Gear Energy (OTCQX:GENGF) has new management, and a new Chairman of the Board, as noted in the last article. Management has been executing the interim strategy which was to finish what was begun at the end of the fiscal year. However, the details of the future plan of action have been delayed until the start of the first quarter. That means that the original strategy of allowing the company cash flow to repay debt completely will likely be accomplished. However, the forward strategy will likely be changing as the Canadian industry has had some major new intervals come online over the last few years. But a small company with virtually no debt will likely have an above-average chance of success.

That last article noted that Don Gray, who is retiring as Chairman of the Board, purchased a fair amount of stock as a show of faith in the new board. The current debt paydown would offset the temporary lack of a strategy and may well indicate that a small position be considered by investors.

Today's announcement shows a big change in company direction compared to what the market was likely expecting.

Transformative Announcement

Shown below is the buyout and remaining corporate proposal from Gear Energy management:

"The Transaction will be accomplished by way of a statutory plan of arrangement under the Business Corporations Act (Alberta) (the "Arrangement"). Under the terms of the Arrangement, each holder of Gear Shares (each a "Gear Shareholder" and collectively, the "Gear Shareholders") will receive $0.607 in total consideration per Gear Share, consisting of, at such Gear Shareholder's election: (i) $0.607 in cash per Gear Share; (ii) 0.3035 common shares in Newco ("Newco Shares") per Gear Share; or (iii) a combination thereof, subject to proration and consideration caps set out in the Arrangement."

(Note that the above is expressed in Canadian Dollars)

Probably the other key item would be:

" Current production from the Gear Assets is approximately 3,700 boe/d (consisting of 3,400 bbl/d of heavy and medium crude oil, and 2,000 mcf/d of conventional natural gas), with a liquids weighting of 91%."

"Newco will retain 31% of Gear’s production, equating to approximately 1,700 boe/d (consisting of 1,100 bbl/d of light crude oil, 200 bbl/d of NGLs and 2,000 mcf/d of conventional natural gas) with a liquids weighting of 80% and a deep inventory to grow production and cashflow."

All of the quotes above come from the news release on the company's website Dated December 2, 2024.

This definitely helps with the future. But as many commenters noted under the previous article, they still have questions about what will remain and how will it be handled. The major question is likely to be the dividend policy of the new company as this company had become a dividend favorite.

There is also a question of debt levels even though the new company is expected to retain some cash. Evidently insiders will be expected to retain stock as otherwise that level of cash shown above is not going to happen because there are far too many shares for an all-cash distribution to everyone.

Usually, companies would present a corporate presentation that spells all this out and more. But as of right now, there is no corporate presentation.

Earnings

(Note: This is a Canadian company that reports in Canadian dollars unless otherwise stated.)

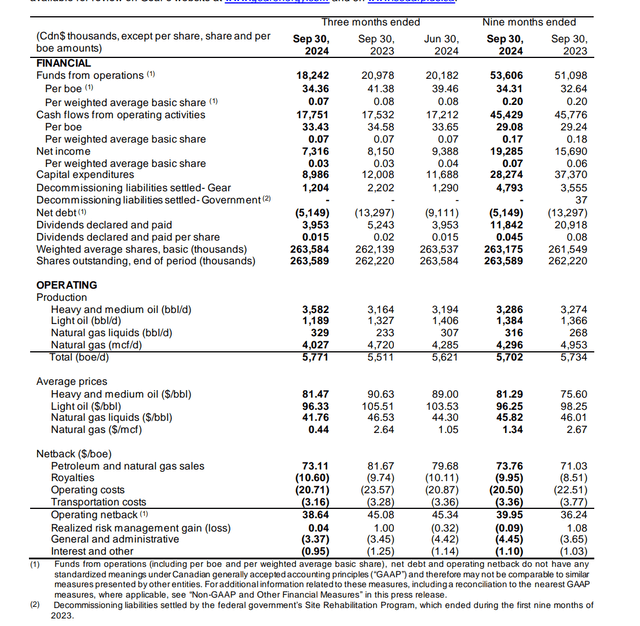

Both earnings and cash flow would appear to be adequate for a company of this size. The debt free status would eliminate a "per BOE" expense that many competitors have. Since costs are on the higher side, that advantage may be needed at some point in the future.

Gear Energy Third Quarter 2024, Results Summary (Gear Energy Press Release Third Quarter 2024)

This is a very typical situation for small upstream operators in that the price-earnings ratio is fairly low despite the dividend payment. What is probably needed here is some growth to attract more institutional investors.

The market is not all that efficient for companies that are this small. It is therefore quite possible for the "bargain status" to remain. This stock is therefore for patient investors. Traders can look elsewhere.

