Copper Short Squeeze Goldbugs Waited Years For A Massive Comex Short Squeeze, And Finally Got It... Just In The Wrong Metal | ZeroHedge Excerpts:

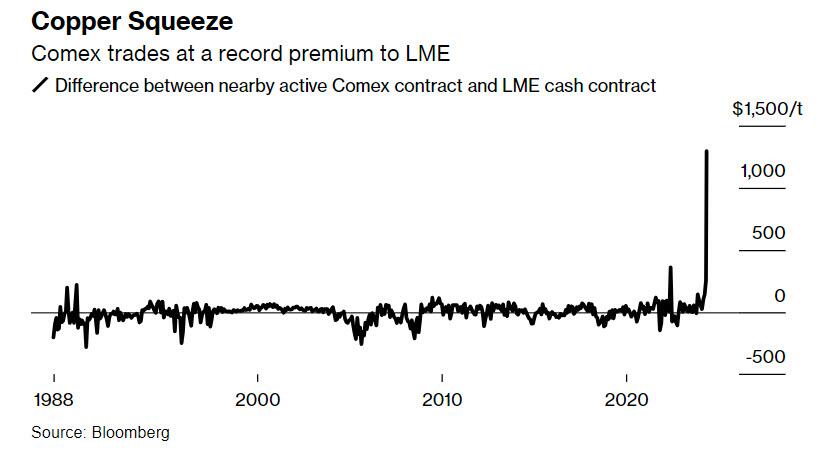

For much of the past decade, gold bugs religiously tracked the physical gold inventory located in the various gold vaults that make up the Comex system, eagerly awaiting the day when there would be more deliverables (via paper shorting of gold) than physical in storage, sparking a historic, Volkswagen-like short squeeze. Well, the day of a historic Comex short squeeze finally arrived... only it wasn't in gold but in the far less precious metal that is copper. The source of the disruption, as Bloomberg reports, is a record short squeeze that has driven up copper prices on the Comex exchange to the point where the premium for New York copper futures above the London Metal Exchange price has rocketed to an unprecedented level of over $1,200 per ton, compared with a typical differential of just a few dollars.

The blowout in that price spread has wrong-footed major players from Chinese traders to quant hedge funds, all of whom are now scrambling for metal that they can deliver against expiring futures contracts!

Adding fuel to the fire, the surge in the price is not just driven by technicals but also reflects the surge of interest from speculators after forecasts that long-term copper mine production will struggle to keep pace with demand