As we head into January 6th, the talk of the Doomsday Scenario where Congress refuses to certify the Electoral College. There are some NEVER TRUMPERS in the Republican camp who want to depose House Speaker Mike Johnson (R-LA), which in itself could put in place a delay in certifying Donald Trump as the next president. Then you have the leftist press like The Hill advocating that Congress refuse to approve the Electoral College and proclaim Trump is guilty without any trial of an insurrection that they stage for this very purpose to refuse him the presidency and install Kamala with all her strings pulled by the NEOCONs who will promise to line the pockets of Congress with another one of the endless wars.

The LEFT is going completely insane. New York state will now fine fossil fuel companies a total of $75 billion over the next 25 years to pay for damage caused to the climate under a bill Governor Kathy Hochul signed into law on Thursday. They should stop selling all fuel in New York State and see how long it takes the people to storm her palace.

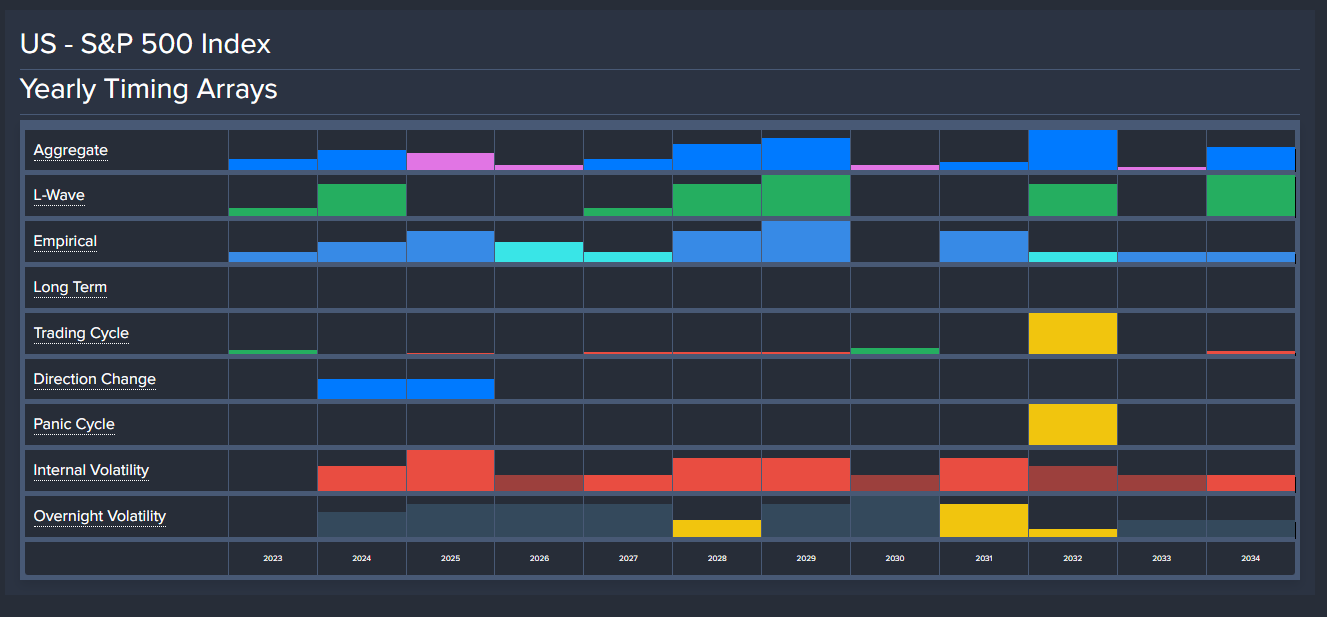

When we look at the Yearly Array for the S&P500, There is no doubt that we have a pause in the uptrend, for this has been just another bubble in Bitcoin and AI like canals in the Panic of 1825, English Railroad in the 1840s, US railroads in 1907, and US Industrials in 1929, or the DOT.COM bubble in 2000. There are always these sorts of bubbles, and people will always proclaim it will never end. Companies like MicroStrategy only pitch one side of a market in Bitcoin and never consider they might be a correction.

Looking at the Yearly Array, notice two directional changes in 2024 and 2025. With governments falling around the world, the LEFT was desperate to stage a coup to seize power and force their agenda upon the world, just as the Communists did in Russia in 1917 and in China by 1949, with government debt tittering on the brink of a sovereign default, the only place to high will be in private assets. Stay away from mutual funds, for most fund managers will lose on this one.

What we may see is a correction, but one that is a fake-out and a buying opportunity. We are preparing an important report for the view into 2025.