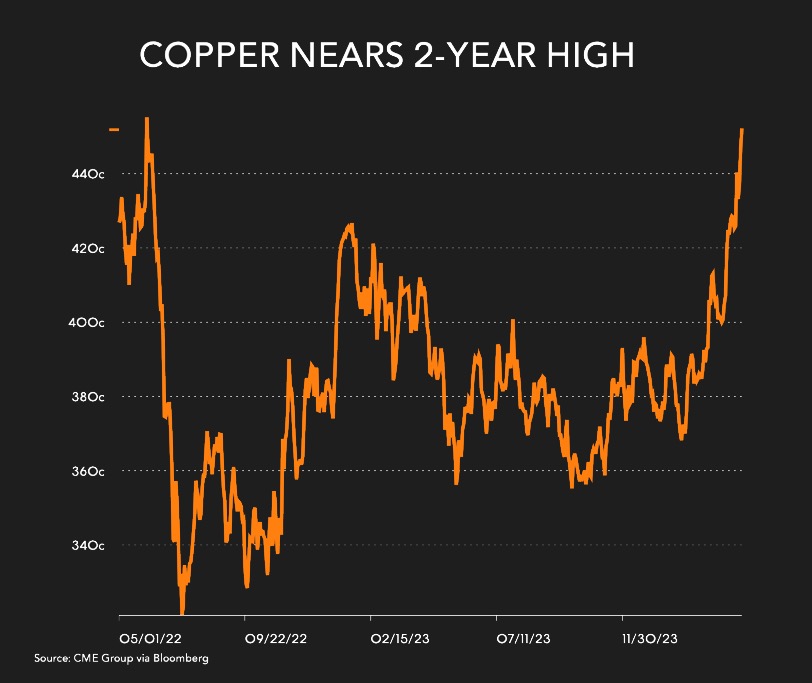

The spectacular upward move over the last couple of weeks comes as so-called managed money build long positions – bets on higher prices in future – to the equivalent of more than 2 million tonnes on the London Metal Exchange, a new record. Likewise, long positions on Chicago’s CME copper futures contracts are at levels last seen in January 2018.

BMO Capital Markets in a Friday research note on CESCO Copper Week in Santiago summed up the mood at the conference as “Buoyant but not bullish”.

There was widespread agreement at the conference that, while most market participants were happy with the higher copper price seen over the past month, the recent run has been slightly ahead of fundamentals.

“In our view, this reflects the heavy inflows towards copper, and commodities as an asset class, a dynamic that many producers were keen to understand more about,” BMO said. “There is some confidence demand can improve further to backstop current price levels, but without this emerging soon the recent rally may prove vulnerable.”

https://www.mining.com/spectacular-copper-price-rally-only-gaining-momentum/