Adam Gault

By Ryan McMaken

The Treasury Department posted its latest revenue and spending totals this week, and deficits continue to mount at impressive speed.

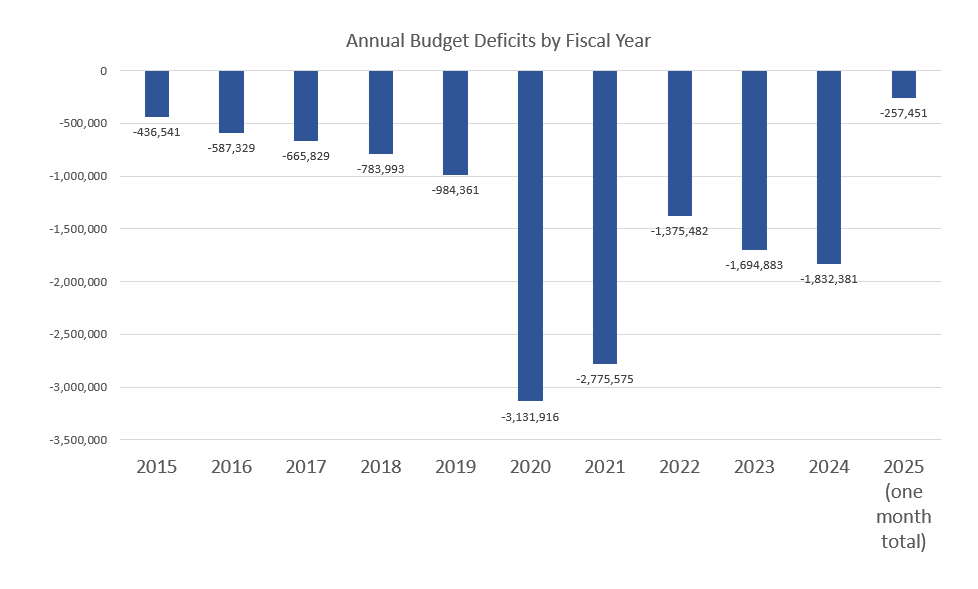

During October-the first month of the 2025 fiscal year-the federal deficit was more than a quarter of a trillion dollars, coming in at $257.4 billion. Tax revenue in October had totaled $326 billion, but spending totaled $584 billion.

Now one month into the new fiscal year, the federal government is on pace to add more than $2 trillion dollars to the national debt during the 2025 fiscal year. If the economy significantly worsens in coming months-and tax revenues plummet as they do during times of economic trouble-the deficit will be much larger than $2 trillion.

There is no sign of any relief from mounting deficits. The 2024 fiscal year ended on September 30 with the FY's total deficit coming in at $1.8 trillion. That's the largest deficit in three years and is the worst since 2021 when the US will in the midst of the Covid Panic.

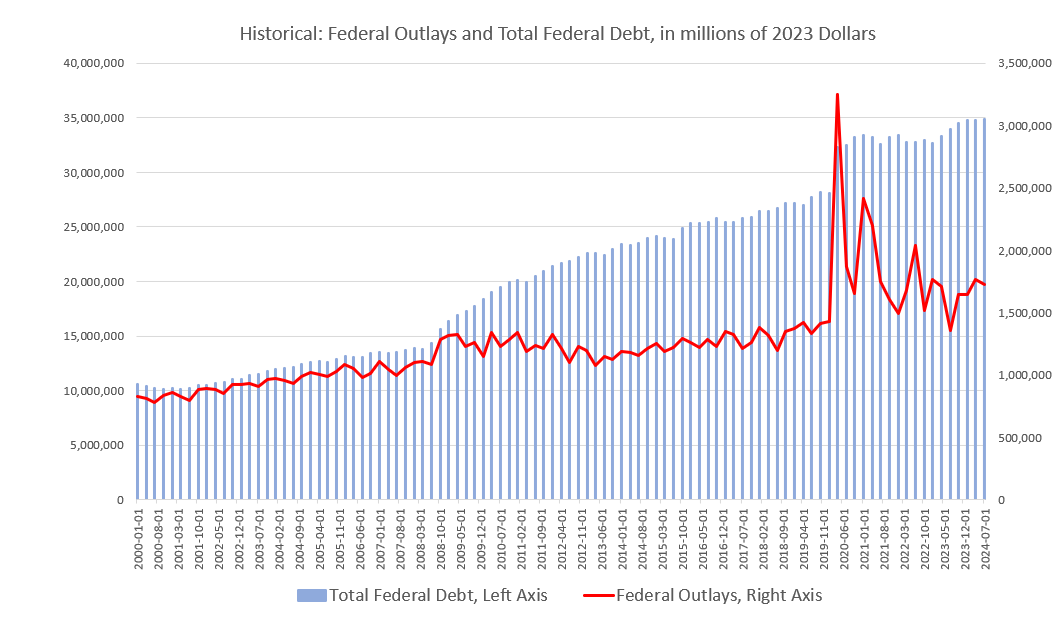

With this additional $1.8 trillion added to the national debt, the total debt is now over $35 trillion. Federal spending has trended up since the third quarter of 2023, once again accelerating overall growth in the debt, and all but ensuring total debt will top $36 trillion by the time Donald Trump is sworn in January 2025.

