Nicholas Wright/iStock via Getty Images

Silvercorp (NYSE:SVM) is my favorite play on silver. I have written about the company on a number of occasions (such as here, here and here). The share price is still up about 20% year-to-date, but it was up more than 90% at the beginning of October. The recent sell-off has been nothing short of brutal.

Silvercorp's share price has declined from October-November 2024 highs of around $4.80-5.00, down to the $3.00-3.20 range, representing approximately a 35-40% pullback. The stock is now trading below both the 20-day and 50-day moving averages, indicating strong bearish momentum. A "death cross" pattern (20-day crossing below 50-day) formed in November. This implies that the bearish momentum is likely to continue in the short term.

tradingview.com

In this situation, a technician would probably wait for confirmation of a reversal (such as a break above the 20-day MA). However, I am not a technician: I am a value investor. As a value investor, I can appreciate the big picture behind the price action. I recognize that the price should not set the narrative: on the contrary, a divergence between the price and the company's fundamentals is precisely what creates the very opportunity for value investing to work. As will be argued in the rest of this article, I believe the recent sell-off has been triggered by a series of events that have been misconstrued by the market. That is, Mr. Market is acting irrationally again.

During the sell-off, silver prices have remained relatively stable around $30 per ounce. This suggests that the decline is company-specific. Indeed, there have been a few important events since my last article.

- First of all, the Adventus acquisition, initially announced back in April, has been successfully closed in July. Silvercorp has thus acquired the El Domo project, a fully-permitted, copper-gold project in Ecuador. The project is set to provide both jurisdictional and metal diversification. At the moment, Silvercorp's only producing assets are the Ying and GC mines in China. Over 60% of revenues come from silver, 32% from base metals and only about 4% from gold. El Domo will be the first producing asset outside of China. The hope is that this move will remove part of the geopolitical discount currently weighing on the share price. In addition, El Domo will give the company exposure to copper: El Domo is expected to add about $150 million in revenues (on an attributable basis), with more than half coming from copper. Because of the merger between Adventus and Luminex, Silvercorp has also inherited the Condor project, an exploration-stage gold project in Ecuador. The Condor project is larger and more expensive to develop than El Domo, so it is further into the future, but it is going to add a significant amount of gold to the company's production profile.

- Second, the company announced in November an offering of $130 million senior notes (later increased to $150 million). The day of the announcement, Silvercorp's share price plunged by about 10%. The market probably worried that the money might be spent on value-destructive acquisitions. In addition, the terms of the offering, including the interest rate and conversion rate, were not disclosed, which added further uncertainty. However, even after the terms were disclosed a few days later, and proved to be quite favorable, the share price continued to decline. Concerning fears about poor capital allocation of the funds, the company has not disclosed exactly how it plans to utilize them (except in very generic terms: "[...] for the construction of copper-gold mining projects outside of China, for the exploration and development of other projects and for working capital"). On paper, El Domo is fully-funded: initial CapEx was estimated at around $250 million in the 2021 PEA study, and the company holds more than $200 million in cash, plus it is set to receive more than $150 million as part of a streaming agreement with Wheaton. It is likely that the funds will be used to further advance the Condor project, though there is also the possibility of a further acquisition, as hinted in a recent interview. In any case, I believe the fears are vastly overblown. Silvercorp has a track record of prudent capital allocation. Before acquiring Adventus in 2024, the company had been looking for the right opportunity for several years (they tried to acquire Guyana Goldfields in 2020, Celsius Resources, and then OreCorp in 2023). The management team has therefore shown price discipline and a value-based approach to acquisitions, with a focus on high-margin, construction-ready projects. Therefore, I see the offering as an overall positive. It allows the company to leverage its strong balance sheet and avoid future dilution, as it prepares to deliver on its strategy of diversification outside of China. The terms of the deal qualify it as "cheap capital": the interest rate is only 4.75% paid semi-annualy; in addition, the notes, if converted, can be settled in cash or in shares, entirely at the company's discretion.

- Finally, the company has provided an update in December about its Condor project. The project was originally planned to be developed as an open-pit mine, with over $600 million in initial CapEx, an average grade of 0.72 g/t Au and annual production of 187,000 oz Au. Now, Silvercorp plans to switch to a much smaller underground operation. A PEA based on the new mine plan is not yet available, but we might guess that the production rate will be lower, e.g. around 50-100,000 oz annually. Operating costs will also be higher: typically $70-100/tonne vs $20-30/tonne for open pit. However, higher grades should offset the higher unit costs, and recent drill intersects have highlighted new target zones with grades in the range 8-44 g/t Au. An underground operation is also more challenging from a technical standpoint, requiring a more complex mine planning and better understanding of structural geology. As a result, the share price declined when the announcement was made, an indication that the market believes an underground operation implies a lower NPV. This, however, is not necessarily the case. An underground operation will likely require significantly less initial capital, perhaps around $200-300M. A staged development becomes possible, reducing upfront funding needs. This can actually improve IRR, combined with earlier cash flow from high-grade zones and better unit economics. But, the greatest advantage is that an underground operation implies a small surface footprint, less waste rock and lower water management requirements. In other words, a much reduced environmental and social impact. This is extremely relevant, considering that the Condor project is located high in the Andes, at the southern end of Cordillera del Condor. I am not overly worried about political risk, considering there is already an Investment Agreement in place with the Government of Ecuador and that the new president of Ecuador, Daniel Noboa, is generally seen as business and mining friendly. I am more concerned about the local communities that, often instigated by environmental NGOs, can be quite vocal in their opposition. In any case, the switch to a less risky mine plan should be perceived by the market as a positive, given the higher probability of success. It should not warrant a significant discount to the net present value of the asset.

