heywoody/iStock via Getty Images

The following segment was excerpted from this fund letter.

Kraken Robotics is a marine technology company based in Newfoundland, Canada, that develops and manufactures devices for underwater exploration, surveying, automated underwater vehicles (AUVs) and batteries. The company was founded in 2008 as Kraken Sonar Systems and through a series of mergers and acquisitions, it has since grown to become a leader in the field of marine robotics, sensors, and underwater batteries. The company sits in a unique position in the marine technology market, as there is incredible interest from governments around the world to explore autonomous underwater vehicles, and there are very few companies that have the battery and sensor technology required to build AUVs.

High Quality Business Model

Kraken Robotics offers a range of products that cater to various applications and industries, such as oil and gas, defense, ocean science, and renewable energy. Their business is broken down into three segments: sensors, batteries, and services.

Some of their main product lines are:

- KATFISH: A towed synthetic aperture sonar system that provides high-resolution seabed imagery and bathymetry.

- SEAPOWER: A pressure-tolerant battery system that can power underwater vehicles and devices for long durations.

- AQUAPIX: A miniature interferometric synthetic aperture sonar that can be integrated into various platforms, such as ROVs, AUVs, and USVs.

- ALARS: An autonomous launch and recovery system that can deploy and retrieve underwater vehicles and devices without human intervention.

Krakens pressure neutral Subsea batteries "SEAPOWER" have no known competitors that can match the depth of 6000 m at the same energy density. Their batteries were developed over the course of 15 years at ENITECH Subsea GmbH, which was acquired in 2017 by Kraken Robotics. ENITECH developed pressure-tolerant components that can operate satisfactorily under high pressure (hyperbaric or hydrostatic, such as oil baths) without the need for a highpressure enclosure. The company's unique pressure-tolerant molding technology enables 6,000meter-rated encapsulation in silicone instead of oil-compensated or titanium pressure housings. The technology results in packaging solutions that are less expensive, more compact, lighter, and less prone to underwater corrosion and biofouling. This gives them a significant advantage over other subsea batteries on the market, as they can power underwater vehicles and sensors for longer durations and in harsher environments. Kraken's SEAPOWER batteries are also modular, scalable, and customizable, allowing them to meet the diverse needs and specifications of various customers and applications. With their unique and valuable features, Kraken's SEAPOWER batteries have the potential to revolutionize the subsea industry and create new opportunities and markets for the company. I believe Kraken has an extremely rare product monopoly in a niche and burgeoning underwater AUV market.

Kraken Robotics has a global presence, with offices and facilities in Canada, the United States, the United Kingdom, Germany, Denmark, and Brazil. The company employs over 250 people, including engineers, scientists, technicians, and business professionals. The company has also established partnerships and collaborations with various organizations, such as the Royal Canadian Navy, Ocean Infinity, the Royal Australian Navy, and the German Navy.

Outstanding Management

The two key figures behind Kraken Robotics' success have been its founder, Karl Kenny, and its current CEO, Greg Reid. Kenny founded Kraken Sonar Systems back in 2008. The company was focused on software-defined sonar technology. Kenny was the CEO of Kraken after its reverse merger with Anergy Capital in 2015, which brought the company public on the Canadian Venture Exchange. Kenny later oversaw the key acquisition of ENITECH Subsea in 2017 that combined Kraken's sensor technology with ENITECH SEAPOWER batteries and developed software, making it possible to build many of the new AUVs coming on the market now. Kenny retired and was succeeded as CEO of Kraken by Greg Reid in early 2023.

Reid has over 25 years of experience in the marine industry, with a background in engineering, management, and finance. He joined Kraken in 2015 as the chief financial officer. Under his leadership, Kraken has expanded its product portfolio, increased its revenues, raised growth capital, and strengthened its market position. As CFO, Reid has been a key decision-maker driving the company's strategic acquisitions in recent years and scaling their existing business. While it is clear Kenney was the visionary and innovator that led Kraken to bring together the exceptionally well-positioned marine portfolio, Reid is the person to scale the business and grow it into a larger commercial organization.

