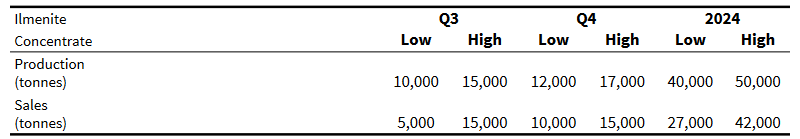

Ilmenite Estimation Ilmenite 2024 Guidance

Old 2024 Ilmenite Guidance

Revised 2024 Ilmenite Guidance

H1-24 Actuals

In Q1-24 Ilmenite Sales Volume = 513T; Revenue = US$69,000 (or $135 per tonne). Ilmenite Production Costs = $47,000. Thus Gross Profit = $22,000 representing a gross margin = ~32%

In Q2-24 Ilmenite Sales Volume = 12,261T; Revenue = US$2,400,000 (or $196 per tonne). Ilmenite Production Costs = $1,100,000. Thus Gross Profit = $1,300,00 representing a gross margin = ~55%

H1-24 Revenue = US$2,469,000; Production Costs = $1,147,000; Gross Profit = $1,322,000

H2-24 Ilmenite Revenue Scenarios

US$

| Period | Newly Revised Sales Guidance | Scenario 1: $200/T Same sale price as Q2 | Scenario 2: Base Case, $250/T (sale price increased with quality) | Scenario 3: Best Case, sale price = $300/T |

| Q3-24 | 5,000T - 15,000T | $1,000,000 - $3,000,000 | $1,250,000 - $3,750,000 | $1,500,000 - $4,500,000 |

| Q4-24 | 10,000T - 15,000T | $2,000,000 - $3,000,000 | $2,500,000 - $3,750,000 | $3,000,000 - $4,500,000 |

| H2-24 | 15,000T - 30,000T | $3,000,000 - $6,000,000 | $3,750,000 - $7,500,000 | $4,500,000 - $9,000,000 |

H2-24 Ilmenite Gross Profit Scenarios

US$

| H2-24 | Revenue Estimates | Gross Profit as per Gross Margin Assumption @ 55% same as Q2 | Gross Profit as per Gross Margin Assumption @ 60%. Base Case with Costs improved after ramp-up | Gross Profit as per Gross Margin Assumption @ 65%. Best case |

| Scenario 1 | $3,000,000 - $6,000,000 | $1,650,000 - $3,300,000 | $1,800,000 - $3,660,000 | $1,950,000 - $3,900,000 |

| Scenario 2 | $3,750,000 - $7,500,000 | $2,063,000 - $4,125,000 | $2,250,000 - $4,500,000 | $2,438,000 - $4,875,000 |

| Scenario 3 | $4,500,000 - $9,000,000 | $2,475,000 - $4,950,000 | $2,700,000 - $5,400,000 | $2,925,000 - $5,850,000 |

Full Year Ilmenite Gross Profit Scenarios

US$

| Full year | H1-24 Actual Gross Profit | Full Year Gross Profit as per Gross Margin Assumption @ 55% same as Q2 | Average | Full Year Gross Profit as per Gross Margin Assumption @ 60%. Base Case with Costs improved after ramp-up | Average | Full Year Gross Profit as per Gross Margin Assumption @ 65%. Best case | Average |

| Scenario 1 | $1,322,000 | $2,972,000 - $4,622,000 | $3.8M | $3,122,000 - $4,982,000 | $4.1M | $3,272,000 - $5,222,000 | $4.3M |

| Scenario 2 | $1,322,000 | $3,385,000 - $5,447,000 | $4.4M | $3,572,000 - $5,822,000 | $4.7M | $3,760,000 - $6,197,000 | $5.0M |

| Scenario 3 | $1,322,000 | $3,797,000 - $6,272,000 | $5.0M | $4,022,000 - $6,722,000 | $5.4M | $4,247,000 - $7,172,000 | $5.7M |

Ilmenite concentrate distribution costs as per 2024 Cost Guidance = US$2M - $4M. For the sake of argument let’s assume an average distribution cost of $3M for FY 2024 and estimate the average FY Net Profits in different scenarios after deducting the $3M average distribution costs.

Full Year Ilmenite Net Profit Scenarios after deducting Distribution Costs

| Full year | Average Distribution Costs as per 2024 Guidance ($2M to $4M) | Average Full Year Net Profit as per Gross Margin Assumption @ 55% same as Q2 (minus $3M ) | Average Full Year Net Profit as per Gross Margin Assumption @ 60%. Base Case with Costs improved after ramp-up (minus $3M) | Average Full Year Net Profit as per Gross Margin Assumption @ 65%. Best case (minus $3M) |

| Scenario 1 | $3.0M | 0.8M | 1.1M | 1.3M |

| Scenario 2 | $3.0M | 1.4M | 1.7M | 2.0M |

| Scenario 3 | $3.0M | 2.0M | 2.4M | 2.7M |

Conclusion

Based on the newly revised Ilmenite 2024 sale guidance and using 3 different Revenue scenarios and 3 assumptions of Gross Profit Margins, I find that the Net Profits after taking into consideration the associated distribution costs from the full year sale of Ilmenite can vary from US$0.8M to $2.7M in 2024.

DYODD