After slumping over the past two years due to China’s weakening economy due to the strict COVID-19 restrictions, the copper price has rebounded and even rallied to break its record high.

On May 20, 2024, the red metal reached a fresh all-time high of around $10,900 per ton, breaking its previous record of $10,845 per ton in March 2022.

Copper’s rally happened despite the continuous aggressive monetary tightening in the United States and China’s dragging economic recovery. The price of the red metal – used in home appliances, electronic products, transportation equipment, and building construction – has fallen since May, but it remains elevated at more than $9,500/ton.

Copper 5-Year Performance Chart. Source: Trading Economics

Copper 5-Year Performance Chart. Source: Trading Economics Can the copper price maintain its momentum and keep its gains? Let’s explore our latest copper price forecast for 2024, 2025, and beyond up to 2030.

Key Takeaways

- A deficit in the copper concentrate market is likely to persist this year as mine disruptions continue.

- The copper uptrend remains dependent on the recovery of China’s property sector.

- The Fed’s rate-cutting cycle could release pent-up demand.

- Analysts anticipate the Fed to kick off monetary easing in September.

- Energy transition and growing electricity demand are expected to become a tailwind for copper in the long term.

Copper Price Predictions Summary

| Year | Forecast Range | Key Factor |

| 2024 | $8,340 – $9,535/ton $3.83 – $4.83/pound | – Copper concentrate deficit – Fed’s rate cuts – Rising demand from green energy sector, including EV and renewables |

| 2025 | $8,400 – $9,950 $4.30 -$4.90/pound | – Rising demand from energy transition – The Fed’s monetary policy |

| 2026-2030 | General sentiment: bullish | – Rising demand from energy transition, electricity consumption – Persisted deficit |

Copper Price Analysis in 2023

Over 2022, copper dropped by 13.87% as China’s restrictive zero-COVID policy slowed the country’s industrial activity, reducing demand for industrial metals, including copper.

The lifting of COVID-19 restrictions in China, the world’s biggest copper buyer, in late 2022 helped copper prices get off to a strong start in 2023 at over $8,300/ton at the London Metal Exchange.

The price event briefly hit $9,430 per ton in mid-January 2023, the highest price for the year and the highest since June 2022, due to optimism about China’s economy following the reopening of the country’s borders in early January.

However, as the year progressed, China’s recovery remained challenging due to a prolonged property crisis, weak local demand, and high levels of local government debt. In 2023, China’s economy grew by 5.2%, more than the government’s target of 5%. However, according to data provider Trading Economics, excluding the pandemic years, China’s 2023 economic growth was the slowest pace of annual rise since the 1990s.

The slump in China’s property market has sparked concerns across the industrial metals complex, primarily due to the sector’s significant consumption.

According to S&P Global, the property sector accounted for 30.8% of China’s steel consumption in 2023, 30% of the country’s aluminum consumption and 20% of copper consumption.

Ewa Manthey, Commodity Strategist at Dutch Bank ING, wrote in a note on March 18:

“China is also the world’s biggest consumer of copper and a slump in China’s property market has been a major headwind to copper demand for the past year. A continued slowdown in the sector remains the main downside risk for the metal.”

On top of China’s lackluster recovery, central banks, particularly the US Federal Reserve, still maintained its hawkish rate hike, adding pressure to copper price.

Supply concerns, as several key producers struggled to raise output, kept copper prices supported in 2023.

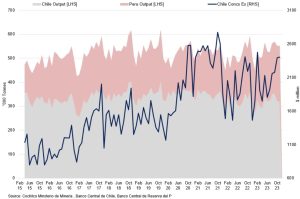

S&P Global reported that copper output from Chile, the world’s largest producer of the metal, reduced by 2.3% in 2023 to 5.33 million tons, the lowest since 2008, due to tougher mining conditions, less rich ore grades, water constraints, and delays to major investment projects.

In October 2023, industry group the International Copper Study Group forecast a deficit of 27,000 tons in 2023.

Over 2023, copper price at the LME gained 2.2% year-over-year (y/y) and 2% at the US COMEX.

Factors Affecting Copper Prices in 2024

At the time of writing on July 1, LME copper price was trading around $9,566/ton, about 12% from the record high reached in May 2024, and has gained 11.68% year-to-date (YTD).

Copper Price Performance YTD. Source: Trading Economics

Copper Price Performance YTD. Source: Trading Economics The following factors may shape copper price predictions for 2024 and beyond.

Copper Underpin by Robust Power Demand

While copper demand from the construction sector still struggles, particularly as China’s real estate sector has remained underperforming, rising demand from decarbonization and electricity consumption are expected to support the red metal. Deploying renewable energy and meeting new power demand will require new investment in power infrastructure, such as building new generation capacity and grid infrastructure.

