Bet_Noire

A Buy rating for Osisko Mining Inc.

This analysis reiterates the Buy rating already assigned in the previous analysis for shares of Toronto-based gold explorer in Quebec: Osisko Mining Inc. (OTCPK:OBNNF) (TSX:OSK:CA).

As for the previous rating, investors may want to wait before acting on the buy recommendation as a drop in the share price is expected. The drop carries the potential for higher returns given the favorable climate for Osisko shares driven by the promise of The Windfall Lake property, the company's flagship project in Quebec, on bullish sentiment over the precious metals.

After the Previous Buy Recommendation: This Is What Happened. A Strategy that Should also Pay Off in the Future

Since the last analysis on March 7, 2024, the strategy has performed well as expected: OBNNF and OSK:CA shares are up 10.8% and 7.2%, respectively, from prices included in the previous publication, compared to a gain of about 7% for the S&P 500. Even bigger, they have outperformed the US stock index after the (expected) dips on March 26.

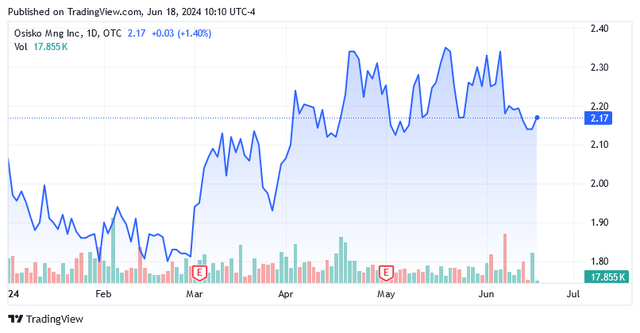

The chart below illustrates OBNNF shares on the OTC Markets OTCPK (the US over-the-counter market) year-to-date with a dip on March 26:

Source: Seeking Alpha

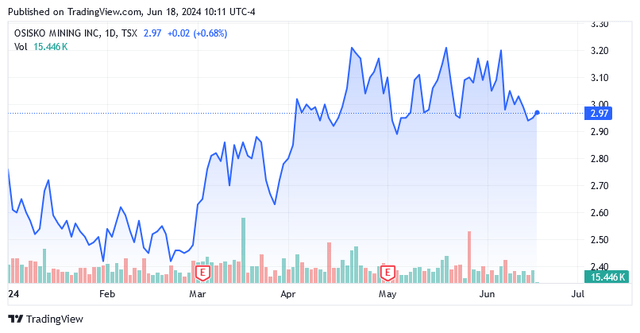

The chart below illustrates OSK:CA shares on the TSX (Toronto Stock Exchange) year to date with a dip on March 26:

Source: Seeking Alpha

Until shortly before March 20, gold prices were driven by expectations of a first cut in the cost of borrowings by the Fed. Then came the disillusionment on the market when the Fed confirmed interest rates at the current level of 5.25-5.50% and no further indicators were seen in the following period that could have inspired optimism for the yellow metal. On the back of the strengthening of the US dollar currency, which, reinforced by the Fed's persistently restrictive interest rate policy, made gold purchases significantly less attractive to foreign investors, analysts had assumed that the metal price could at best move sideways until the end of March. In short, Commerzbank Research from Commerzbank AG (OTCPK:CRZBF) (OTCPK:CRZBY) added in a note that the gold market rally was likely over.

In the wake of this sudden gloom for gold, Osisko Mining Inc. shares declined sharply by 9.6% and 8.7% to $1.93/share and CA$2.63/share on March 26, respectively, from March 20, bringing the stock price closer to correction.

Subsequently, geopolitical risks and central banks' gold hedging strategies against economic slowdown, inflation, and rising debt-to-GDP ratios led to a strong rally in OBNNF and OSK:CA shares, which formed another high on April 19-22. The rally was fueled by the positive correlation between stocks and the price of gold, which was headed for its “longest winning streak since January 2023.” The highs offered the opportunity for robust returns, and investors who chose to take profits did well because until Osisko Mining's flagship project at the Windfall Lake site comes online with 306,000 ounces of payable gold annually for a ten-year-mine life, there is no guarantee that today's position will deliver the expected return by patiently holding it over the long term. It is better to take advantage of the cycles because when they occur, the cycles provide a good opportunity to set aside excellent profits.

