Brief Thesis Walkthrough

Vermilion Energy (NYSE:VET)(TSX:VET:CA) has a significant asset base in Europe, with a large part of that being liquid natural gases. VET estimates that European gas production will be responsible for 37% of the total fund flows from operations in 2025. Gas prices here have been rising at a steady pace and over time will likely keep up in this direction. Cutting of Russian gas imports has meant rising prices and with VET operating solid production sites in the Netherlands and Germany, which is Europe's largest oil and gas market. European premium pricing of gases has been a growth driver over the past 12 months, but I see the Westbrick acquisition that VET has proposed as a significant value addition to the already very strong portfolio. Westbrick would contribute an additional $275 million in net operating income, along with $110 million of FCF. I found VET to be a strong buy case before this announcement, now afterward is the icing on the cake.

VET Market Position And Current Market Climate

In Europe, VET plays a significant role as a gas and oil producer in several countries. In France, it's the largest oil producer. Operations began in 1997 for VET here. In the Netherlands, VET is the second-largest onshore natural gas procedure. Germany is next on the list for VET's European expansion. Since 2014, it has increased its presence by acquiring non-operated interest in certain assets. In Q4 last year, VET made progress in Germany by commencing drilling at the Weissenmoor well, with expectations of results being noticed this quarter. Along with this, two other sites had solid testing reports, with the first one expected to be in the production stage in the first 6 months and the other site in the first 6 months of 2026.

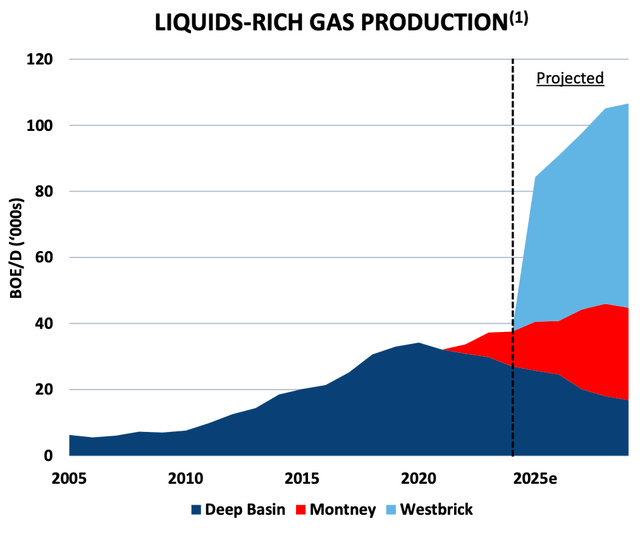

Figure 1 - Forecasted BOE/D (Quarterly Presentation)

The suggested Westbrick acquisition would significantly increase VET's asset base in Canada. In total, liquids-rich natural gas production would more than double, and with VET plan on further increasing Westbrick production capacity from 50,000 boe/d to 60,000 boe/d within just 5 years, the company is on track to be a much larger player in the North American energy market.

The business itself is essentially divided into the North American segment, which is the US and Canada. The second part is international, which includes the European countries previously along with Australia as well notably. North American operations are predominantly oil production, whilst European operations are predominantly gas, which has been beneficial given the rising prices I've mentioned earlier following regional instability caused by Russia's invasion of Ukraine.

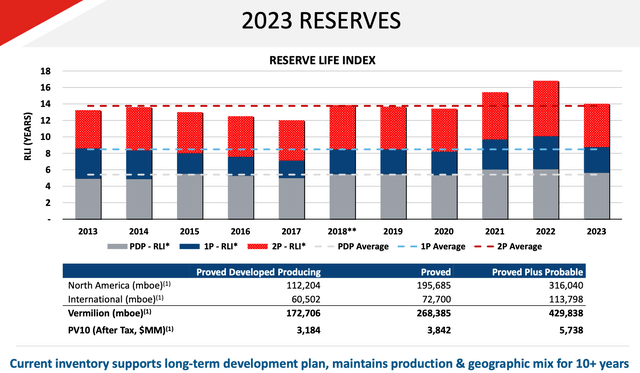

Figure 2 - Company Reserves (Quarterly Presentation)

Company reserves are depicted above. North American proved developed producing reserved is 112,204 mboe whilst international is 60,502 mboe. For the chart above, grey is reserves in production already, blue is proven reserves, and red lastly is probable reserves. VET maintains that their current reserves will leave another 10 years of operations, which is helping support its long-term development plan. It also means that VET can be on a strategic path and make acquisitions like the one for Westbrick.

