update and further validate projections ( Happening now ? ) IMPLEMENTING AN INCREMENTAL COMMERCIALISATION STRATEGY FOR HPQ POLVERE FUMED SILICA

To meet the anticipated demand for low carbon fumed silica materials, HPQ Polvere commercialisation strategy is based on building a 1,000 tonnes per year (TPY) Fumed Silica Reactor and scaling up capacity to meet demand with an additional 1,000 TPY Fumed Silica Reactor.

To prepare the internal economic study, HPQ Polvere management used technology provider and equipment supplier PyroGenesis Canada Inc. (TSX: PYR) (OTCQX: PYRGF) (FRA: 8PY) (PyroGenesis) rough order of magnitude study regarding the cost of building the first 1,000 tonnes per year (TPY) Fumed Silica Reactor. HPQ management then used selling prices for the Fumed Silica and potential operating costs from information derived from third party sources and publicly available data.

The salient points of the internal economic study indicate that the HPQ Fumed Silica Reactor will have:

- Capex between US$ 9.00 and US$ 10.00 cost per Kg of annual capacity [5]

- Energy consumptions between 10 – 15 KWh per Kg of Fumed Silica [6]

- EBITDA margins between 60% and 65% [7]

- Payback period per 1,000 TPY Reactor of around 1.7 years [8]

“HPQ Silica is uniquely positioned to be the sole provider capable of supplying the materials required to meet the increasing demand for low carbon Fumed Silica products,” added Mr. Tourillon. “This demand is anticipated to necessitate the deployment of numerous 1,000 TPY Fumed Silica Reactors in the future.”

While HPQ Polvere technology is the only ultra–low carbon footprint process, no green premium was used when calculated the selling price of the material used for the internal economic study.

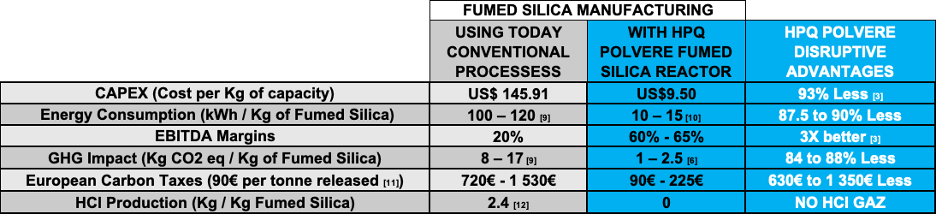

HPQ POLVERE DISRUPTIVE ADVANTAGES IN ONE TABLE

“This table clearly shows that HPQ Polvere Fumed Silica Reactor (FSR) has many disruptive advantages that can threaten traditional Fumed Silica Manufacturing and can be a significant opportunity for HPQ and its shareholders,” continued Mr. Tourillon.

HPQ management plans to update and further validate these projections when more data is collected from an upcoming pilot plant testing phase later in the year. This will be achieved with the completion of an engineering cost and feasibility study that will be conducted by an independent party at the appropriate time.

Internal Technical and Economic Study Indicates HPQ Fumed Silica Reactor’s Robust Potential at Commercial Scale — HPQ Silicon Inc.