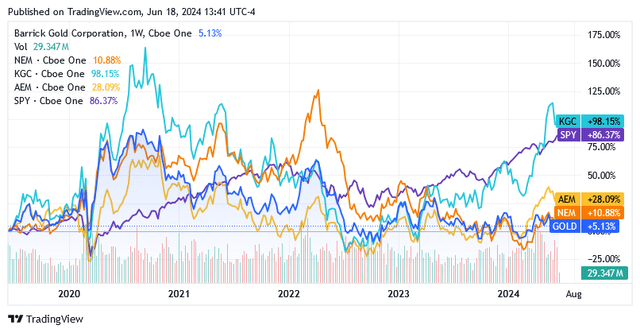

Furthermore, even large gold operators who have been in the business for several years cannot guarantee that it is worth holding long positions, as these, with rare exceptions, tend to significantly underperform the US stock market, as the following returns show: Over the past 5 years, Barrick Gold Corporation (GOLD) gained 5.3%, Kinross Gold Corporation (KGC) gained 98.2%, Agnico Eagle Mines Limited (AEM) gained 28%, and Newmont Corporation (NEM) gained 10.88 % versus SPDR® S&P 500 ® ETF Trust (SPY) up 86.37%.

Source: Seeking Alpha

The Positive Correlation Between the Stocks Prices and Gold Prices

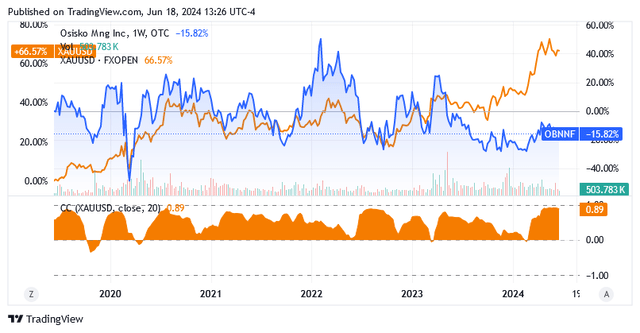

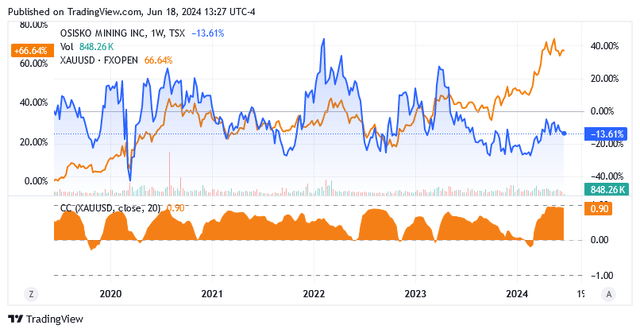

The positive correlation that has allowed shares of Osisko Mining to rise when gold prices were bullish and retreat when gold prices were bearish is illustrated by the following two charts. In the lower part of them, the dark yellow area curve above zero for almost the entire period of the last 5 years suggests that the two assets tend to move in the same direction regardless of the returns, which can even vary widely.

Correlation measures how one security moves when another is trending up or down (assuming they are correlated), but not how much they have lost or gained.

The positive correlation between Osisko Mining Inc. (OTCPK:OBNNF) and the gold spot price (XAUUSD:CUR) over the last 5 years:

Source: Seeking Alpha

The positive correlation between Osisko Mining Inc. (OSK: CA) and the gold spot price (XAUUSD:CUR) over the last 5 years:

Source: Seeking Alpha

Positive Correlation With Gold Prices Led to Further Stock Price Dips Amid Fading First Rate Cut Expectations

Diminished non-yielding gold's appeal caused by the following factors led to further stock price dips:

a) earlier in May as “Fed left rates unchanged on May 1.

b) on May 13 due to “hawkish remarks from Fed officials and speculation about a possible delay in Fed’s easing”.

c) on May 23-24 led by signals of further hawkish policy from various policymakers, as reflected in “minutes from the two-day meeting of the Federal Open Market Committee” that ended May 1.

The dips were followed by two major jumps.

Against the background of gold's solid protection against escalating tensions in the Middle East and China's safe-haven appeal, gold prices received two boosts above all: Renewed interest rate cut hopes and US government bonds down five times in a row.