In terms of market share, VET is still relatively small, with a market cap of just $1.58 billion. Compared to the giants in the Canadian oil market like Cenovus Energy (CVE) or Suncor Energy (SU) VET holds a very small part of the market.

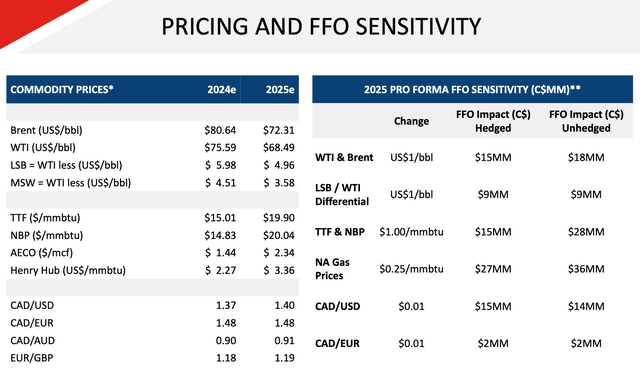

Figure 3 - Pricing and FFO Impacts (Quarterly Presentation)

In the last quarterly presentation, VET provided more information regarding pricing and FFO sensitivity, as shown in the image above. 2025e is for Brent crude oil to be $72.31 on average, down from $80.64 in 2024. A $1 change in WTI & Crude would have a C$15 million impact on the FFO if VET has hedged, unhedged the impact would be C$ 18 million instead. The hedging strategy that VET has is something that I will go over later on. Moving over to natural gas prices in North America the impact of a .25/mmbtu change looks the following, hedged it will materialize to C$ 27 million whilst unhedged C$36 million instead.

Management Comments And Outlook

"The past year was a very challenging year for North American gas producers, especially Canadian gas producers who were subject to sub-a-dollar gas price for most of summer months. While we do have exposure to AECO, the majority of our gas wells in Western Canada are liquids rich, which means that liquids production make these wells more profitable."

Dion Hatcher, CEO of VET, commented on last year's challenges. The North American gas market is experiencing far lower AECO prices at the moment and has historically also been far lower than European prices. However, for VET it makes an impact but not necessarily that much since they have their gas wells are liquids-rich instead. This means they are far more profitable, which has limited the impact of low North American gas prices compared to peers.

"Our current annual dividend represents approximately 6% of 2024 FFO which leaves ample flexibility to manage and even increase the dividend in a lower commodity price environment. Our production through the first nine months of 2024 has averaged 84,881 BOE a day which is about 1% above the midpoint of our original guidance range of 82,000 to 86,000 BOE a day."

Lars Glemser, the CFO, commented on the current dividend that VET maintains. He hints at a potential increase to a dividend is possible even if we see declining gas and oil prices over the next few years, i.e., and enter a bear market. This is only possible because VET maintains on average a 6% distribution of FFO as dividends.

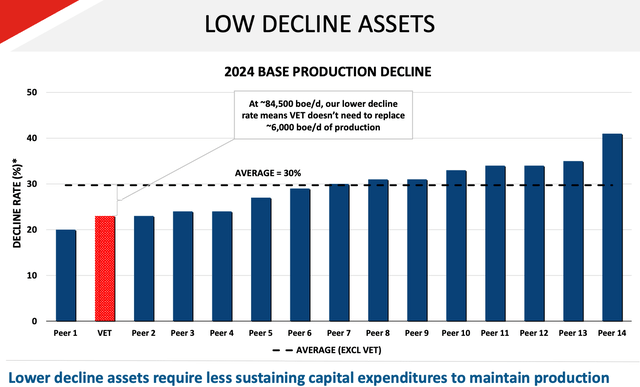

Figure 4 - Asset Base (Quarterly Presentation)

I would even argue that one of the biggest reasons for VET being capable of maintaining the current dividend as Lars mentioned is also because of the low decline rate of VET assets. It's over 30% below the sector's average of 30% declines, which means 6,000 in boe/d productions don't need to be replaced. This creates a less capital-intensive operating structure for VET. With less capital expenditures, the FFO left over is greater, and VET's ability to distribute that to shareholders is in turn also greater.

Westbrick Acquisition Summarized

On December 23 VET came with the announcement of another acquisition, this time for Westbrick with a deal valued at C$1.057 billion or $746 million. This is an attempt by the company to strengthen its presence in the Alberta Deep Basin. 1.1 million acres of land and a forecast 15-year period where production can be kept flat and create $110 million in annual cash flows based on VET's own forecasts.

