Calmac9sh Good points.

I made money with LGO when the company was under the leadership of Brennan and Smith. Since commercial independence things went downhill. Paulo Misk, our former CEO, was a bad leader. Ernest Cleave, an overpaid condescending CFO who could not hold a job for more than 2 years anywhere else other than Largo is not shy from showing his disagreement with the BoD in public. Paul Vollant, a newly hired Sales Director who gets fast tracked up to VP Commercial and President LPV in record time, is known for providing misleading information to the public. Furthermore the fact that the top executives with 7-figure compensation have no skin in the game speaks volumes about their loyalty to Largo and its shareholders. The anti-transparency corporate culture makes things worse. Commodities, especially in mining, are definitely cyclical. And yet Largo ended up in red ink (negative ESP) when V2O5 prices were as high as US$8 - $10.72/lb in the past 2 years.

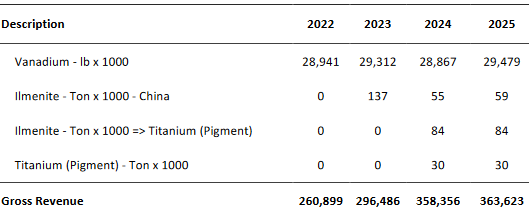

NPV valuation of US$2bn? So outdated. That base case study was based on an average sale of 13,200T of V2O5 per annum starting from 2022 which is ~30% higher than the maximum range of our actual sale guidance (10,700T). It also expected a considerable revenue stream from TiO2 starting from 2024. The 3 phases of the TiO2 project would require ~$300M to complete. The project is now on the back burner until management figures out the financing.

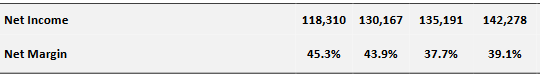

The following table illustrates how unrealistic the base case study was even from 2022 to 2025:

In 1,000

Comparison between base case data and actuals (2022 & 2023)

US$

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Item | 2022 Base Case Study | 2022 Actual | 2022 Differences col.3 minus col.2 | 2023 Base Case Study | 2023 Actual | 2023 Differences col.6 minus col.5 |

| Gross Revenue | 260.9M | 229.3M | (31.6M) | 296.5M | 198.7M | (97.8M) |

| Net Income (Loss) | 118.3M | (2.2M) | (120.5M) | 130.2M | (32.4M) | (162.6M) |