With a strong return in the gold price, shares in Osisko Mining peaked in the wake of the first lift on May 20, while the second pushed shares higher on June 6.

The Outlook for Gold Prices

The bullish sentiment towards gold is largely fueled by investors strengthening their positions in the metal, thereby increasing demand for gold as they seek to hedge against risks and uncertainties caused by geopolitical tensions and economic instability.

The geopolitical tensions are mainly related to the conflicts in Ukraine and the Gaza Strip, while the economic problems are a consequence of the US Federal Reserve (or “Fed”)'s restrictive monetary policy.

While it is nice that, despite a very uncertain scenario, people still have jobs that allow them to look at the future with less pessimism, this is probably why inflation still has not convinced the Fed to return to the 2 percent target and then decided to delay the first rate cut from May session.

The situation can only get worse if the Fed keeps interest rates raised for too long. Among economists weighing signs of a slowdown in economic growth, the team of economists at Wells Fargo & Company (WFC) led by Jay Bryson believes that consumption is likely to continue to decline in the second half of 2024.

Consumption is the largest part of the US economy. YCharts indicate that US personal consumption expenditure accounted for nearly 70% of US GDP as of March 2024. The slowdown will ultimately orient markets toward a weaker and shakier economy, and away from the prospect of a soft landing.

Political and economic instability in the US is expected to have a major impact on the future direction of gold prices, as these factors bode well for gold demand as a safe-haven investment. Many forecasts predict gold will exceed $3,000-$5,000 per ounce in the next decade, Jonathan Rose of Genesis Gold Group said last week, according to Dow Jones. At the time of writing, the spot price of gold (XAUUSD:CUR) was $2,315.35/oz.

But as soon as the Fed's decision to keep interest rates elevated is announced, there is a short-term fall in the price of gold because the argument for owning interest-bearing assets like US Treasuries rather than income-free gold is vindicated. On the contrary, rising expectations of a rate cut by the Fed or changes in economic data that lead to the belief that momentum is heating up in that sense, cause the price of gold to leap forward. Last week was emblematic of this situation: On Wednesday, June 12, gold prices rose as the market liked moderate US inflation data, but the gains were then pared after the Fed decided to keep interest rates unchanged for the month. The US central bank assessed disinflation differently than the market to the extent that policymakers now expect only one instead of two interest rate cuts this year.

But in principle, the specter of an economic slowdown returning as the Fed maintains “higher interest rates for longer” policy is good for the long-term growth prospects of the precious metal as a long-term hedge. This structural long-term gold bid is driven by central banks’ purchases around the world, but especially by purchases in emerging markets such as China, as demonstrated by robust transactions in March and April, according to analysts at Citigroup Inc. (C).

While this type of perception is nothing new, rather it has been fueling the hype around gold as a safe haven for months already and has contributed to more and more levels sliding off the floor in support of a stable structure for higher prices in the long term:

In terms of the longer term, last April David Meger of High Ridge Futures said that the “higher uptrend in gold will continue as the Federal Reserve might not be cutting rates as soon as the market expects.”

Osisko Mining Inc. in Quebec: the Windfall Lake property

Any significant change in the price of gold, driven by investors' safe-haven purposes or various sentiments affecting expectations of Fed policy easing, shakes Osisko Mining's share price. Thanks to the Windfall Lake property under development in Quebec, the market associates Osisko's shares with the target metal, gold, which the project would like to produce one day.

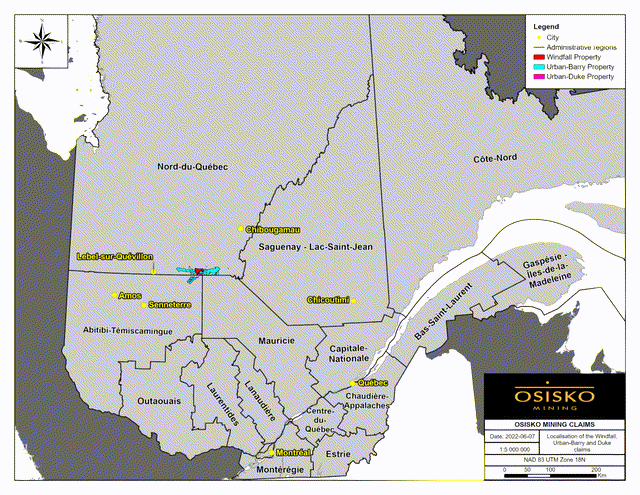

Osisko Mining has its projects in Qubec, Canada, including the Quvillon Osborne Project and the Urban-Barry Project in addition to the 50% interest in the Windfall Lake Project, but the latter is its flagship (see small red spot in the below map).

