Canadian asset management giant has rebounded from the rejection of the $20 billion bid for Origin Energy by launching an agreed $10.2 billion offer for Neoen, the French company that has become the most successful and biggest developer of renewable and storage assets in Australia.

Brookfield says it has reached agreement with Impala, the French company controlled by billionaire Jacques Veyrat that has backed Neoen – and the more recently launched TagEnergy – and other shareholders to secure a 53.32 per cent of the company.

An offer will be made to other shareholders, pitched at a premium of 27 per cent over the last closing price, and which values the company at €6.1 billion ($A10.2 billion).

The agreed offer is the second attempt by Brookfield to gain a major foothold in the Australian energy market, and advance its plans to secure a big position in the accelerating green energy transition on the country’s main grids.

Last year, it led a consortium that offered $20 billion for Origin Energy, the country’s biggest energy utility, and won agreement from its board. But the deal was voted down by a minority of shareholders led by the fossil-fuel industry leaning Australian Super.

In moving on Neoen in this way, Brookfield has also likely blown away the ambitions of some other big players in the market who had been eyeing some of the projects that Neoen was potentially offering for sale, or partial sale, as it gathered funds for future developments. Now, its pockets will be very deep.

Neoen has led some of the landmark renewable and storage deals in Australia, including winning a significant share of the landmark ACT government renewable energy tenders, and building the original “Tesla big battery”, aka the Hornsdale Power Reserve in South Australia.

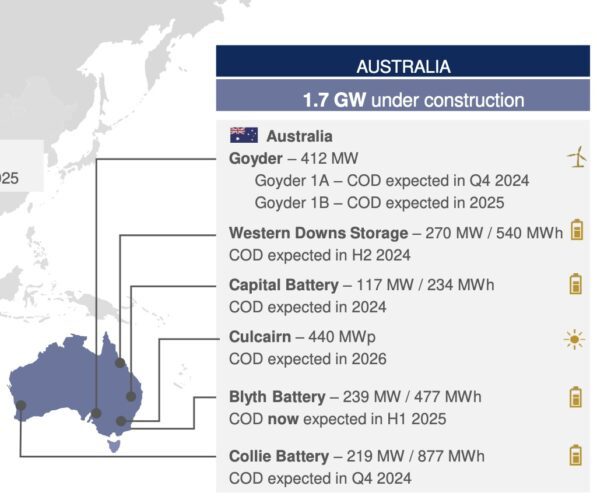

It owns the Victoria Big Battery, still the largest in the country, and will trump that with the now 560 MW, 2240 MWh Collie battery that will ultimately take the position as the biggest in the country – at least for a time. It is also adding a number of new wind, solar and storage projects across the country.

Neoen also has successful renewable energy investments in France, Finland, Mexico and recently won a tender to build one of the world’s biggest batteries in nuclear-dominated Ontario.

“Neoen has built one of the world’s greatest renewable energy development platforms,” said Connor Teskey, the CEO Renewable Power & Transition at Brookfield Asset Management.

“We are excited to build on Brookfield’s expertise, track-record and access to capital to further accelerate Neoen’s growth while preserving its culture and identity. Acquiring Neoen further strengthens Brookfield’s global scale, while diversifying into key renewables markets and adding expertise in battery storage technology.”

Neoen chairman and CEO Xavier Barbaro said the Brookfield offer opens a new chapter for Neoen, some 15 years after the company was founded.

“Our Board of Directors fully welcomes the transaction and sees Brookfield as a partner of choice to preserve the structure and identity of Neoen in the best interests of its employees and its stakeholders.”

Brookfield says it is acting in concert with the Singapore government owned investment fund Temasek, which was also involved in the spurned bid for Origin Energy.

Brookfield says Neoen is an attractive company to own given it already has 8 GW of assets in operation or under construction, and another 20 GW in the pipeline, much of it in Australia.

“Neoen has significant expertise in battery storage technology, which will become an increasingly important part of the energy mix going forward,” it says.

“Neoen’s best-in-class capabilities include an experienced management team with in-house development, financing and operational capabilities and a track record of successfully delivering more than 1,000 megawatts of renewable capacity on an annual basis in attractive global markets.

“Brookfield sees the investment in Neoen as an opportunity to scale Neoen’s portfolio of diverse high-quality assets in a context of accelerating clean power demand. Brookfield is well positioned to support and accelerate Neoen’s high quality development pipeline thanks to its access to capital and in-depth industry knowledge.

“The growth of AI and cloud computing continues to drive higher demand for renewable sources of power, as typified by Brookfield’s recent agreement to supply Microsoft with over 10,500 megawatts of renewable power, the world’s largest such power supply deal.”