Topical: China energy storage boom China, struggling to make use of a boom in energy storage, calls for even more

Excerpt

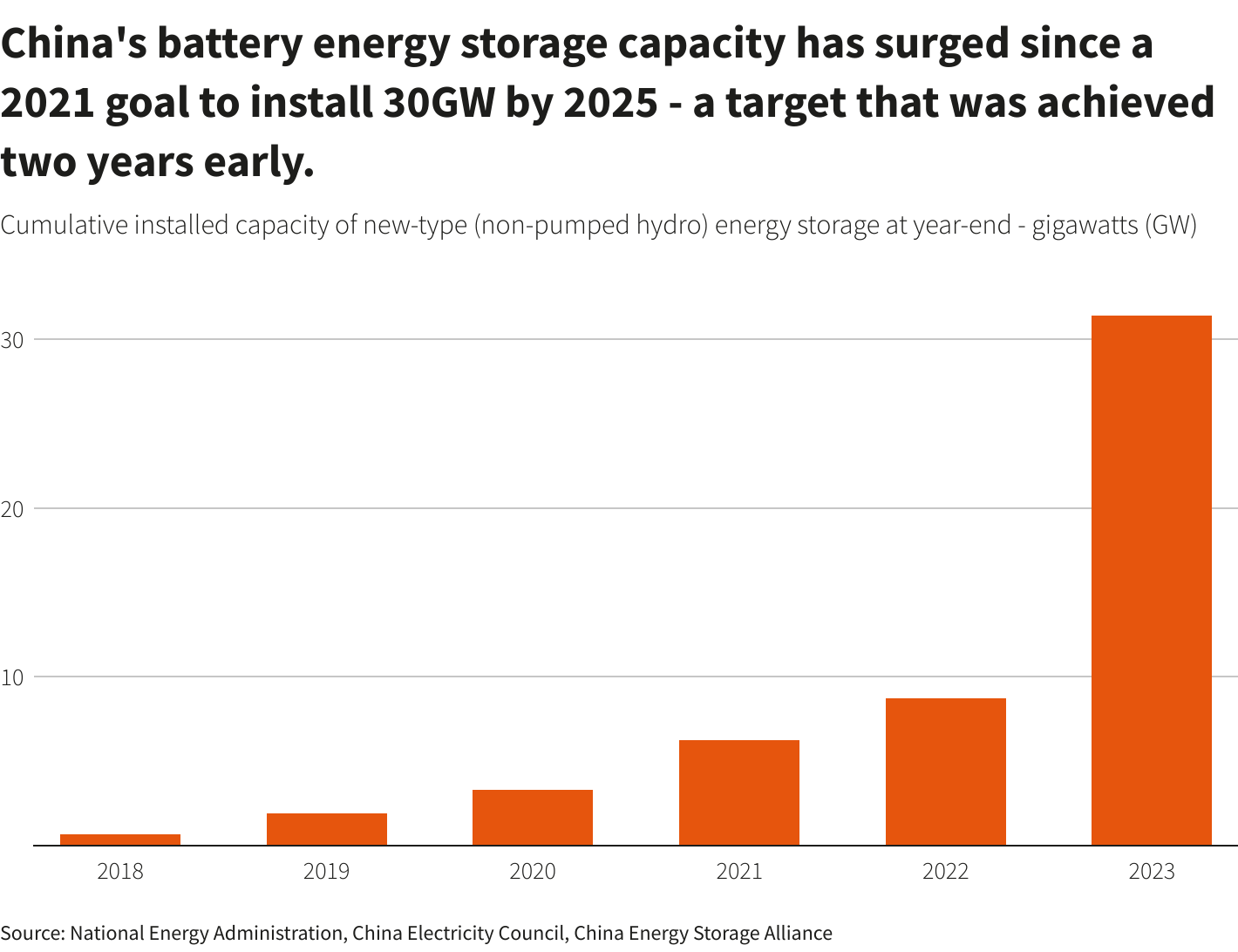

Investment in grid-connected batteries in China surged 364% last year to 75 billion yuan ($11 billion), according to Carbon Brief, creating by far the world's largest storage fleet at 35.3 GW as of March.

In May, China set a new target of at least 40GW of battery storage installed by the end of 2025, up 33% from the previous goal under a wider plan to reduce carbon emissions.

Storage is critical to help balance supply and demand when wind and solar farms produce more renewable electricity than the grid's distribution system can handle, or when a lack of sun or wind means they are generating too little power.

To meet Beijing's targets, local governments have required renewable energy plants to build storage, driving rapid capacity growth.

However, highly regulated power markets have struggled to incentivise usage, particularly at solar and wind facilities, leading China's cabinet to call for research into improving price mechanisms.

Energy storage at renewables plants operated just 2.18 hours a day last year, while independent facilities operated only 2.61 hours per day, according to the China Electricity Council. By comparison, storage at industrial and commercial plants operated 14.25 hours per day.

Policy mandates requiring renewables plants to install storage have failed because they add to project costs and often sit idle, said Cosimo Ries, an analyst at Trivium China.

"Because power prices are not flexible enough during different hours, these projects just can't really make money," Ries said.

BIG BUILD

The stakes are high for China, which leads the world in adoption of energy transition technology, and for its battery giants, which are seeing faster growth in batteries for storage than for cars as electric vehicle sales growth slows.

While government mandates are a key driver of China's storage boom, big power users such as industrial parks and EV charging stations are also driving adoption. China, where 60% of the world's electric vehicles are sold, has worried about the effects of EVs on its power grid, and storage can help smooth demand spikes.

Falling battery prices are improving the economics of storage in China, with costs for batteries used in standard energy storage down by about a fifth between the end of 2023 and mid-June, according to consultancy Shanghai Metals Market.

Also, expanding adoption of "peak-valley pricing", which discourages electricity use during peak demand times by raising prices, gives storage providers more chance to profit by selling stored power when they can charge more.

That has led to intraday price differentials of up to 0.9 yuan per kwh in coastal provinces like Guangdong, where the peak price of 1.1868 yuan/kwh is more than four times the low, enough to incentivise use of both battery and pumped hydro storage, said Alex Whitworth, head of Asia Pacific power research at Wood Mackenzie.

Pumped hydro is an established technology with more than 60% greater capacity than battery storage in China, but with geographical limitations and long lead times.

Investor returns on solar-plus-storage projects are also improving as solar module prices fall, making renewables-plus-storage "financially feasible in most parts of China" with internal rates of return meeting the minimum investment hurdle rate of at least 8%, wrote Pierre Lau, a Citi analyst.

Further market reform is needed to incentivise battery storage, industry players say, with storage operators calling for wider use of capacity payments similar to those meant to keep struggling coal plants online, with costs shouldered by customers.

BETTER BATTERIES

Battery technology is also improving.

The vast new Shandong plant incorporates both lithium ion and vanadium redox flow batteries, according to a report by local state media. Vanadium is a newer technology that promises longer storage times and improved safety.

While the economics of lithium ion batteries are expected to improve, experts say most current technology is suitable for shorter storage durations of four hours or less, and some say it is best used in smaller-scale applications. Fire risk remains a concern, particularly with lower-quality batteries, experts say.

Emerging technologies such as thermal energy storage, redox flow batteries, and sodium ion batteries have shown promise for longer-duration storage but have higher up-front costs, with technology and supply chains that are less mature.

China is hedging its bets by increasing its pipeline of pumped hydro projects - which can take five to seven years to build - and encouraging demonstration projects in emerging technologies.

https://www.reuters.com/business/energy/china-struggling-make-use-boom-energy-storage-calls-even-more-2024-07-05/