If you are new to investing in early stage mining companies you might have heard of the term ‘JORC resource’.

A JORC resource is the standard used for measuring the in-ground size of a mineral deposit that a company may have discovered.

After making a discovery, companies will do a bunch of exploration work to determine HOW BIG and WHAT GRADE the deposit is.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

Once enough drilling data has been collected, and the company hits what they think could be the ‘edge’ of a deposit, the company will announce a new (maiden) JORC resource estimate.

Companies with an existing JORC resource looking to improve the economics of their project will also undertake exploration work, collect data and then announce what is called a ‘JORC resource upgrade’.

Because JORC is the standardised method of evaluating the size and grade of a mineral deposit, it allows investors to compare and contrast other companies with a JORC resource of the same mineral.

A JORC resource can underpin a company's value, as it defines the in-ground mineralisation that has been discovered, and without a JORC resource, the company cannot undertake feasibility studies to evaluate the economics of the project.

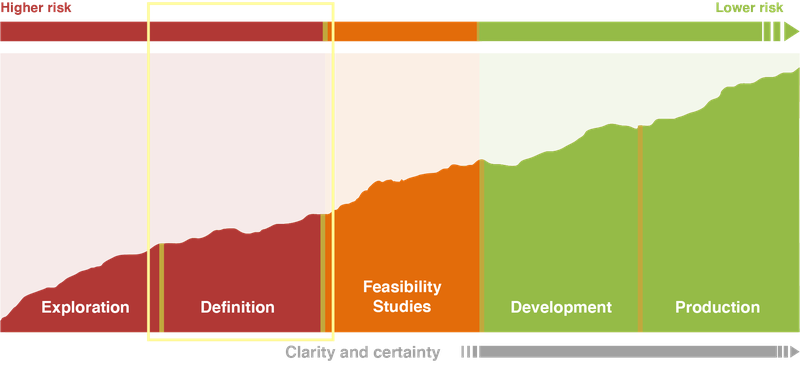

For a mining company to progress from exploration to development a JORC resource needs to be defined and eventually be upgraded into a reserve category.

This is called the definition phase:

Generally, whether or not a project is economic is dependent on the size of the JORC resource and its grade.

The size is important as mines are capital intensive and require economies of scale.

And the grades are important because they determine how much mining needs to happen to be able to extract that particular commodity.

Spot prices for respective metals also alter the value of the JORC resource.

A high copper spot price due to increased demand, may mean a relatively low grade JORC resource is still considered economically viable, and vice versa.

How to Read a JORC Resource

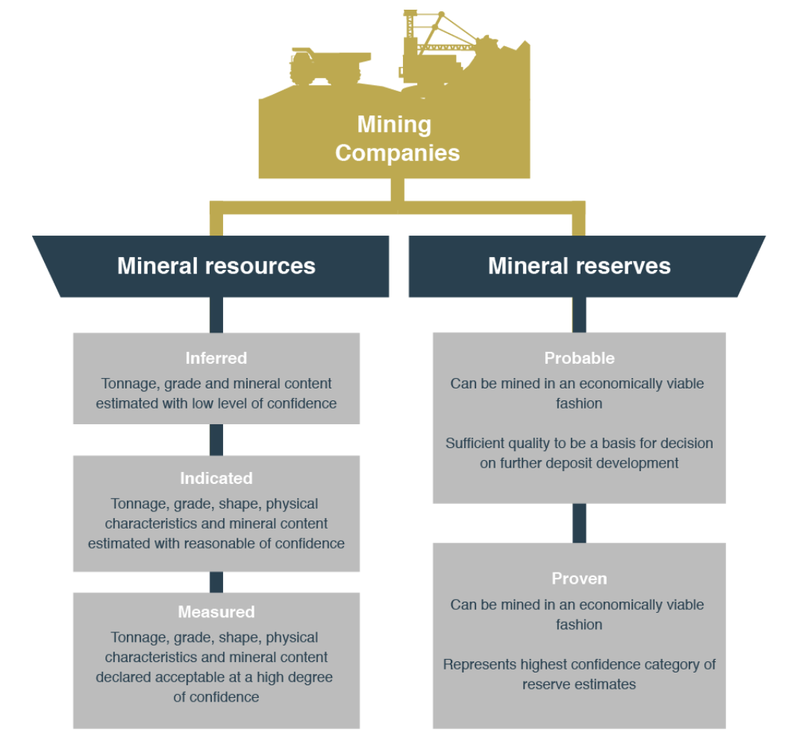

Discovered deposits can be classified as resources or reserves. The difference being how confident the company is that the deposit is valuable and extractable. In summary, reserves are better than resources... and here is why:

Resources are potentially valuable, with reasonable prospects for eventual economic extraction. Resources can be classified as inferred, indicated or measured for miners.

Reserves are valuable, and legally, economically and technically feasible to extract. Reserves can be classified as proven or probable for miners.

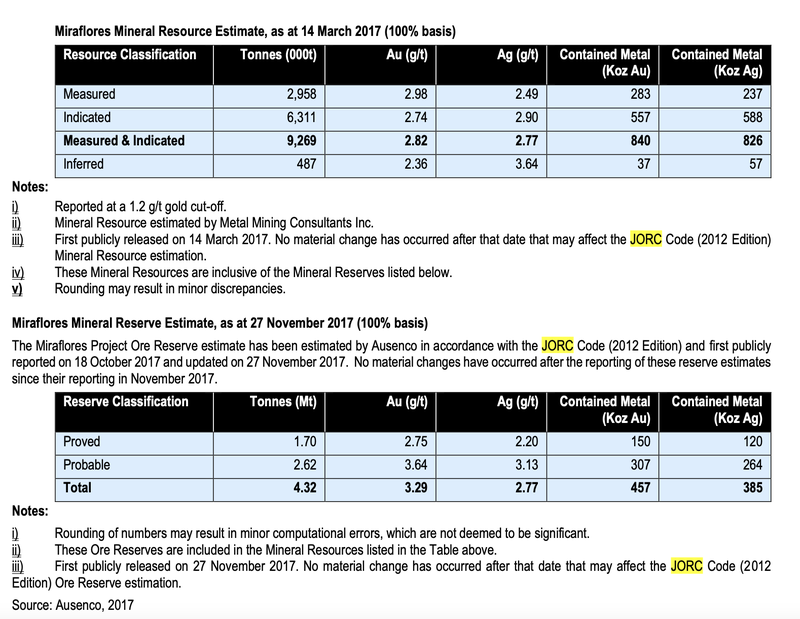

Here is an example of a JORC resource estimate from the Miraflores deposit for our gold Investment Los Cerros (ASX:LCL). As you can see, the classification is split into a ‘resource’ and a ‘reserve’ - with the reserve being the minerals that can be mined in an economic fashion.