We have begun our due diligence on CCMI. We covered the stock from 2020 to 2022, and plan to relaunch coverage in the coming weeks. Below is a brief overview of CCMI’s portfolio and our initial assessment.

The company owns two advanced-stage copper projects: the Bull River mine in B.C., and the Thierry mine in Ontario. CCMI has received an offer from QC Copper and Gold (TSXV: QCCU) to purchase its 30% interest in the Thierry mine project for $3.5M in shares. We believe this deal will allow CCMI to maintain focus on its flagship Bull River mine, while retaining indirect exposure to QCCU’s projects through equity ownership.

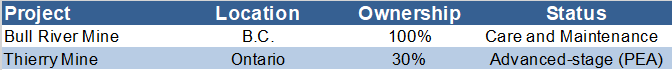

Portfolio Summary

Source: FRC / Company

Bull River Mine, B.C.

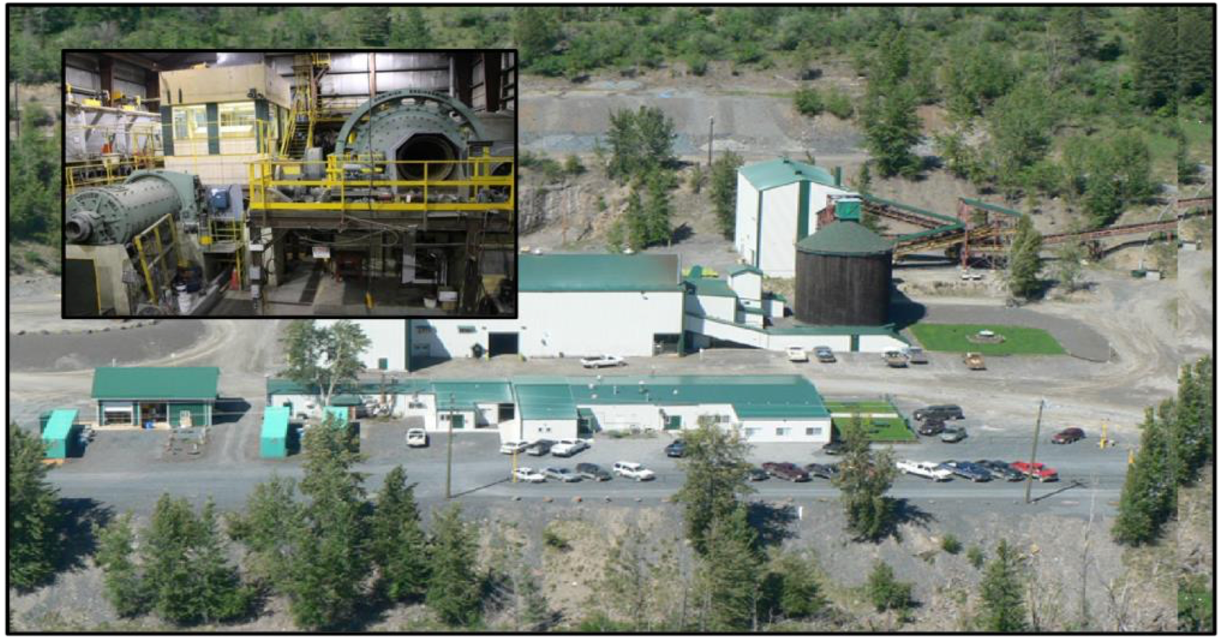

The Bull River copper-gold-silver mine is a past producer currently in care and maintenance, with significant infrastructure in place. The property features an underground mine, a large surface stockpile, a 700 tpd mill, and and 22,000 meters of underground workings.