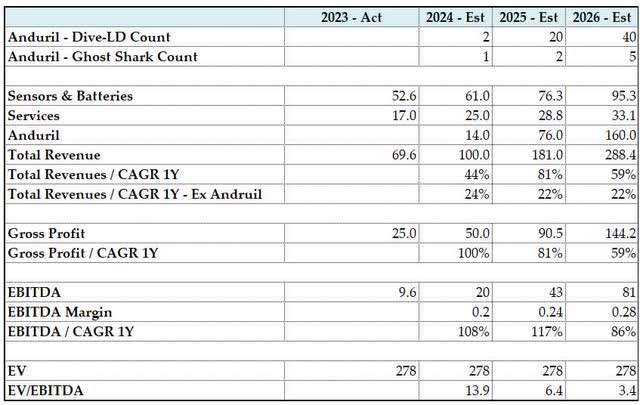

Sustainable Long Term Growth Prospects: The Anduril Dive-LD Opportunity

Anduril Industries, a VC backed defense company with billons of funding and ambitions of developing the future of robotic defense, is building a new manufacturing facility for autonomous underwater vehicles (AUVs) in Rhode Island. The facility in Quonset Point will enable large-scale production of the Dive-LD family of AUVs so that Anduril can keep ahead of customer demand, the company said in a 17 release. The facility, when fully ramped up, will be able to produce 200 Dive-LD AUVs per year. The facility is expected to open in early 2025. Each Dive-LD contains several SEAPOWER batteries, Kraken Sensors, and utilizes Kraken software to help manage both the power and sensors within the Dive-LD. In total, each Dive-LD will be equipped with $2.5m of Kraken SEAPOWER batteries and $0.5m of Kraken sensors and software. Anduril has already secured a $18.6 million contract with the US Navy to produce Dive-LD and has a co-development partnership in place with the Royal Australian Navy.

If Anduril can ramp up their Rhode Island facility to full production of 200 Dive-LD systems per year, the revenue opportunity for Kraken is ~$600 million per year. We expect that in the near term, the facility will produce between 25 and 50 Dive-LDs starting in 2025, which could be a $100 million to $250 million opportunity in the near term.

Due to the Dive-LD design already utilizing multiple products from Kraken and the lack of any competitive Deepsea batteries with an operational depth of 6000 m at similar energy density, it is highly likely that all Dive-LD systems will incorporate Kraken products. In anticipation of Anduril sourcing all the parts from Kraken for the Dive-LD, it would make sense for Kraken to set up a battery manufacturing location near the Rhode Island Anduril facility.

Kraken is an acquisition target for Anduril here, as they can pay $300m now (current market cap of Kraken * 60% premium or $1.85/share) for Kraken, or they pay them +$100m a year for the next 10 years for batteries and sensors and keep the 45% gross margins. Anduril recently raised $1.5 billion in funding at the end of last year to support their ongoing programs, so they have plenty of capital for an acquisition of this size. Small acquisitions are a core part of Anduril's strategy, having made five acquisitions to date of small defense technology companies, including Dive Technologies, the company that developed the Dive-LD.

Extra Large AUVs

A more recent development in marine space has been the push to build large AUVs that are essentially replacements for submarines, known as Extra Large AUVs (XL-AUVs). XL-AUVs are different than smaller AUVs (like the Dive-LD) in that they have increased battery capacity, size, maneuverability, carry munitions, and allow much longer duration at sea without refueling. The main goal of XL-AUVs is to monitor, deter, and provide response capabilities for navies without having men at sea for long periods of time. Due to this fact, these XL-AUVs require large amounts of batteries. The XL AUVs are being developed globally by navies around the world and include defense contractors Boeing, Anduril, Saab AB, Kongsberg, Oceaneering, BAE Systems, and several smaller contractors.