75% is gas and 25% is liquids of the 50,000 boe/d in productions that VET knows will be able to add to its portfolio. The acquisition will be able to immediately show a per-share positive impact. To reiterate, 2025 estimates are for $275 million more in net operating income and $110 million more in FFC, 40% of which the company will distribute to shareholders.

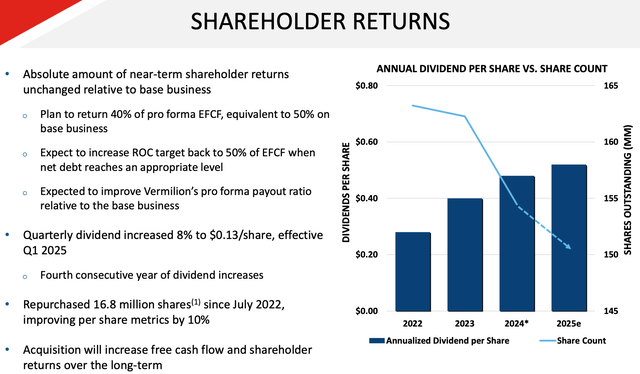

Figure 5 - Shareholder Returns (Quarterly Presentation)

Shareholder returns are estimated to continue at the current pace. 40% of the FCF is equivalent to 50% of the base business. The dividend will now be 8% higher than last year and payable in Q1 2025 at .13 per share, putting the FWD yield at 3.27%. VET hasn't announced how much they plan to dedicate exactly to share repurchases, but going on the graph above it will likely be between 4–5 million, or $45 million on average next year.

VET plans on funding the acquisition with an existing credit facility of $1.35 billion, which has a max capacity of $2.5 billion. VET entered into a C$250 million loan agreement in regard to the acquisitions, as well as a $300 million bridge loan. This will mature in May 2028. At the 2025 year-end, VET anticipates having $1.8 billion in net debts following the completion of the deal. Net debt/FFO would be sub 1.5x and the company plans to maintain a high liquidity level, which is over $500 million now.

In short, investors can expect a significant asset value boost following the acquisition, along with even better outlooks for future dividend increases. The deal is funded with an existing credit facility, and it looks to not put the balance sheet in an overleveraged position. The market didn't react well to the news and the stock dropped, but now 3 weeks later the stock has more than recovered and those who bought on the announcement have likely made a return of potentially 20% already.

Company Hedging Strategy Summarized

Like a lot of companies that work with commodities, like oil and gas in the case of VET, employing a hedging strategy can be a key strategy to keep profits above peers during lower periods of the market cycle. I will cover some of the hedges that VET has done but focus more on the AECO since that is where VET is doing most of their hedging at the moment.

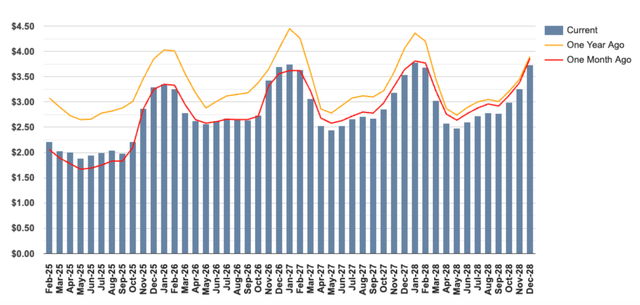

Figure 6 - AECO Hedges (VET Hedge Report)

Above is an image depicting the last updated AECO hedges that VET holds, released for October 2023. Throughout 2025–2026, the weighted average for puts is C$3.17 and for calls, it is C$4.22. As with a hedging strategy like this, the strategy is to lock in a range in which one believes said commodity will trade within. The range between put and call is roughly 33%. This is quite a wide range to hedge in but should provide VET with relatively more reliable outlooks for their Canadian gas operations. In the latest earnings call, Dion Hatcher mentioned the company hedged 30% of AECO production in 2023, and I would suspect VET will remain at relatively the same percentage going forward.

"As a reminder, we also hedged 30% of our AECO exposure this year at prices much higher than what we deserve this summer."

Figure 7 - AECO Price Forecast (GasAlberta.com)

Future prices for AECO are displayed above, taken from GasAlberta. The yellow line displays forecasts from a year ago and the red line forecasts made one month ago. The blue staples are the current ones. We can see that a year ago the market anticipated higher gas prices and slightly more volatility too, but this seems to have stabilized now.