I have thus argued that recent company-specific events do not provide sufficient reason for the sell-off. Let us now look more in detail at the valuation. The company currently has a market capitalization of around $700 million. It holds more than $200 million in cash and short term investments (not counting the $150 million recently raised via its senior notes offering). Silvercorp also has a 27% interest in New Pacific (NEWP), which is valued at around $90 million. This gives Silvercorp an enterprise value of about $400 million.

The company's main assets are its Ying and GC mines in China. These are cash-generating assets with over 10 years of mine life. They are currently able to sustain annual production of around 8 million AgEq ounces, at AISC of $11.66/oz AgEq. Moreover, Silvercorp is investing in a number of optimizations and efficiency-increasing opportunities. Most importantly, it is on track to complete a new mill facility at Ying, which will bring total processing capacity to over 4,000 tonnes per day (up 60% from the current 2,500 tonnes). This will allow to increase production to around 10 million AgEq ounces from 2026. The mines are already profitable, having generated almost $100 million in operating cash flow over the last 12 months. Thus, even if Silvercorp consisted of nothing else, paying $400 million for assets generating $100 million per year would not be such a bad deal.

There is, of course, more than that. First of all, let us discuss El Domo. At El Domo, detailed engineering design is on-going. Silvercorp has identified opportunities to reduce initial CapEx, e.g. by switching to alternative construction vendors. It has also performed metallurgical tests to improve gold and silver recoveries, thus further reducing costs. First production is planned for the second half of 2026. The mine is expected to produce 11kt Cu, 26koz Au, 12kt Zn, 488koz Ag annually, at a competitive AISC of $1.26/lb CuEq. The project is fully funded via a combination of cash on hand and a streaming agreement with Wheaton. It is fully permitted for construction and operation. An Investment Protection Agreement has been signed with the government of Ecuador. A JV structure has been established together with junior mining company Salazar Resources, which holds a 25% interest. Silvercorp is going to fund 100% of the construction costs, in exchange for the first $30M of free cash flow; then, 95% until equity contributions are repaid; finally, 75% of free cash flow.

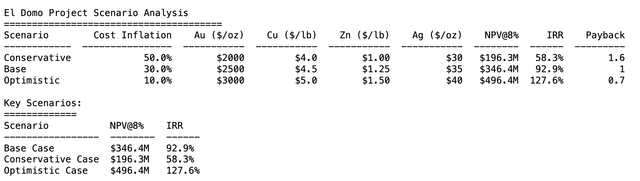

The original 2021 PEA study gave El Domo a NPV-8% of $260 million. Such a number, however, is far from accurate, considering that it is based on very outdated metal price assumptions (copper $3.50/lb, gold $1,700/oz). One might, however, anticipate significant cost inflation compared with initial estimates. I have considered the three scenarios described in the table below. In the base case scenario, I have assumed cost inflation of 30% and metal prices close to spot prices: gold $2,500/oz, silver $30/oz, copper $4.5/lbs and zinc $1.25/oz. I then ran a DFC analysis, taking into account the terms of the streaming agreement with Wheaton, the terms of the JV with Salazar, existing royalties and other taxes. The NPV-8% increases to about $350 million. Given the advanced nature of the project, the fact that no further dilution will be required to complete it, and the robust economics, I believe the acquisition of El Domo was very well managed.

DFC sensitivity analysis of El Domo NPV-8% (Author's computation)

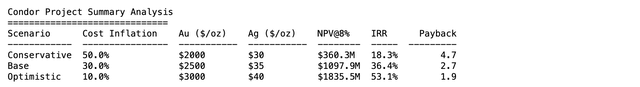

Let us now look at the Condor project. The original PEA envisioned a 12-year mine life, annual production of 187,000 oz of gold and 758,000 oz of silver, based on resources of 2.3 Moz Au & 12.8 Moz Ag (indicated) and 4.3 Moz Au & 18.1 Moz Ag (inferred). Initial CapEx was expected to be much higher than El Domo, at over $600 million. I ran a similar sensitivity analysis to assess Condor's NPV-8%. However, it is important to emphasize that Silvercorp is in the process of completely redesigning the mine, switching from an open pit to an underground operation. We might, nonetheless, reasonably assume that the redesign will not drastically impair NPV.

DFC sensitivity analysis of Condor NPV-8% (Author's computation)

Summarizing, the recent sell-off in Silvercorp is not justified by fundamentals. The silver price has recently been resilient and, with the silver market in a deep deficit, I would expect it to remain so. Silvercorp's actions have been consistent with its clearly communicated strategy of metal and geopolitical diversification away from China. The recent raising of $150 million via convertible senior notes has allowed the company to gear up its balance sheet, taking full advantage of a cheap financing option. The proceeds will be employed to advance its newly acquired El Domo and Condor projects. When one tries to value the company by summing up its different pieces, it becomes almost impossible to make sense of the current valuation. The conclusion is that Silvercorp trades at a significant discount to the NPV of its assets and, if the management can continue to deliver, I see a re-rating as inevitable.