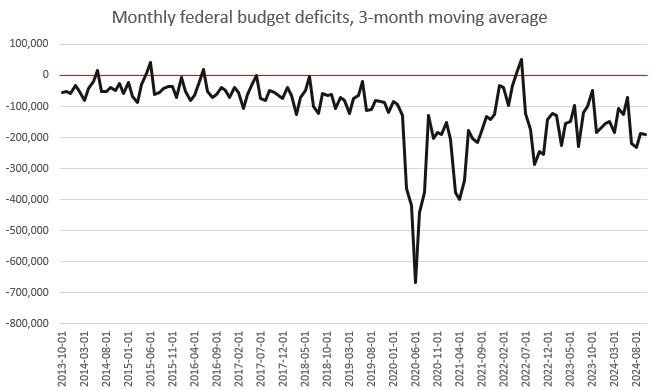

Federal spending today remains well above where it was prior to the covid lockdowns in the first quarter of 2020. Moreover, deficits have trended deeper into negative territory in recent months.

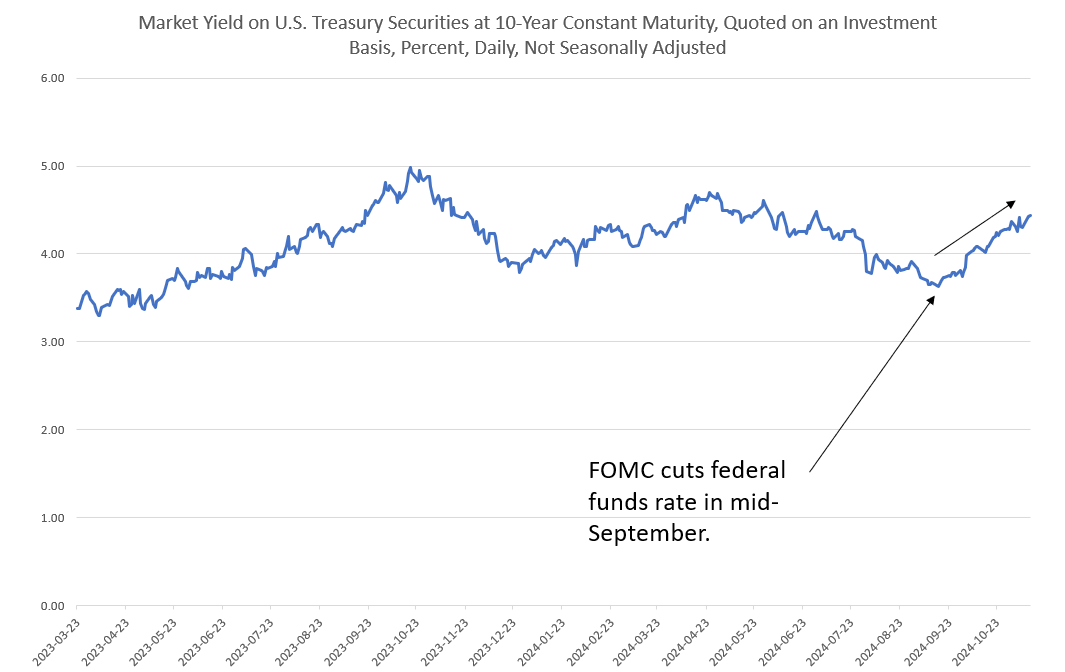

Although the issue of the national debt was largely ignored during the presidential campaign, the debt is likely to have a growing effect on interest rates as the federal government continues to issue ever larger amounts of Treasurys. This will put upward pressure on interest rates even as the central bank attempts to cut short-term interest rates.

For example, although the Federal Reserve cut the target interest rate in September, the ten-year Treasury has grown since mid-September to four-month highs. This is likely being fueled in part by bond investors' expectation of even more deficit spending and the need to issue ever larger amounts of federal debt-thus driving down bond prices and driving up yields. Rising yields also suggest many investors expect more price inflation. As deficits grow, the Treasury will call upon the Fed to buy up more bonds to push down yields. That will lead to monetary inflation and, eventually, price inflation.

This presents a problem for many sectors of the economy that have become dependent on ever-falling interest rates, such as the many zombie companies that are deeply in debt and will need to refinance in the near future. Bankruptcies will follow. Many consumers will also put off large purchases as financing becomes more expensive. This is likely to become more evident given how the 30-year mortgage rate-which generally follows the 10-year Treasury yield-has risen from 6.1 percent to 6.8 percent since September. Not surprisingly, the market has slowed in recent months.

Fed officials, of course, pretend that the rising yields on the 10-year, 20-year, and 7-year are rising. During the FOMC press conference this week, Powell brushed the question aside with a hand wave, claiming rates must be going up because investors expect more growth. He refused to admit it had anything to do with deficit and inflation expectations. Goolsbee at the Chicago Fed is also pretending it is a mystery as to why rates might increase.

The Trump administration has stated that it plans to slash as much as $2 trillion from the federal budget, using the so-called "Department of Government Efficiency" (DOGE) under Elon Musk. More sophisticated observers of fiscal policy are unlikely to find this very convincing, however. The DOGE group has little influence over what budgets Congress approves. DOGE's recommendations will remain just that-recommendations-to the White House's Office of Management and Budget (OMB).

Those who have watched the budget process in the past know that budget recommendations from the OMB are generally DOA at the Congress. There's no reason to believe this will be different in 2025, especially with such an evenly divided Congress, and with Senate leadership positions controlled by spendthrift old-guard Republicans.