Source: Osisko Mining Inc. - Company WebSite

The Quvillon Osborne-Bell property with prospective mineral resource basins of 2,621 claims covering approximately 140,207 hectares in the Lebel-sur-Quvillon region of Quebec, includes the Osborne-Bell gold deposit and is open for exploration. The Urban-Barry property in the Abitibi Greenstone Belt, Eeyou Istchee James Bay, Quebec, consists of 1,372 individual claims covering approximately 74,135 hectares.

These projects are being developed under a 50/50 joint venture agreement signed in May 2023 with South African global gold mining company Gold Fields Limited (GFI), giving Osisko Mining Inc. a strong presence in the Abitibi Greenstone Belt on the Ontario-Quebec border in Eastern Canada.

The Windfall Lake gold mineral project consists of 286 mining claims covering approximately 12,523 hectares located 700 kilometers north-northwest of Montreal, approximately 200 kilometers northeast of Val-d'Or, and approximately 115 kilometers east of Lebel-sur-Quvillon.

With other major gold companies already in production for years, the region is endowed with significant mineralization, increasing Windfall Lake's chances of success.

Abitibi-Tmiscamingue: World-Class Precious Metal Resource Region

There are several gold and silver mining operations in the region, but the few mentioned are owned by well-known gold and silver mining companies. These operations are a testament to world-class precious metal deposits in the Abitibi-Tmiscamingue region, whose border lies near the Windfall Lake Project. And while they're not exactly close to where Osisko wants to set up gold production, as they are located approximately 1.5 to 3 hours south/southeast/southwest of Windfall, the fact that the region is also home to major gold mining companies could give the stock price an additional incentive, when a strong bullish sentiment is taking place in the gold price.

These well-known gold mining companies are Eldorado Gold Corporation (EGO) (ELD:CA) with its Lamaque operation, located 1 km east of Val-d'Or in the Canadian province of Quebec, producing 42,299 ounces of gold at an All-In Sustaining Cost ("AISC") of $1,262 per ounce of gold sold in the first quarter of 2024. Since the start of commercial production in March 2019, the Lamaque operation has produced more than 848,000 ounces of gold, exceeding initial pre-feasibility study expectations of 644,100 ounces by 32%.

Agnico Eagle Mines Limited (AEM) (AEM:CA) operates the following mines in the region:

- Its 100% interest in The Canadian Malartic Complex (Canadian Malartic open-pit mine, Odyssey underground mine, and processing plant) located 1 km south of Malartic, Quebec, Canada. In the first quarter of 2024, the complex has produced 186,906 ounces of gold at total cash costs per ounce co-product basis of $860 or a total cash cost per ounce - by-product basis of $850. The mine life of the asset is until 2042.

- Its 100% interest in the LaRonde complex (underground mines, a mill, a treatment plant, a secondary crusher building, and related facilities) located 44 km east of Rouyn-Noranda, Quebec, Canada produced 68,364 ounces of gold in the first quarter of 2024. The ounces came from the LaRonde mine, which incurred $1,271/oz, and the LaRonde Zone 5 mine, which incurred $1,192/oz total cash costs per ounce — co-product basis. Or the LaRonde mine incurred $1,028/oz, and the LaRonde Zone 5 mine, which incurred $1,180/oz total cash costs per ounce — by-product basis. The mine life of the asset is until 2034.

Hecla Mining Company's (HL) 100% interest in the Casa Berardi Mine (open pit/underground gold/silver mining, a mill, additional open pits under development, tailings storage facilities), located 85 km north of La Sarre, Quebec, Canada. The Casa Berardi Mine produced 22,004 ounces of gold and 6,127 ounces of silver in the first quarter of 2024 at cash costs per ounce, after by-product credits of $1,669/ounce and AISC per ounce, after by-product credits of $1,899/ounce.