Copper has remained a preferred metal for making lines and cables due to its superior ability to conduct electricity and heat effectively. According to ANZ Research, electricity networks account for 29% of global copper consumption.

Extreme weather in recent years has added pressure to electricity grids as demand for cooling has continued to increase.

Daniel Hynes and Soni Kumari, analysts at ANZ Research, said in a note on June 27:

“As more electricity is needed to protect people from weather extremes, the pressure to increase power grids is likely to raise demand for key metals, such as copper and aluminum, in coming years.”

This condition is happening as countries accelerate the clean energy transition, which will require countries to have bigger, stronger, and smarter grids than the existing infrastructure, they said.

China is anticipated to lead investment in power infrastructure as it continues to push for renewable energy.

“China’s power industry accounts for around a third of the country’s total copper demand. This is likely to rise amid strong growth in grid infrastructure development to facilitate renewable energy and to protect the power system from surges in demand,” Haynes and Kumari wrote.

Copper Supply & Demand Outlook. Source: IEA’s Global Critical Minerals Outlook 2024

Copper Supply & Demand Outlook. Source: IEA’s Global Critical Minerals Outlook 2024 In recent years, the metal has also become increasingly critical in applications such as electric vehicles (EVs), wind power, and solar energy. In EVs, copper is utilized not only for cables and wires but also for inverters, charging stations, batteries, and electric motors. Similarly, wind turbines extensively employ copper in generator coils, transformers, and electrical cables.

ANZ Research upgraded its copper demand projection from the electricity sector on 27 June, reaching 38.5mt in 2030 from a previous forecast of 31.5mt for the year. The projection represents annual growth of 4% to 5% over the next five years.

Potential Supply Deficit

Copper supply may face challenges in meeting demand this year and next year as some mines struggle to recover production amid rising costs and various obstacles. This includes the prolonged halt of operations at the Cobre mine in Panama, which is operated by Toronto-based miner First Quantum Minerals.

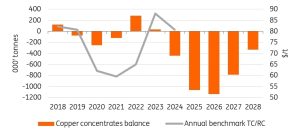

Copper concentrates deficit continues to grow. Source: CRU, Fastmarkets, ING Research

Copper concentrates deficit continues to grow. Source: CRU, Fastmarkets, ING Research First Quantum Minerals, on November 28, 2023, announced it shut down its Cobre Panama mine, one of the world’s largest open pit mines, after Panama’s Supreme Court declared a law that approved the mine’s contract as unconstitutional. The decision came following a blockade by locals at a port and road to the mine.

In a note on May 10, ANZ Research Senior Commodity Strategist Daniel Hynes and Commodity Strategist Soni Kumari estimated that growth in copper mine supply is likely to fall to 4% in 2024 after the shutdown of the Cobre mine in Panama and lower production elsewhere. They added that the closure of Cobre Panama could push the concentrate market into a deficit.

Additionally, rising costs have forced some miners to lower their production in 2024, further squeezing the concentrate market.

For instance, AngloAmerican, London-listed miner, has set copper production guidance at 730-790kt for 2024, lower than the 2023 output of 826kt. Brazilian miner Vale aims to produce between 320kt and 355kt of copper in 2024, compare to 2023 output of 326.6kt.

Daria Efanova, Head of Research at London-based Sucden Financial, wrote in the Quarterly Metal Report for Q2 2024:

“While diminishing supplies from key mining areas didn’t immediately affect prices, they are shaping the long-term outlook. By 2024, we anticipate a finely balanced market, with a growing deficit expected from 2025, supported by increased copper demand in the green energy sector.”

Furthermore, bringing supply from new copper projects to the market will be equally challenging as the current copper price is not high enough to cover development costs.

Peru and Chile Copper Production and Concentrate Exports. Source: Sucden Financial

Peru and Chile Copper Production and Concentrate Exports. Source: Sucden Financial Citing data from global consulting firm Wood Mackenzie, ANZ Research noted that the weighted average total cash cost for global copper supply last year was up 25% to $4,425/t from 2019. According to ANZ Research’s calculation, a 300kt copper mine will need prices around $12,000/t to achieve a 10% rate of return.

“Anything below that and they may be reluctant to proceed,” Hynes and Kumari wrote in a May 10 note.

“There are several small copper operations being commissioned that are due to begin producing metal over the next 18 months. However, we believe supply growth will keep rising only if prices rise further,” they added.

ANZ Research predicts that the copper market could face tightening conditions in the coming years, potentially resulting in deficits of approximately one million ton.