Current XL-AUVs in development

Of note to Kraken is the Anduril Ghost Shark, which is confirmed to use $8 million of Kraken SEAPOWER batteries and sensors per vehicle. The Ghost Shark program is run as a codevelopment program between Anduril, the Royal Australian Navy, and the Australian Defense Science and Technology Group (DSTG). Under their current $90 million co-development agreement, Anduril is to deliver three Ghost Sharks by June 2025. The first was delivered ahead of schedule and on budget in April. If successful, it is likely that the Ghost Shark program will Outside of that, it is likely that a handful of other AUV manufacturers are using Kraken SEAPOWER batteries, but none have been announced. The XL-AUV segment will be a huge driver for both segments for the next 10 years.

Sensors, Services, and Batteries

Outside of the massive opportunity that Kraken has to support Anduril's DIVE-LD and Ghost Shark programs, the companies' other segments have strong tailwinds driven by the autonomous ambitions of western countries Navy's. Their services business is largely driven by contracts with global navies and private ventures for offshore wind, oil and gas, and offshore infrastructure looking to complete underwater sonar surveys (via KATFISH). This business is lumpy due to contract timing and execution schedules but has been able to scale to about $20 million of anticipated revenues in 2024, up from $8 million in 2023 and $15 million in 2022. This business will likely continue to grow from here at a slower pace than the growth expected in 2024, but it will continue to expand. They do have some visibility in their service business due to the contracts lasting for multiple years once they are won with a specific navy. They do not share the backlog, but from my understanding, they are likely to expect double-digit growth from the 2024 level.

The subsea batteries and sensors segment outside of Anduril will continue to grow rapidly.

Kraken has released press releases highlighting their subsea battery sales. It is clear that Kraken have other demand outside of Anduril. In Kraken's Q1 revenue press release, the company provided 2024 revenue guidance of $90-100 million. Of that $100 million, roughly $80 million is expected to be batteries and sensors, which implies significant growth in 2024 and over $56 million in 2023.

The market for Kraken's products is still in its infancy, but I believe that due to their position in the battery market, the company could see significant growth due to the overall growth of the AUV market over the next 10 years. Kraken could easily become a multi-billion-dollar defense contractor in a few short years.

Reasonable Valuation

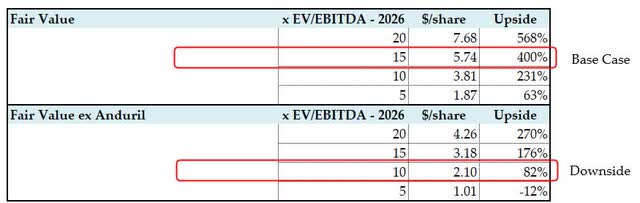

With the backdrop of understanding the position in which Kraken currently sits in Deepsea Batteries, it is easy to come up with a huge valuation for the company when their counterparty opportunity with Anduril could be ~$400-$800m/year. But that opportunity is clearly still years away and depends largely on the demand for Dive-LD AUVs and the success of the Ghost Shark program. We took the approach of valuing the company with and without the Anduril opportunity to see if the Anduril opportunity is never realized and if the outcome is still positive.

Kraken Robotics - Forecast - $m CAD

Kraken Robotics - Valuation

In the base case, we modeled the Andruil opportunity at a modest 40 Dive-LD/year run rate in 2026 and 5 Ghost Shark deliveries. Under that scenario, shares of Kraken will be valued at $5.74 per share in 2026, which is 400% upside to the current price of $1.15 per share, or a 90% IRR over 2.5 years. In the downside case, we modeled the business without any Anduril revenue. Under that scenario, shares of Kraken will be valued at $2.1/share in 2026, which is 82% upside to the current price of $1.15/share, or a 27% IRR over 2.5 years. An upside case could easily be modeled at 4x the value of the base case if you believe Andruil scales their Dive-LD production and expands their Ghost Shark program. In conclusion, I believe that with the unique position in which Kraken sits in a burgeoning industry and a line of sight to a potentially large opportunity in front of it, Kraken is an excellent investment at the current value of 13.9x 2024 EBITDA.