Relevant Windfall Lake Metrics: Considerations on Production Potential, Profitability, and Costs

The project includes a technical study from 2022, which in the economic analysis part gives different scenarios that - based on the market price of gold - a higher or lower net present value (at a 5% discount rate), as well as higher or lower profitability, and some other important indicators are assigned. A rising gold price on a promising future as a hedge against an increasingly risky and uncertain global scenario can stimulate interest in the project, which as a positive catalyst can lead to higher share prices on the stock exchanges.

Through exploration activities and development, Osisko Mining has the potential to transform the Windfall Lake project into an operational gold mine, enabling multi-year production of the yellow metal at a low cost even compared to larger operators. Annual production is estimated to be around 306,000 ounces of gold or 76,500 ounces of gold per quarter, as these will be mined from 12,183 metric tons at 8.1 g/t (“grams of gold per ton of mineral”) leading to 3.2 million ounces of gold in Probable Mineral Reserves, implying 10 to 11 years mine life with the potential to be extended further. The further expansion potential lies at 4.1 million ounces of gold in measured and indicated resources grading 11.4 g/t plus 3.3 million ounces in inferred resources grading 8.4 g/t. Measured and Indicated Gold Reserves are one level below Probable Reserves, the only mineral resource category with "probable profitability". Not to mention gold ounces estimated in inferred resources, which require several steps to bring them to a probable or even proven level of profitability through several funds allocated for exploration.

However, given the region's world-class metal deposits, which attract several major industrial players in the same region, it is safe to assume that Windfall Lake can theoretically expand its operations for at least a decade after the first series of production reaches completion.

The Windfall Lake property will recoup the initial investment to bring the asset online within two years and has an internal rate of return (or “IRR”) of 33.8%. These metrics make the project very competitive versus others we have observed during previous analyses. These projects were well above the 2-year payback period or well below the 34% IRR at a price assumption greater than Windfall's $1,600/oz. This is also a very conservative price assessment considering that the average spot price for gold in US dollars over the last five years was around $1,811/ounce, reflecting markets that have been primarily influenced by macroeconomic and geopolitical factors that will most likely continue to impact future gold markets.

The Windfall Lake property project implies a LOM operating cash cost of US$587 per ounce of gold on a by-product basis, which is favorable compared to the previously mentioned operators. The project has an after-tax net present value (NPV) of CA$1,168.4 million (or US$851 million) or CA$3.20 per share (or US$2.33) based on approximately 365.61 million shares outstanding and the current US dollar/Canadian dollar exchange rate. The project will no doubt get a boost when the Fed starts cutting interest rates, lowering them dramatically from current levels. While this may take a few years, the potential for a net present value significantly higher than the current share price of $2.14 as gold seems set to trade well above the assumed price of $1,600 per ounce is implying an incredible upside for Osisko on the stock market going forward.

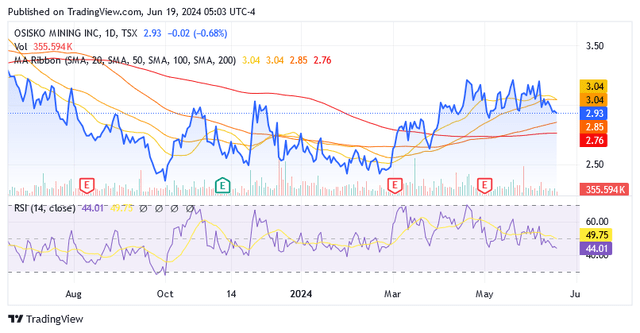

The Stock Price: Dip Targeted

Shares currently trade at $2.14 per share, giving it a market capitalization of $785.94 million, and no dividends are paid. Shares have fluctuated between a lower limit of $1.72 and an upper limit of $2.52 over the past 52 weeks.

Source: Seeking Alpha

Shares are trading slightly above the midpoint of the 52-week range at $2.12 and still partially above the MA Ribbon. Amid downward pressure from the Fed, which aims to keep interest rates higher for longer until inflation is convincingly returning to the 2% target, shares are headed for another dip. In line with the dynamics outlined earlier in this analysis, the next dip presents another opportunity to reposition this stock ahead of two types of positive developments in gold prices: a milder move, but one that is long-term due to safe-haven demand for the metal, and another with stronger near-term upsides emerging as confidence in the Fed's first rate cut returns.