China Copper Capacity

Chinese top copper smelters agreed to start production cuts at some loss-making plants to cope with a shortage of raw material, Reuters reported on 13 March. The specific rates or volumes for the cuts have not been set.

The move came after spot treatment and refining charges (TCs/RCs) fell to record lows recently as Chinese producers scrambled for copper concentrates amid disruptions at mines and the expansion of global copper smelting capacity.

TCs/RCs are fees paid by mining companies to smelters to have their semi-processed ore or concentrate processed into refined or finished metal. A shortage of raw material supply typically leads to a drop in TCs and RCs.

China has been expanding its copper smelting capacity to anticipate demand from the green energy sector, such as electric vehicles (EVs), wind and solar power.

ANZ Research, in a note on March 5, stated that the expansion of smelting capacity supported China’s refined copper production to hit above 1 million tons in 2023.

Despite slumping spot treatment charges and the planned production cut, China’s refined copper output has remained robust.

Fastmarkets reported on June 25, citing data from China’s National Bureau of Statistics (NBS), that the country produced 1.09 million tons of refined copper in May, down 4.14% from 1.14 million tons in the previous month but still up from 1.08 million tons in May 2023.

Chinese smelters compete not just for raw materials with one another but also with new copper smelters that have sprouted in other parts of the world.

New projects, including Freeport McMoran’s new Manyan copper smelter in Gresik, Indonesia’s East Java Province, will have the capacity to process around 1.7 million tpy of copper concentrate, Fastmarkets reported.

According to Fastmarkets, major additional smelting capacity is scheduled for this year in India, the Democratic Republic of Congo (DRC) and Indonesia.

Fed’s Rate Cuts

Energy and commodities markets are watching closely when the US Federal Reserve will begin loosening its monetary tightening cycle.

After the hope for an early rate cut starting in March diminished, traders priced in the possibility of the first cut in the second half of this year. However, the Fed has signaled that it is likely to keep rates ‘higher for longer’ due to the stronger-than-expected US economy and stubbornly high inflation.

In June’s meeting, the Fed decided to keep the federal funds rate steady at 5.25% to 5.50% for seven consecutive meetings.

Increased rates, which resulted in a stronger US dollar, have weighed on industrial metals over the last two years. A stronger US dollar increases commodity prices for buyers using local currencies.

Analysts now project that the Fed will likely keep the rate at its current level in July’s meeting and only begin the rate-cutting cycle in September.

“Our Country Risk team now believes that the loosening cycle will kick off in September, expecting the Fed to cut the funds rate from 5.50% to 5.00% by year-end,” according to BMI in a note on June 27.

ANZ Research also shared a similar forecast. It predicted that the Fed would initiate two 25 basis points (bps) rate cuts in September and December, lowering the rate to 5% by the close of 2024. The firm expects a further reduction of 150 bps over 2025, aiming to decrease the rate to 3.50% by December 2025.

CME’s FedWatch on July 1 reflected the anticipated beginning of monetary easing in September, with 57.93% of market participants expecting the Fed to cut the Federal Fund Rate to the 5.00% – 5.25% range. In contrast, 35.87% of participants anticipated the Fed would keep the rate steady at its current level.

The Fed is scheduled to hold rate meetings on July 30-31 and on September 17-18.

Copper Price Forecast 2024

| Analyst/source | Copper Price Forecast 2024 |

| | March | June/July |

| ANZ Research | $8,950 | $9,245 |

| Australia’s OCE | $8,340 | N/A |

| BMI | $8,800/ton | $9,200 |

| Fitch Ratings | $8,400 | $8,600 |

| ING | $8,738 | $9,535 |

| TD Securities ($/lb) | $3.65 by the end of 2024 | Q1: $3.83 Q2: $4.40 Q3: $4.45 Q4: $4.50 |

| Trading Economics ($/lb) | $3.75/pound in end Q1; $3.57 in 12 months | Q2: $4.67 Q3: $4.76 Q4: $4.83 |

In general, analysts projected the copper price to trade higher this year, supported by a potential supply deficit, the US rate-cutting cycle, and improving demand.

In its latest copper price forecast on June 20, BMI – a country and industry risk research company that is part of Fitch Solutions – projected copper to average $9,200 per ton in 2024, a 7.9% increase from the estimated $8,523 in 2023.

A weakening US dollar will support prices of base metals, including copper, as it lowers the cost of dollar-denominated commodities in local currency terms, BMI wrote.

“However, a later Fed cut could limit the upside for base metal prices across the board in 2024,” the firm said.

ANZ Research’s copper price forecast 2024 on June 27, expected the metal to trade at $9,290/ton, higher than the previous forecast of $8,950/ton and up from $8,496 in 2023.

