Welcome to the August 2018 edition of the lithium miner news. What a busy month! This past month saw China spot price falls accelerate (but no panic) and plenty of great lithium market and company news. Perhaps the biggest news was SQM exiting their partnership with LAC at Cauchari, only to be replaced by Ganfeng Lithium. Other notable news was all the major lithium producers reporting outstanding revenue and profit growth results. Added to this we welcomed three new lithium spodumene producers from Australia.

Lithium spot and contract price news

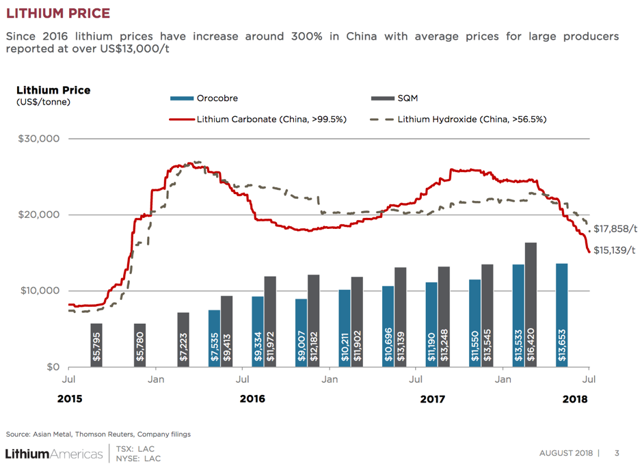

During August, 99.5% lithium carbonate China spot prices were down 9.77%.Global Lithium Carbonate Equivalent contract prices are around USD 16,000/tonne, and are up about 20% on 2017 prices. SQM reported their average LCE contract price in Q2 2018 were "slightly higher" than their Q1 figure of US$16,400/MT. As expected in 2018 we have seen China spot prices decline from lofty levels and global contract prices rise. SQM state: "Prices could be slightly lower in the second half of the year but significantly higher than average prices reported last year."

Lithium China Spot prices

Source: Lithium Americas August 2018 company presentation

On August 20 Benchmark Minerals wrote: "China’s lithium price decline is not the full picture to an industry surging. The growing separation between China and rest of the world lithium prices was not sustainable and slower than anticipated demand growth in H1 2018, coupled with increased domestic production (in particular from Qinghai’s lithium brines) finally brought an end to the excessive price premiums in the Chinese market by Q2 2018. The subsequent decline in Chinese lithium carbonate prices, which slipped over 9% to $14,500/tonne for technical grade material and $16,500/tonne for battery-grade material in July 2018, is expected to continue over the coming weeks. It’s critical to note this is not the case for the rest of the world or for lithium hydroxide."