The 14-day RSI of 43.20 shows that shares still have room to reach a lower level, leading to a greater chance for superior margin going forward as investors take advantage of an outlook that provides more gold price upside.

A robust labor market keeps inflation sticky despite 11 rate hikes by the Fed. With non-farm payrolls coming in surprisingly higher than anyone expected at this point and unemployment not falling as targeted by policymakers, these forces are pushing the Fed not to cut interest rates more than once this year. U.S. nonfarm payrolls reached a five-month high in May 2024, with gains in many industries. In addition, unemployment is not expected to worsen until 2025, declining only slightly by 0.2 percentage points in 2024 from the current level of 4%.

Contrary to the CME FedWatch tool's forecast for September, which predicts a 61.1 percent rate cut, Fed governors could be more inclined to make the first rate cut after September. The market assumes the Fed will make its first rate cut at the September meeting but there are still three months to go, and the summer holidays are just around the corner. Many have already started their summer vacation in 2024. People spend more on vacations but also have to dig again in their pockets when they get back because of taxes as well as school fees and stuff for the kids waiting. This period could see the prices of goods and services rise again, and the Fed is certainly thinking about the effect of the 2024 summer holiday stress test on inflation. Persistent inflation leads to high interest rates, and this affects the price of gold. Unlike income interest-bearing investments such as US Treasuries, gold does not generate any income for its owners; the only gain is the price increase. Given the headwinds to gold prices caused by the Fed's inflation-related tight monetary policy, Osisko Mining shares also face downward pressure due to a positive correlation with the metal.

Investors should therefore possibly wait to implement the buy recommendation until this phase of uncertainty and fear leads to another dip in the stock price.

Additionally, the average volume of OBNNF stock is 197,771 shares traded in the past 3 months. Scroll down this Seeking Alpha page to the “Trading Data” section to view it. OBNNF stock is a low-liquidity stock, and investors should not hold too large positions, otherwise they will find it difficult to reduce their holdings accordingly if circumstances require it.

The same considerations apply to shares in Osisko Mining Inc. under the symbol OSK:CA. The shares were trading at CA$2.93 each at the time of writing, giving them a market capitalization of CA$1.07 billion. The shares did not trade completely below the MA Ribbon and were slightly above the CA$2.82 midpoint of the 52-week range of CA$2.36 to CA$3.28.

Source: Seeking Alpha

Additionally, the 14-day RSI's trend at 44.01 suggests that despite the recent pullback, shares have plenty of room to the downside in a high interest rate environment.

Additionally, the average volume of OSK:CA stock is 919,861 shares traded in the past 3 months. Scroll down this Seeking Alpha page to the “Trading Data” section to view it. OSK:CA stock is a low-liquidity stock, and investors should not hold too large positions, otherwise they will find it difficult to reduce their holdings if circumstances require doing so.

Conclusion

Osisko Mining shares receive a Buy rating, but investors should not implement this rating immediately, but only after an expected stock price dip. This analysis targets a dip as a result of a “Higher-for-Longer” interest rate policy by the US Fed, which is considered necessary in the face of inflation still not convincingly returning to the 2% medium-term target. A robust labor market makes inflation-curbing plans for the Fed more difficult than initially thought.

After the last analysis, the stock market created various dips in Osisko Mining's stock price due to waning expectations of a first Fed rate cut, as inflation was stickier than expected. Investors took advantage of the stock price dips because the return of momentum for the Fed's pivot led to rapid upward swings in the price of gold, thereby also driving Osisko up in the short term. Gold prices and Osisko Mining shares are positively correlated.

The company is developing the Windfall Lake project as part of a 50:50 joint venture with Gold Fields Limited to turn Windfall Lake into a low-cost, profitable gold operation. The area is a few hours from the Abitibi-Tmiscamingue region, home to major gold mining companies, a testament to a world-class region in terms of precious metal resources hosted.

Windfall Lake project may be worth more than Osisko Mining stock indicates in both North American markets as gold prices continue to rise, but cyclically not steadily, giving Osisko Mining investors incredible return opportunities.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.