HYPO PART 42012 PEA - Page 95 - 96 702 boreholes, of which

183 were drilled from surface and

519 drilling from various underground workings https://secure.kaiserresearch.com/i/jk/tr16/TRNKL20120801.pdf 2012 Tetra Tech PEA Mode cutoff

0.2% Indicated Pitshell 14,432,900 1.4% Ni Eq

0.2% Inferred Pitshell 446,649,000 0.6% Ni Eq

2015 - PEA - Page 182 776 holes - 68,898.30 m

https://s21.q4cdn.com/491660439/files/doc_downloads/2015pea/2015_wg_pea_report.pdf cutoff

0.15% ( m + i ) 329,569,000 0.261 Ni ( eq not factored )

0.15% inferred 846,389,000 0.237 Ni ( eq not factored )

-------------------------------------------------------------------------

2012 PEA metions 702 drill holes

2015 PEA mentions 776 drill holes

What had not fully come to fruition in, 2012 ? = All historical holes / reassaying / relogging not yet completed -

till 2013 = Hence, the indifference between 2012 pea and 2015 pea

= 2012 pea should've stated how many holes were then assayed from 702

By the time 2014 quick resource calc was pressed and to... 2015 pea

M + I Reasource and Inferred grew in size

All historicals were in, with all the more new holes ( 702 - 776 )

74 more holes like 2015 / 2016 press outlines ( yet, press adds, more historicals were included )

PAGE 19 - 2015 PEA Mineralized mill feed material is planned to be mined mainly from a large open pit (383 Mt) with

additional feed from an underground mine (9 Mt). The total planned mine life is approximately

25 years with 392 Mt of mineralized material mined and processed and 296 Mt of waste rock

mined giving an overall strip ratio of 0.75 t of waste rock to 1 t of mill feed material.

392 Mt of mineralized material mined

296 Mt of waste rock mined

= 688 Mt

Reads as,

just mine the ( m + i )

Historical drill compilation 516 ug holes - east

80 surface - east

70 surface - west

= east + ug mine + below mine

= 2015 resource ( derived mostly from this zonation )

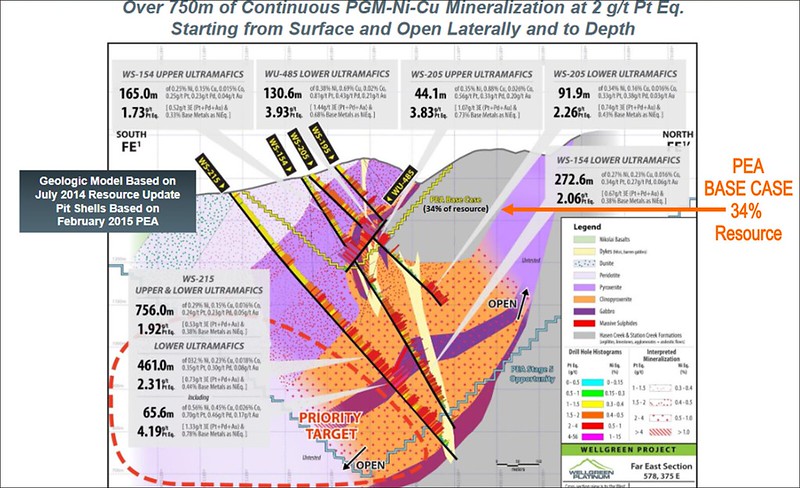

2015 Yellow pitshell

2.5 km strike

2 main pits ( east / west ) inferred = below pits and outlier boundary of only yellow bounday

If... 2015 PEA

only factored ( m + i ) then what remains ?

= 846 Mt inferred 846 million t

would have to comprise

benieth pits and... larger yellow boundary

Then, what was 2014/2015 crew implying when speaking

37 yr mine life, 56 yr mine life ?

Aqua green parameter  Therefore,

Therefore,

846 Mt inferred would have to be geared toward

= 2015 PEA yellow parameter

= if both east + west pits are mined

= leaves only 2 zones to comprise 846 Mt inferred

= deeper + full extent of, yellow boundary

2015 PEA ( page 24 ) Gabbro 11%

Clinopyroxenite/Pyroxenite 88%

Peridotite 1%

Keep in mind 2015 characterized ore into 3 groups seen above ^

( peri with subgroup = dunite + olivine ) all grouped under peridotite

Peridotites increased to 10% after 16 yr of ming

2015 included - gabbs 2017 press - recharacterized ore - segragated gabbs, sulphides

= test at later date

Yet... 2015 PEA already included these gabbs / sulphide ore kinds

lol 2015 PEA extraction recoveries not factored

2023 PFS extraction recoveries inputted into block model

Yet... one must keep in mind, 2017 changed - cutoffs

- boundaries

- rechacterized ore

- test sulphides + gabbs later date = my compass ---> ug mine and below it

= lower ultramafics Shallow pit shells ( 2015 / 2023 ) what's below ?

2013 - Johnson 756m hole

2013 - Johnson 756m hole drill outside pea pitshell ( yellow boundary ziggy pit )

Visually seeing what's below yellow pitshel in diagram

Visually seeing what's below yellow pitshel in diagram = convinces me there's strong support for 846 Mt inferred below

= lower ultramafics

2023 pfs mentions arch... but what about west ?

2023 pfs includes waste mining cost near same cost to mine mineralized ore

If 2023 main 2 pit shells

ride atop + skirt mine

are shallow and don't run as deep as the johnson hole or ug holes

= then, does this not spark interest towards 86% inferred loss ?

= it does for me

These Hypo posts along with a few other posts

are a compilation of my research on, Wellgreen.

Not investment advice.

Moreso an effort to track down the 86% loss of, resource.

I maybe wrong, but then again i maybe bang on.

Open to another's correction via post.

Cheers...

Yes, i do admire the Wellgreen project.., not the Shaw.