Peer Group Comparison And Fair Value Assessment

Compared to the energy sector, VET trades at a steep discount. Based on FWD earnings, the company has a 4.32x multiple whilst the sector has a 12.35x multiple, a 65% discount. Based on book value, investors can buy VET at a 22% discount to book value, 0.78x multiple. For context, the energy sector has an average FWD P/B of 1.6. One reason for this could be the market anticipation that VET will have less opportunity to build up a stronger asset base because of the recent C$1 billion deal to acquire Westbrick. Another reason could be the negative ROA that VET has. It's negative 13.67% whilst the sector average is 5.09%. This could indicate that VET has a poor asset base and that it can't turn a consistent profit, something I don't agree with.

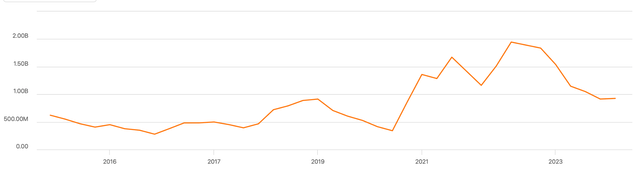

Figure 8 - 10Y EBITDA (Seeking Alpha)

Looking at the 10Y chart for EBITDA which measures core earnings performance, a key figure to look at when assessing a commodity-driven business like VET, it shows a consistent profit. Does this imply that VET can't turn a profit on its assets? Quite the opposite, I think. ROA measures net income whilst I am looking at EBITDA, and I want to make the point here that it's more worthwhile to look at EBITDA. Depreciation and amortization make up a large cost for all companies like VET, which is why the ROA is weighed down here. I think the market is looking too much at these measurements and not the EBITDA, which has undoubtedly remained incredibly strong over the past 10 years and will continue to climb even higher because of the addition of Westbrick.

Let's take a look at two peers to VET, HighPeak Energy (HPK) and Kosmos Energy (KOS), both of which as relatively the same market cap as VET. Both companies work with natural gas but have their operations in different areas, KOS with some in the Gulf of Mexico whilst HPK has most in the Permian Basin.

FWD P/E Non-GAAP (2025)

HPK - 16.13

KOS - 6.73

VET - 4.32

TTM P/B (2025)

HPK - 1.14

KOS - 1.45

VET - 0.74

TTM EBITDA Margin

HPK - 79.2%

KOS - 65.5%

VET - 68.8%

From these metrics, I can spot that HPK has incredibly strong EBITDA margins, perhaps therefore the higher FWD P/E multiple. Higher margins should equal higher valuations. Despite that, VET has the second-best EBITDA margins at 68.8% but is still at a steep discount to these peers. Both HPK and KOS trade above their book value. HPK trades at a premium to the sector based on FWD Non-GAAP earnings, and KOS at a slight discount of 45.5%.

I think one case for the lower multiple to VET could be its more diversified asset base. I've covered how nearly half of all production is international. The two peers have a more concentrated asset base instead. For VET, this means more price fluctuations because it's exposed to more markets. But I think this is where the appeal of VET is found. Because it has operations in Europe, it managed to capture and benefit from the high gas prices over the past 3 years. It meant that in 2022 VET generated nearly $2 billion in EBITDA.

I see the fair value of VET being based on its book value, which should be 1 right now. Because of this, I see a minimum upside here of 22% to get to that level. In terms of a stock price, that would equal $12.6. Depending on the developments of the Westbrick acquisition, I could see VET being able to over time grow its book value by 2 - 3%. Combined with capital returns to shareholders being roughly 5 - 6% (3% dividend yield + 2% outstanding shares repurchased) annually, we are looking at a solid yearly return here, therefore my Strong Buy case.

Risks To The Thesis

Primary risks to VET include significant volatility in commodity prices. I've covered how the company has a solid hedging strategy for AECO with a 33% rough interval for the hedge. However, if local gas prices slump, VET will see the impact, especially since it is investing in a region that is exposed to these prices.

A follow-up risk from volatile commodity prices is poor EBITDA generation, which would potentially put pressure on capital returns to shareholders as debt repayments need to be attended to before capital can be returned. VET should be able to continue maintaining its current 40% distribution of FFO nonetheless. I mention this risk for the fact the EBITDA is so crucial to watch here. As long as the core business remains profitable, I am not that worried VET will fail to pay back debts or give back to shareholders.

Conclusion

VET stock prices have been in a slump since May of last year. It saw a drop following the announcement of acquiring Westbrick in the Alberta basin. It has since rebounded as those who bought after the drop have made a nice 20% return in just 3 weeks. I remain bullish on the company going forward, especially after analyzing the impact that Westbrick will have on the portfolio. The stock trades at a 22% discount based on book value. Based on the quality of the business and how the energy market is looking right now, I feel confident putting a 12-month target price of $12.6 for VET and rating it a Strong Buy.