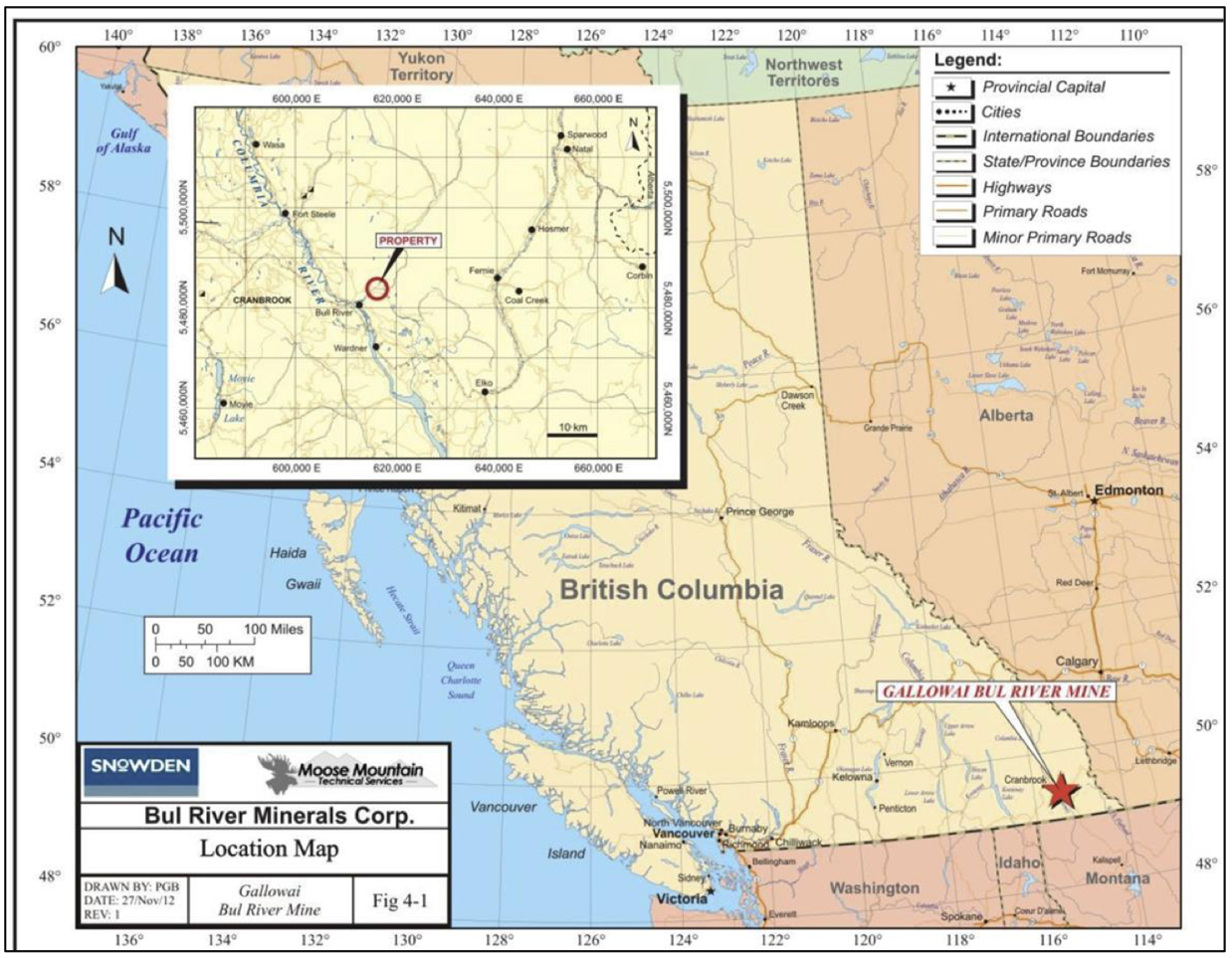

Location Map

Source: Company

Existing Infrastructure

Source: Company

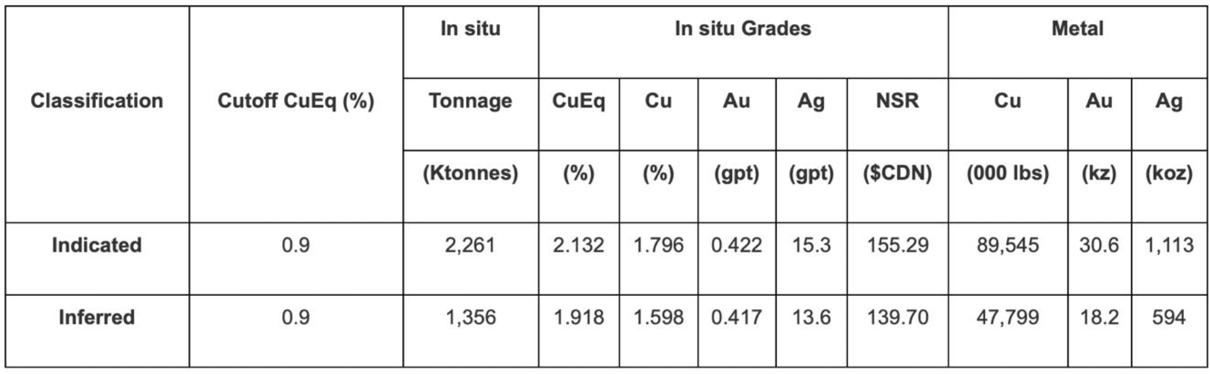

The project hosts a relatively low-tonnage/high-grade copper-gold-silver deposit, with resources totaling 164 Mlbs CuEq. In addition to the underground resource, the project hosts 6.1 Mlbs CuEq (1.7%) in surface stockpiles. Note that these grades are unusually high for stockpiles.

2021 Resource Estimate

Source: Company

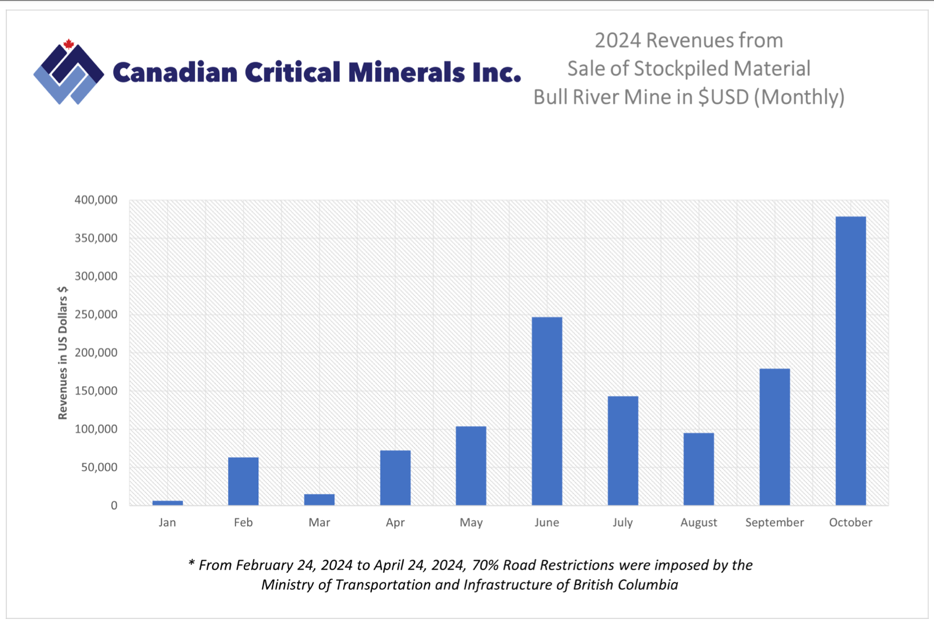

With existing infrastructure in place, the project can be advanced to production with a CAPEX of <US$15M. The company has an ore purchase agreement with New Gold’s (TSX: NGD) New Afton mill facility to supply up to 90 Kt of stockpiled ore over two years. To date, CCMI has shipped approximately 5.3 Kt of mineralized material, generating US$1.3M in revenue.

Surface Stockpile

Source: Company

Management is focused on bringing Bull River back into production. Copper projects are usually capital-intensive, but Bull River’s low CAPEX and swift path to production present a compelling opportunity for CCMI. In our previous report in April 2022, we valued Bull River at $52M, or $0.18/share. CCMI is currently trading at just $0.04/share. As mentioned earlier, we plan to initiate coverage with a detailed report and updated valuation in the coming weeks.