That stock price could also be due to the fact that the company has been ignored for some time. New management therefore will have to prove that it can do a lot more with these assets than was done in the past. That may take some time to catch the attention of the market.

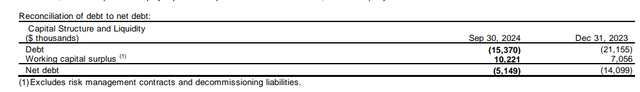

Net Debt

Bank debt has not been paid down as much as net debt has declined. This may be a move by management to give itself a fair amount of flexibility once it decides upon a strategy. The amount of bank debt is relatively low compared to the cash flow. Therefore, the debt ratio is not a worry nor is the ability to repay the debt.

Note that the offer for the company mentioned above will probably stop all drilling activity going forward. That may allow the company to accumulate still more cash before the deal closes.

Gear Energy Net Debt Calculation And Comparison Third Quarter 2024Gear Energy Net Debt Calculation And Comparison Third Quarter 2024 (Gear Energy Press Release Third Quarter 2024)

That working capital surplus indicates a very conservative idea of cash flow outspend that can happen in the next fiscal year. The reason is that many companies report negative working capital on the quarterly reports without having to borrow more money.

Canadian wells are generally cheap (but definitely not always). It is therefore possible that the cash flow plus the working capital surplus available would well fund a program that jump starts growth.

It is also possible that the company will do some accretive acquisitions in an attempt to gain economies of scale. This may not be as likely as Don Gray's other company Peyto (OTCPK:PEYUF) has long stated that acquisitions will be a rare event at Peyto. The new management may change that strategy.

The Business

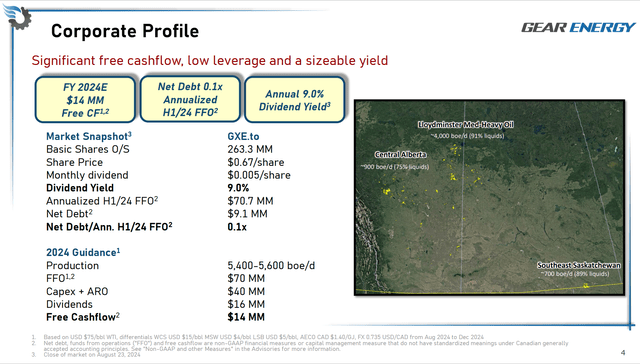

Below is a summary of the business from August along with a map of the company operations.

Gear Energy Summary Of Operations And Map Of Business Acreage (Gear Energy Corporate Presentation August 2024)

While a fair amount of the left side is outdated and needs to be brought current, the map of operations is reasonable.

Note that the latest announcement does detail what is going with the purchase and what stays. Investors can use the map above to get an approximate idea of the remaining operations if they vote in favor of the deal.

The dividend may or may not continue once the new management decides upon a strategy. Therefore, this is not a consideration for income investors that need a reliable income.

This is a company that originally began as a heavy oil producer but acquired some light oil acreage to make it through periods like fiscal year 2020. That means that the company has at least two areas to emphasize in a growth strategy.

I cover companies like Headwater Exploration (OTCPK:CDDRF) that are making some fantastic profits in heavy oil due to the technology advances in heavy oil production. Now, whether the acreage the company has can use that technology going forward is anyone's guess.

The big advantage that the company has is a very wide margin due to the extremely high mix of oil and liquids in the production mix. However, there is a natural gas amount that could provide some cash flow if the expected recovery of natural gas prices materializes.

Summary

Gear Energy is switching management at a time of an extremely strong balance sheet. That strong balance sheet minimizes the risk of failure.

At the same time, the management selected by Don Gray as he retires has considerable industry experience. That management can also relay on Don Gray as an information source. This likewise minimizes the small company risk and any risk of future strategies chosen.

Gear Energy remains a strong buy due to the strong management team and the very low debt levels. Some would consider the company size as speculative.

There will likely be very low operational activity involving the capital budget in the fourth quarter. However, once management announces the new strategy, there should be a very active first quarter before Spring Breakup mandates a time of lower activity until Spring Breakup ends.

This idea is probably best as a basket of similar sized companies, rather than loading up on any one company. Things tend to happen to smaller companies that do not happen to larger companies. So. diversification is in order.

Risks

This is a small company with a substandard level of production for economies of scale to be achieved. Hence, the recommendation to make a basket rather than go "all in" on any one company.

Don Gray is retiring. He is a legend in the Canadian oil and gas industry. While he is a source of information, that is not the same as running the company yourself. There could be some extra risk here until the new management and the new Chairman of the Board establish their own record.

Any upstream company is subject to the volatility and low visibility of future oil and gas prices. A severe and sustained downturn could materially affect the company's future. However, as a low debt company, this company may well be the first to recover from such an event.

The loss of key personnel can be critical to the future of small companies.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.