Exxon has entered the chat...

That was the gist of the message Chevron gave to the world earlier this week after warning that its proposed $53 billion acquisition of Hess could see competing bids from ExxonMobil and China National Offshore Oil Corporation.

Both ExxonMobil and China National Offshore Oil Corporation are "asserting their right to pre-empt its purchase of a stake in a Guyana oil project that is central to the deal," according to a new report from Financial Times.

Exxon and CNOOC are joint owners of the Stabroek Block project, the report says. A Chevron regulatory filing out this week says it is in discussion with the parties “regarding a right of first refusal provision in the joint operating agreement” and Exxon has said it is “engaged in conversations with Hess and Chevron and those conversations will continue”.

The full text of Chevron's new disclosure states:

Chevron may not complete the acquisition of Hess Corporation within the time frame the company anticipates or at all, which could have adverse effects on Chevron.

The completion of the acquisition of Hess Corporation (Hess) is subject to a number of conditions, including regulatory approvals and approval by Hess stockholders of the adoption of the merger agreement. Additionally, Hess and Chevron have been engaged in discussions with Exxon Mobil Corporation and China National Offshore Oil Corporation regarding a right of first refusal provision in the joint operating agreement for the Stabroek Block offshore Guyana.

If these discussions do not result in an acceptable resolution and arbitration (if pursued) does not result in a confirmation that such right of first refusal provision is inapplicable to the merger, then there would be a failure of a closing condition under the Merger Agreement, in which case the merger would not close.

Exxon also confirmed earlier this week it was in talks regarding the deal, stating: “We owe it to our investors and partners to consider our pre-emption rights in place under our joint operating agreement to ensure we preserve our right to realise the significant value we’ve created and are entitled to in the Guyana asset.”

The “most likely outcome is one in which the . . . deal is ultimately consummated, perhaps with a bit of a delay," analyst Jason Gabelman with TD Cowen told FT.

He continued: “A low-probability outcome is one in which an arbitrator rules a [right of first refusal] is applicable, in which case the deal would fail and [Hess] would continue to exist as an independent company with its current interest in the Stabroek Block.”

A Chevron spokesperson responded: “There is no possible scenario in which Exxon or Cnooc could acquire Hess’ interest in Guyana as a result of the Chevron-Hess transaction.”

He continued, stating the Chevron was “fully committed to the transaction”.

As WSJ noted, the disagreement centers on the specifics of a Joint Operating Agreement (JOA) established over ten years ago. Hess became a party to this agreement in 2014, acquiring its share from Shell. Under some JOAs, current partners, such as Exxon, are granted the opportunity to engage in changes to ownership, enabling them to counter an offer for a stake in the ownership with a bid of their own.

Exxon and Chevron have divested billions in assets in Asia and Africa, highlighting the shift towards U.S. shale and South America. Chevron resumed oil operations in Venezuela under eased sanctions, boosting production unexpectedly, and is also investing in Argentina's shale and exploring near Guyana. Meanwhile, tensions have risen as Venezuela increased its military presence near Guyana, a less equipped neighbor, though analysts deem an invasion unlikely, the WSJ report notes.

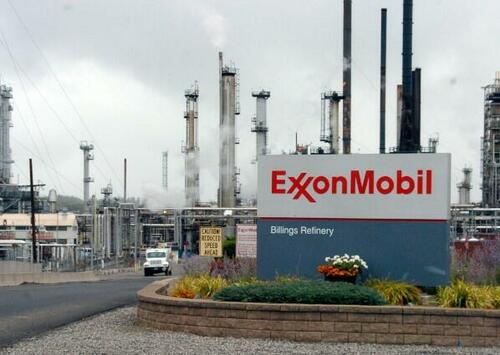

Exxon, taking on significant risk, has spearheaded drilling in Guyana, uncovering vast oil reserves now estimated at nearly 11 billion barrels. The company recently initiated a new offshore development in Guyana, increasing production significantly, with plans to expand further by 2027, aiming for a daily output of 1.2 million barrels.

The likely scenario we think?