World Bank - VFB Market Forecasts vs V2O5 prices

2024 Installations (GWh)

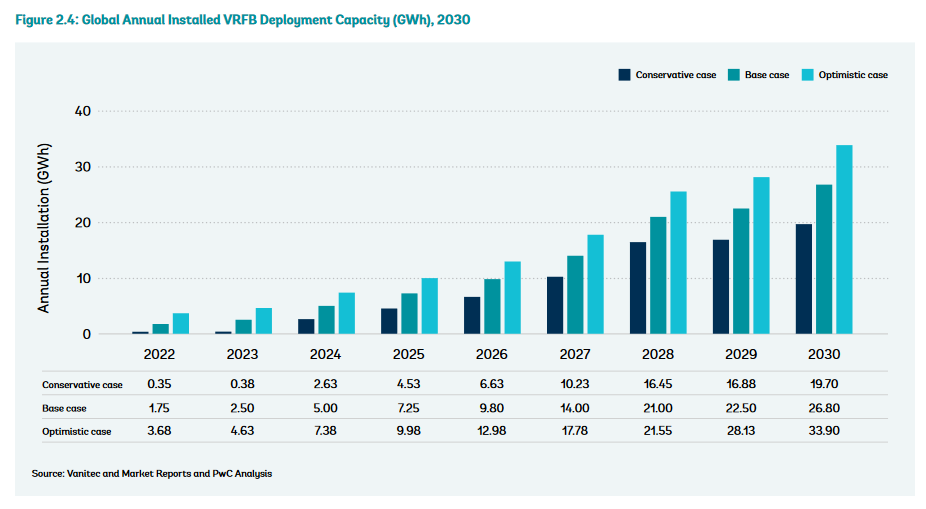

| Scenario | 2024 Annual | Annual V2O5 demand equivalent | 2024 Cumulative | Cumulative V2O5 demand equivalent |

| Conservative | 2.63 | ~24,300T | 3.36 | ~31,000T |

| Base case | 5.00 | ~46,300T | 9.25 | ~85,700T |

| Optimistic | 7.38 | ~68,300T | 15.69 | 145,100T |

2025 Installations (GWh)

| Scenario | 2025 Annual | Annual V2O5 demand equivalent | 2025 Cumulative | Cumulative V2O5 demand equivalent |

| Conservative | 4.53 | ~41,900T | 7.89 | ~73,000T |

| Base case | 7.25 | ~66,900T | 16.5 | ~152,,600T |

| Optimistic | 9.98 | ~92,300T | 25.67 | ~237,500T |

~9.25 tonnes of V2O5 are used per MWh of storage. And 1 GWh = 1,000 MWh

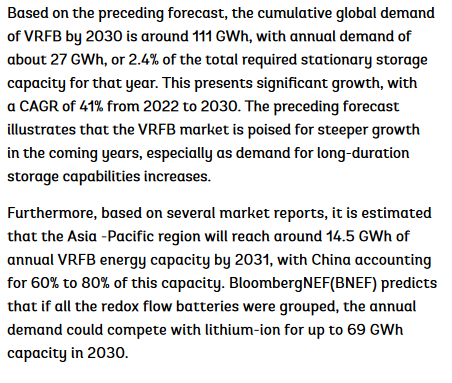

According to Terry Perles the world produced 118,319MTV (equivalent to 211,200T V2O5) and consumed 115,220MTV ( equivalent to 205,670T V2O5) thus a slight surplus of 3099MTV (equivalent to 5,530T V2O5) in 2022. Note: 1 MTV (Metric Tonne of pure Vanadium) = 1.785T V2O5. It is safe to say that there was also a slight supply surplus in 2023 even though the relevant data are not yet available. Therefore it seems like even the most conservative scenario of the World Bank forecast points to a supply deficit of V2O5 starting from 2024. And yet the prices of V2O5 still linger in the bargain basement around US$6/lb in May 2024. Will the prices of V2O5 explode upward in H2-24?