ANZ Research’s Haynes and Kumari said in a separate copper note on May 10:

“In the short term, we expect copper prices to remain highly volatile as the market reacts to the challenging economic backdrop. However, we think prices will remain well supported, underpinned by a huge undersupply of the copper required to feed the emerging energy transition.”

As of June 20, Dutch bank ING projected that copper would trade at around $9,535/ton, higher than the previous forecast of $8,738/ton in March.

Data provider Trading Economics predicted copper will continue rising through 2024. It expected the red metal to trade around $4.67 per pound in the second quarter of 2024, rising to $4.76 in the third quarter and $4.83 in the final quarter.

Fitch Ratings revised its copper price forecast for 2024 to $8,600 in June from its March projection of $8,400/ton, according to the rating agency’s latest forecast on June 18.

In June, TD Securities projected that copper would trade higher through 2024, starting at $3.83 per pound in the first quarter and $4.40/lb in the second quarter. The metal was expected to continue increasing to $4.45 in the third quarter and $4.50 per pound in the fourth quarter.

Copper Price Forecast 2025

| Analyst/source | Copper Price Forecast 2025 |

| | March | July |

| ANZ Research | $9,290 | $9,929 |

| Australia’s OCE | $8,663 | N/A |

| BMI | $9,200/ton | $9,400 |

| Fitch Ratings | $8,000 | $8,400 |

| ING | $8,975 | $9,950 |

| TD Securities (US cents/lb) | Q4: $3.95 | Q1: $4.45 Q2: $4.35 Q3: $4.35 Q4: $4.30 |

| Trading Economics | Q1: $3.57/pound | Q1: $4.91 |

Analysts are divided in their copper price predictions for 2025.

In its copper price forecast 2025, BMI projected copper to average $9,400/ton, up from $9,200 in 2024.

ANZ Research also saw copper could trade higher at $9,929/ton in 2025, up from $9,245 in 2024.

For next year, ING expected the green metal to trade at around $9,950/ton, up from the projected $9,535 in 2024.

On the other hand, TD Securities predicted that the copper price would end its rally and begin to decline. The firm expected the red metal to drop to $4.45 per pound in the first quarter of 2025, down from $4.50 in the last quarter of 2024. It was projected to further decrease to $4.35 in the second quarter and remain steady at that level in the third quarter before dropping to $4.30 per pound in the final quarter of 2025.

For 2025, Fitch Ratings also estimated that copper would fall to $8,400 per ton from $8,600 in 2024. However, June’s forecast represented an upward revision from its previous projection of $8,000 per ton in March.

“The increased 2024-2025 copper assumptions reflect supply disruptions following the cessation of mining at Cobre Panama, reduced production guidance from Anglo American and major Chinese copper smelters announcing output curtailments in response to tightening copper ore supply.”

Copper Price Forecast for 2030

| Analyst/source | Copper Price Forecast 2030 |

| | March | July |

| Australia’s OCE (April) | 2026: $8,991/ton 2027: $9,098 2028: $9,166 2029:$9,211 | |

| Fitch Ratings | 2026: $7,500 2027: $7,500 | Unchanged |

| ING | N/A | 2026: $9,960 |

The exact long-term copper price forecasts for 2030 are unavailable due to a multitude of elements involved and the high level of uncertainty. Analysts, however, were certain that copper prices would remain high owing to rising electricity and energy transition demand.

The Australian Government’s Office of Chief Economist (OCE) projected copper to climb to $8,991 in 2026, and continue rising to reach $9,211 in 2029 from estimated $8,340 in 2024, driven by stronger consumption in copper-intensive sectors such as construction, power sector, appliances and EVs.

“Larger-than-expected expansions of clean energy manufacturing, construction, and the ongoing moving toward EVs in economies such as China and the US, also present upside risks to copper prices over the outlook.”

Without giving a price forecast, Saxo Bank’s Head of Commodity Strategy Ole Hansen said on June 24:

“Long-term fundamentals support robust future demand for copper from electric vehicles, grid infrastructure, and AI data centers, while production may struggle to meet demand, leading to potential supply deficits. Miners need higher prices to justify investments in new discoveries, which take over a decade to yield returns.”

The Bottom Line

A supply shortfall and the Fed’s loosening monetary policy were expected to become tailwinds for copper prices this year.

However, uncertainties about China’s demand and the risk of the Fed keeping high rates beyond the second half of this year may cap any price gain.

Do your own research and always remember your investment decision depends on your attitude to risk, your expertise in the commodity market, the spread of your portfolio, and how comfortable you feel about losing money.

The information in this guide does not constitute investment advice and is meant for informational purposes only.