources, one of the leading countries in terms of uranium demand. It also has one of the largest land holdings in Canada's Athabasca basin, which is the global premier Uranium district.

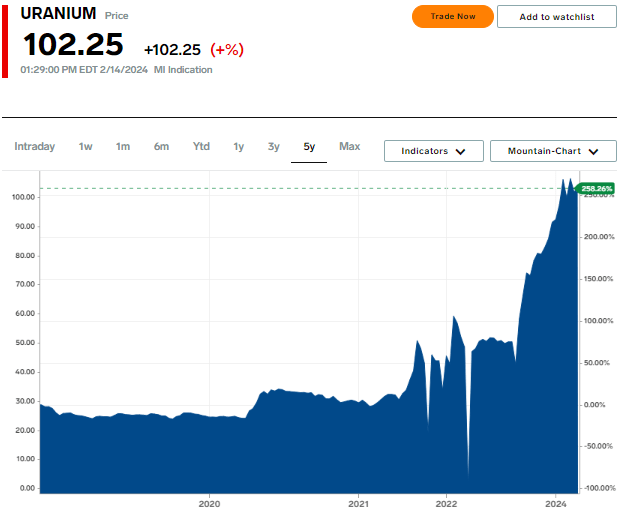

While I believe its leading position in the US in terms of resource ownership and its ownership in one of the prime lands positions the company in a competitive position to supply and leverage on the increasing demand, the other catalyst that compliments the increasing demand is favorable supply dynamics. The global supply chain has been disrupted significantly by production cuts and geopolitical uncertainties, not forgetting the impacts of COVID-19. As a result, Uranium prices have soared recently due to supply chain gaps. As of today, the price stands at $102.25 a 258.26% growth over the last five years.

Business Insider

Notably, it is projected that the supply-demand imbalance will deepen by 2040, which implies that Uranium prices could keep soaring even higher.

World Nuclear Association

With its rich resources in Uranium, the company is adopting several measures to tap into this supply gap. For example, it is investing in Uranium Royalty Corp., something which gives it exposure to royalties from Uranium mines globally. Further, it acquired Uranium One Americas, an acquisition that added two operation production facilities and seven licensed low-cost ISR uranium projects. This will not only improve its portfolio but also its production output.

In a nutshell, with these major catalysts and UEC's rich Uranium resources, I believe the company is well positioned to capitalize on these favorable factors, resulting in strong financials in the future and solid growth.

Comparative Analysis

With a market cap of $2.99 billion, let us evaluate how UEC compares with some of its major competitors and its competitive advantages. One of its key competitors is Cameco (CCJ) which has a market cap of $18.35 billion and a PB ratio of 3.99. The other competitor I will consider is NexGen Energy (NXE) with a market cap of $4.03 billion and a PB ratio of 8.37. Given UEC's PB ratio of 4.30, it appears that this stock has the lowest market cap and moderate valuation of the three. With this background, I would like to highlight UEC's competitive advantages, which I believe will propel its growth and perhaps grow its market cap.

First off, it has a diverse portfolio of uranium projects, including one of the largest physical portfolios in the US as earlier mentioned. In addition, it has seven US ISR uranium projects, all with the relevant permits and ready to ramp up production. Most importantly, the company is unhedged and with no forward contract ties, and therefore it stands a better chance to capitalize on the growing Uranium prices compared to its competitors. For these reasons, I believe UEC is better positioned to capitalize on the industry's tailwinds and grow its market value.

Valuation

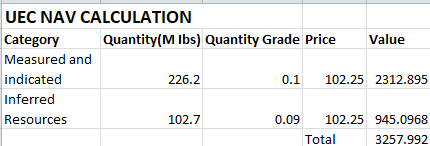

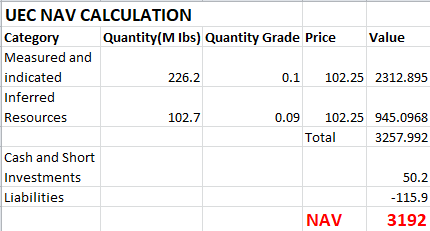

To value this stock, I will use the Net Asset Value of its resources. In my calculation, I will assume the current price of Uranium which is $102.25, and a quantity grade of 0.10 for the measured and indicated resources and a quantity grade of 0.09 for inferred resources. To get the value of the assets, I multiplied the resources with their respective quantity grades and the price of Uranium. According to the company's File SK-1300, technical report summary of May 2, 2023, it had a total measured and indicated resources of 226.2 million Ibs and a total inferred resources of 102.7 million Ibs. With this background, below is the estimated value of these assets.

Author

This value doesn't account for other assets such as cash, investments as well as liabilities. Therefore, factoring these variables, below is the Net Asset Value.

Author

To get the NAV/share, I divided the NAV with the total outstanding shares of 392.98 million, and I arrived at a value of $8.12 per share, which is 6.7% higher than the current share price of $7.61. With this value, it appears that this stock is trading at a discount and investors should capitalize on this cheap entry to enter this company which is bound to experience solid growth in the future courtesy of the solid tailwinds discussed above.

Risks

Although I am bullish on this stock, investors should be aware of the risks associated with this investment. One of the major risks is regulatory and social pressure. Although UEC uses ISR mining technology which is argued to have minimal impact on the environment, this method involves the use of large quantities of water and chemicals which can leak into the groundwater and cause pollution. Further, ISR mining can result in subsidence and land degradation, translating to disturbance of the ecosystem. As a result of all these possibilities, the company may face legal disputes and social pressures to mitigate these aspects or compensate for its actions which could impact the environment.

Conclusion

In conclusion, UEC is in a strong upward momentum as evidenced by the technical analysis and I expect it to continue in the long run given the company's growth potential. The stock is undervalued with strong tailwinds, thus warranting a buy rating.