Largo’s Product Mix

MD&A: “The Company sold 10,396 tonnes of V2O5 equivalent in 2023 (including 929 tonnes of purchased products), within the revised annual sales guidance range of 8,700 – 10,700 tonnes, with sales in Q4 2023 of 2,605 tonnes (including 139 tonnes of purchased products)....

The Company delivered both standard grade and high purity V2O5, as well as vanadium trioxide ("V2O3") and ferrovanadium (“FeV”) to customers globally”

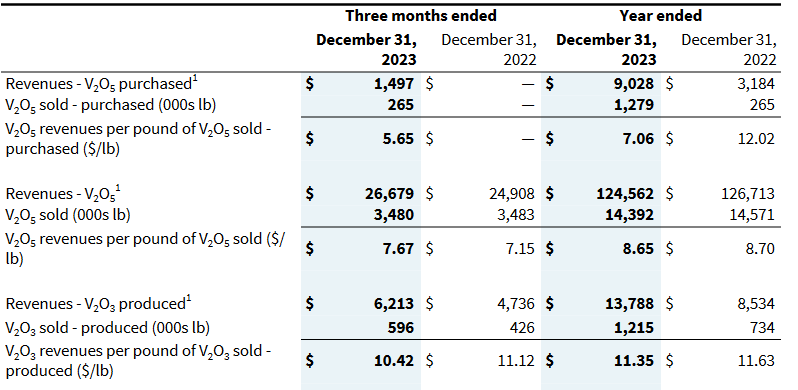

The following table illustrates the revenue from Largo’s product mix in 2023:

Let’s a closer look at Largo’s product mix

1) Sales of In-house produced V2O5 and V2O3

Largo is a primary V2O5 / V2O3 producer so let’s have a look at the revenue from the sales of in-house produced V2O5 / V2O3, as follows

US$

| In-house Products | Q4-23 Revenue per pound | Q4-23 Average Euro Benchmark Prices for V2O5 | Difference Higher or (Lower) than Market average for V2O5 | FY-23 Revenue per pound | FY-23 Average Euro Benchmark Prices for V2O5 | Difference Higher or (Lower) than Market average for V2O5 |

| V2O5 | $7.67/lb | $6.46/lb | $1.21/lb | $8.65/lb | $8.33/lb | $0.32/lb |

| V2O3 | $10.42/lb | $6.46/lb | $3.96/lb | $11.35/lb | $8.33/lb | $3.03/lb |

| Total | $8.07/lb | $6.46/lb | $1.61/lb | $8.86/lb | $8.33/lb | $0.53/lb |

The sale price per pound of our in-house products are higher than the average benchmark standard V2O5 prices for the same period. Why so? Thanks to the fact that Largo delivers not only standard grade + high purity V2O5 but also V2O3 from our in-house production. In 2023 the prices per pound of our V2O5 & V2O3 product mix surpassed the average standard price by $0.53 or 6.4%. Q4-23 was particularly good with $1.61 or 25% higher than the average standard thanks to the fact that it accounted for 50% of the V2O3 sales of 2023. If this trend continued into the future then it would help boost Largo’s revenue growth. V2O3 is a product that carries a very high premium over standard V2O5, Largo should focus on selling V2O3 more.

Btw, last year the sale prices per pound of our V2O5 & V2O3 product mix were lower than the average standard price by (8.12%) and (5%) for Q4-22 and FY-22 respectively.

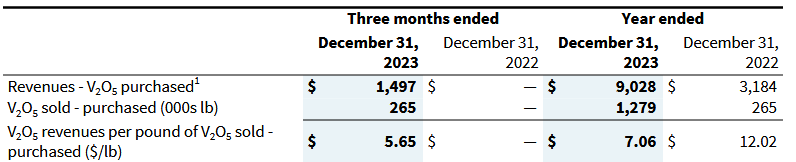

2) Sales of purchased V2O5

Largo is one of the 3 primary producers of V2O5 in the western world. I can’t wrap my head around the fact that the company has to purchase V2O5 for delivery to the end customers, as follows:

| Purchased Products | Q4-23 Revenue per pound | Q4-23 Average Euro Benchmark Prices for V2O5 | Difference Higher or (Lower) than Market average for V2O5 | FY-23 Revenue per pound | FY-23 Average Euro Benchmark Prices for V2O5 | Difference Higher or (Lower) than Market average for V2O5 |

| V2O5 | $5.65/lb | $6.46/lb | ($0.81)/lb | $7.06/lb | $8.33/lb | ($1.27)/lb |

a) The sale prices per pound of our purchased V2O5 were lower than the average standard price by (12.5%) and (15.25%) for Q4-23 and FY-23 respectively.

It doesn’t make sense for Largo to engage in such a non profitable business, does it? Especially when the company has plenty of finished V2O5 in inventory.

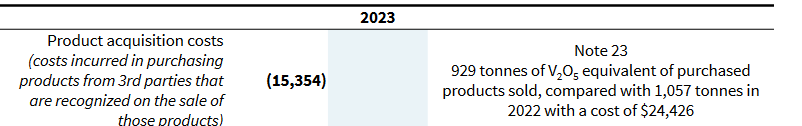

Furthermore the acquisition costs are higher than the sale prices. So go figure.

Q4-23 acquisition costs = $1.97M while the revenue from the sale of purchased V2O5 = only $1.5M (there was no purchase of FeV in Q4-23)

FY-23 acquisition costs = $15.4M while the revenue from the sale of purchased V2O5 and FeV = $9.0M + $1.4M = $10.4M

b) Another point that I don’t understand is that the 265K pounds and 1,279K pounds given in the following table don’t match with the management statement declaring: “The Company sold 10,396 tonnes of V2O5 equivalent in 2023 (including 929 tonnes of purchased products).... with sales in Q4 2023 of 2,605 tonnes (including 139 tonnes of purchased products).

Note that: FY-23 929T = 2,048K pounds (which is higher than 1,279K pounds as shown in the table) and Q4-23 139T = 306K pounds (which is higher than 265K pounds as shown in the table). If 2,048K pounds and 306K pounds were used for FY-23 and Q4-23 respectively the related revenues per pound would be lower than shown in the table.

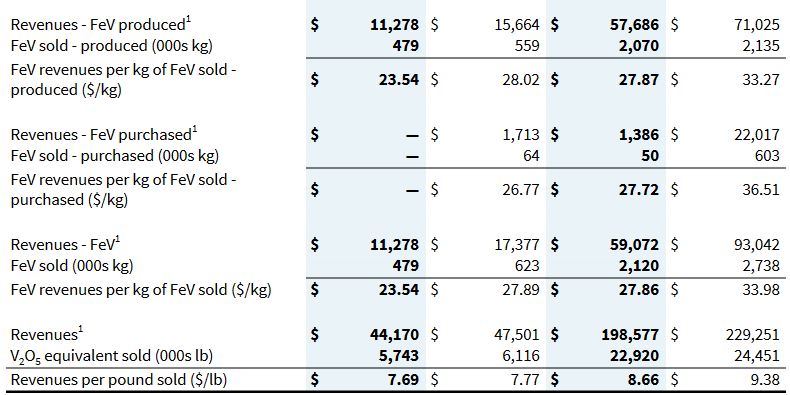

3) Sales of FeV

Largo doesn’t produce FeV, period. In order to be able to sell/deliver FeV to the end customers we have to either make an outright purchase of the finished products from a Brazilian FeV producer or pay him to convert our own V2O5 into FeV. What kind of a profit margin (if any at all) do we get from reselling FeV ? It’s hard to understand why Largo does such a costly thing especially when FeV prices keep declining.

DYODD