REANALYSISBoth sides could argue on the presence of, 2 forms of nickel.

Sulphide Argument - That all we seek is sulphide nickel

- MET Tests were designed to target sulphide nickel

Solution Argument - Admittence of solution nickel (

Page 8 2012 MET report )

- In one breath a guesstimate of 12%

- Second breath admittence of, 0.1 to 0.3% Ni

A portion of the nickel (about 12%), however, is non-sulphide and most likely in solid

solution with amphiboles, serpentine & amphiboles (substitution in crystal structure). It has been reported that the nickel content of the silicate minerals is about 0.1 to 0.3% Ni https://www.wellgreenplatinum.com/pdf/2012_07_Wellgreen_Met_Report.pdf 437 million tonnes

- 20% resource deduction ( 5% sulphide 15% gabbs )

= 349,600,000 million tonnes

x 0.12% Ni solution

=

419,520 Ni tonnes x 2200 lbs

=

922,944,000 lbs

~ 50% recovery

= 461,472,000 million lbs x $ 9 dollars lb

= $

4,153,248,000 billion

Goodness, there are other nickel peers with low grade that do account for

their solution nickel... NCP should too. MET Fail ? Never fully testing ores to arrive at a definitive ( other nickel % )

( solution, plain hydroxide, chloride, carbonate )

If one reviews 2023 metal payables, it makes one wonder if,

silicates really have sulphide nickel ?

Sulphide nickel payables are extremely low.

Therefore... it could point to nickel is in another form.

And the what if, 0.30% silicate nickel in peridotite, clino, dunite ores are

solution form ?

Which begs...

when metals solubilze and go into solution, are they really solution, or...

nano metalloids still mtallics ?

Course grind ( 75 micon ) wouldn't capture these.

They'd be discarded in waste silicates.

2012 MET applied 10 - 20 micron, which increased recoveries.

2017 revised to, course grind to save on, energy.

2015 crew performed a pre-deduction of, 10% for solution nickel in dunites,

prior / while working with engineering firm. ( 2015 PEA page 196 of 342 )

2017 rolls around,

Practical entitlement is applied to both

Peridotite, Clinopyroxene ores.

How i understand practical entitlement ? Pracrical entitlement - entitled to.max % recovery based on industry standard ?

If a junior recovered 90% nickel

90% Ni recovery would reduce to -

73 – 76% ( Peridotite ) Copper is entitled 95% (

Peridotite )

70% PGM's (

Peridotite )

Clinopyroxenite practical max entitlements

Ni - 79 – 83% Cu - 95%

PGM - 70%

Practical Entitlement recognizes that part of the feed metal units exist in a form that is either mineralogically unsuitable for recovery (e.g. nickel as low-concentration solid solution in magnetite or silicates) or in a form that is physically unsuitable for recovery (disseminated microcrystalline inclusions of metal sulphides within silicates). These values can be compared to the physically achieved recoveries in metallurgical testing, which reveal the magnitude of process losses associated with upgrading. https://www.nickelcreekplatinum.com/investors/news-releases/press-release-details/2017/Wellgreen-Platinum-Announces-Results-of-Metallurgical-Testwork/default.aspx SUM ? 2015 - Dunite solution nickel -

10% deducted 2017 - Peridotite Crystal Nickel - capping @

73 – 76% ( 25% limiting deduction avg ) 2017 - Clinopyroxene Crystal Nickel capping @

79 – 83% ( 17% - 21% limit deduction avg ) June 26, 2017 - Additional 74 drills

gained 10% resource Sept. 25, 2018 - 10% resource reduction June 26, 2017 - Inferred class of mineralization declined in tonnage by approximately 86% - Additional drilling combined with the revised geologic interpretation resulted in establishing boundaries of mineral bearing rock types that were previously reported as open. The result is physically less mineral bearing rock that can host mineralization. ( Wango - axing inferred below pea pit shell )

- Inferred mineral resource estimation in the 2017 Resource Estimate utilized a search radius based on the statistical range of influence derived from variography as measured by the Qualified Person. Previous estimates of the Inferred mineralization applied larger search radii. ( Wango axing inferred )

- Changes to metallurgical recoveries and processing costs also impacted the Inferred category by increasing cut-off grades in Net Smelter Return ("NSR") terms. This contributed to the loss of tonnage and an increase in reported inferred nickel grade.

