HEYWOODIt's great the platinum group metals are on the rise but.... It won't do much for our share price ( if the stock is boxed in ) held down.

What's my main focus ? Tracking down ( Wellgreen's sulphides ) while dismissing Shaw's silicates.

Jan. 8, 2018 Wellgreen Platinum name change to Nickel Creek Platinum

Anything else ? Concurrent with our rebranding, we have renamed our 100%-owned Ni-Cu-PGM project to Nickel Shw (from Wellgreen). https://www.nickelcreekplatinum.com/investors/news-releases/press-release-details/2018/Wellgreen-Platinum-Changes-Name-to-Nickel-Creek-Platinum/default.aspx Any connection to, test sulphides and gabbs later date ?

Could the bore holes and 2013 reassaying been segragated at this point in time ?

Yet.... still 100% owned ....

Most are familiar with 2017's press stating " test sulphides and gabbs later. "

Most know the higher grades revolve around (

sulphide, fabbs, clinopyroxine )

reports and press releases mention this wuite often

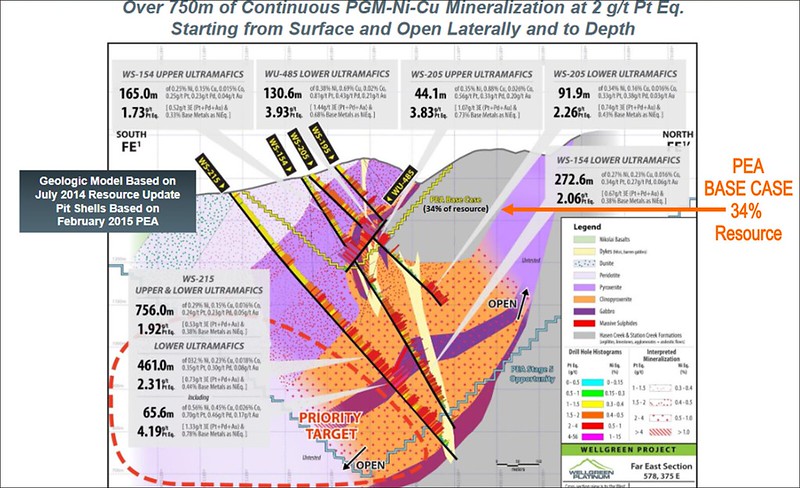

Whare are these higher grade zones ? Lower Ultramafics

Beyond the surficial ( shallow drill holes of 2017 retest of ores for new met tests )

Deeper zones contain the higher grades

Deeper.... benieth the silicate capping

2015 outlined a core higher grade zone consisting of, 72,117,000 million tones ( m + i ) 0.653% Ni Eq 2.493 / g Pt Eq

173,684,000 million tonnes ( inf ) 0.631 % Ni Eq 2.41 / g Pt Eq

Source 2014 ( bottom chart ) https://live.staticflickr.com/65535/53294034400_a645049e8f_c.jpg Rough Averaging Using Sulphides ( figures above ) 246 mil tonnes x 0.64% Ni Eq

=

1,574,400 million tonnes Ni Eq

x 2200 lbs

= 3,463,680,000 Ni Eq

246 mil tonnes x 2.4 / g Pt Eq =

18,983,922 mil oz Pt Eq x $1000 ( avg )

=

18,983,922,000 billion usd So if 2017 retest ( drilled more holes ) for new MET tests

where were these holes ?

= majority were well away from ug mine, well away from far east zones

Did they drill deep ? lol

Try to obtain the deeper sulphides, gabbs ?

Highly likely the upper silicate capping ores were sent to, xps.

and most likely why our 2023 pfs has extremely low metal payables

Which brings the subject full circle to,

2017 - tests sulphides and gabbs - later.

You see, gabbs and sulphides have a far higher recovery.

Industry standards = 85% or more

If 2017 said ( test sulphides and gabbs later )

and new holes were drilled for new met tests which were revealed in 2018

then... how can the MET tests be a continuation of MPP bulk concentrate

when MPP bulk concentrate comprised - sulphide + gabbs + 80% silicates ?

It points to, sulphide + gabbs ( higher grades ) were excluded.

And.... 2017 new drills ( shallow ) were sent to xps.

Question... what's best for shareholders ? - high grade sulphide gabbs = 245 million tonnes @ 85% extraction

or

- 437 million tonnes silicates, course gring, met test that can't handle silicates

25% metal payables in 2023 pfs

Throw in Clinopyroxine

geology aside of gabbs and sulphides

massive orange color  And this, 90% platinum

And this, 90% platinum group could be extracted

https://live.staticflickr.com/65535/53255723282_357390e13d_c.jpg Let's now revamp the wellgreen Focus on sulphide, gabbs, clinopyroxine

reshape pit ( skinny elongated pit shell )

only mine these three geologies

higher grade minerals

higher recoveries 85%

pgm group 90% recovered

exotics as bonus

= highly valuble project Yet... how was this wellgreen project shaped since late 2015 ?

Anyone keeping an eye on, ivn - trading millions each day - for several months ?

Bore hole Billionaire.

While the other billionaire, collecting ncp cheapies.

Cheers...