Near-surface peridotite hosted mineralization however, remains open to the south in certain areas of the deposit. Higher-grade mineralization remains open at depth below the eastern end of the resource pit and mineralized intercepts remain open to the east. These areas will be the target of future exploration drilling.

https://www.nickelcreekplatinum.com/investors/news-releases/press-release-details/2017/Wellgreen-Platinum-Announces-Updated-Resource-Estimate/default.aspx

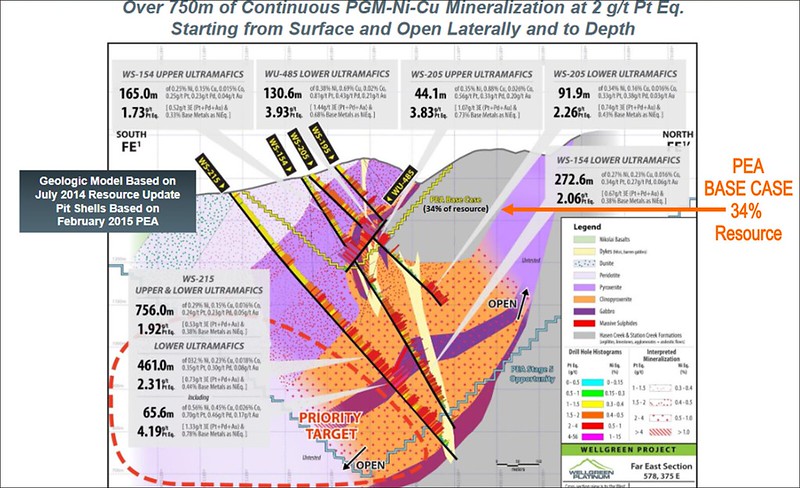

If we review former drill images which reveal ore stratigraphy,

what's below 2015 pea pit shell ?

More resources.

This image shows 3 drill holes sunk into the Pit 5 phase shell.

Johnson's hole runs reall deep.

So how can 2017 crew axe a significant amount of, inferred ?

Especially when, images like this reveal a far larger ore body below ?

Yukon file, reports twinning holes, actual resource runs far deeper.

541m deep.

Look at the pitch of, Johnson's drill.

Passes through first mountain and clear into, other mountain. ( northerly )

Again,

why was 86% resource axed ?

2012 UG HOLES Could this be the reason why our massive inferred was axed ?

- Deep underground drill holes some

are missing in 2015 PEA

- Deep hole list ( WU 2012 )

page 89 of 342 https://s21.q4cdn.com/491660439/files/doc_downloads/2015pea/2015_wg_pea_report.pdf WU 12 528 missing

WU 12 524 missing

WU 12 525 missing

Page 89 documents length of holes, yet... these holes are deep holes.

The depths in pea don't match the image depths seen below.

Compare with this image in, link too.

We can see these deeper holes in, ghosting.

Deeper holes run well past pea pit shell.

These are inside pitshell #5 not in, pea pitshell.

https://live.staticflickr.com/65535/53521505591_6e24ef0d7b_c.jpg See Johnson's ghost drill in gree link above ?

Nope.

Go back to drill image above - where is Johnson's drill hole ? Outside PEA pit shell.

2015 PEA

does show Johnson's hole. Yet, image shows Johnson's hole outside of, pea pit.

Another hole

missing in 2015 PEA -

WS 271 - 676 meters - 3 mineralized lenses. (

important hole )

Sweet Spot.

https://live.staticflickr.com/65535/53321883061_de69f57354_c.jpg Compare distance between WS 271 = 676m of mineralization with WS 184 2 lenses

WS11-184 8.23 to 111.07 = 102.84m mineralized

WS11-184 137.16 to 480.67 = 343.51m mineralizes

Is there a connective to missing holes and cut offs increased

which aided in 86% inferred resource loss ? Galactic 11,000+ meters too ? Even a Yukon file stated,

Twinning of holes did occur but issues with identifying which holes and

where resulted in, not factoring holes ?

Uhmmm... why not take an averaging of each disputed twinned

deep hole - using interpolation - arrive at a mediam grade average ? Below excerpt - drillig year class = Galactic ?

2006, 2007 and 2008 diamond drill programs were carried out to twin historical holes and to upgrade the property’s resources to NI 43-101 standards. One diamond drill hole (WS-06-153) was drilled to test the thickness of the ultramafic body. It reached a

final depth of 561.14 m, far deeper than historical records indicated.

The twined holes generally confirmed historical results however differences in collar locations and elevations between the two sets of data prevented a definitive conclusion from being reached. Underground drilling was carried out to explore the deposit at depth https://data.geology.gov.yk.ca/Occurrence/14129#InfoTab TITANIUM, ALUMINUM, CHROMIUM, MAGNESIUM

Should nickel juniors such as, ncp, take a second look at these minerals ?

Instead of waiting on better, nickel spot ?

2012 pages 8 - 9 resource grades

https://www.wellgreenplatinum.com/pdf/2012_07_Wellgreen_Met_Report.pdf Ti - 3 - 4 kg's per tonne $6.60 kg

Al - 24.5 kg oer tonne - bauxite ore $2,000 tonne

Cr - other assay reports reveal upto 0.33 % - 60% ferro cr ore $2,000 - $3,000 tonne

Mg - by 2023 MgO markets will increase 6x - currently @

$413.58 tonne That's all i'm researching.

This stock has worn me out - lol

Hopefully a few of my posts have helped the junior.

If i've errored certainly no intentional.

Do chime in with a post to correct.

Cheers..