Another excellent article for the AAL board.

https://seekingalpha.com/article/4148738-orocobre-advantage-drill-results-continue-expand-cauchari-basin?uprof=46&isDirectRoadblock=true

Joint Venture partners Orocobre (OTC:OTCPK:OROCF) and Advantage Lithium (OTC:OTCQX:AVLIF) are starting off the year on a positive note as both companies continue to position themselves deeper within the global lithium supply chain. I continue to reiterate my suggestion to buy shares in Advantage Lithium and Orocobre, especially on share-price weakness.

Orocobre shocked the market in mid-January when the company announced that Toyota Tsusho (OTC:OTCPK:TYHOF), the strategic souring arm for Toyota Motors, has acquired a 15% stake in the company in consideration for A$282 million at $7.50/ share. In addition, the company completed a $63 million raise through a 1 for 20 entitlement offer at A$6.55 and expects to raise another $100 million in debt with the aid of Toyota Tsusho. This raise will likely come from Mizuho Corporate Bank (NYSE:MFG) who provided the construction credit facility for Olaroz stage 1. The capital will be used to expand production from 17,500 T LCE per year to 42,000 T LCE per year, which positions Orocobre as a potential leader in global lithium production. In addition, the Joint Venture reported that plans to construct a lithium-hydroxide facility in Japan are well underway with a CAPEX of $60-70 million. It is expected that Japanese government incentives and bank debt will support the majority of the capital requirements, with only $6 million drawn from Orocobre’s treasury.

Surprisingly, shares in Advantage Lithium did not get the response that I had expected. In my opinion, the lack of movement in Advantage Lithium’s share price is unwarranted. The reality of the situation is that a strategic sourcing arm of the largest global automotive company has acquired a 15% stake in Orocobre, above market value, which directly links Orocobre to Advantage to Toyota Tsusho as they are all heavily invested in the holding of marketable securities and ownership positions at Cauchari. More importantly, the Toyota investment is a major win for the Olaroz-Cauchari basin as it clearly illustrates that the region is developing as a global hotspot for lithium investment. The investment from Toyota Tsusho also comes on the heels of Toyota Motors (NYSE:TM) making headlines with its release of electric vehicles in China and around the world.

January update from the Joint Venture

In January 2018, the Joint Venture provided an update on drill results from holes NW CAU15, NW CAU17, SE CAU08, SE CAU11, CAU12, and SE CAU13. The results continued to expand on information previously reported by the company between September and December 2017. The Northwest drilling intersected extensive sandy sediments, thereby confirming that the zone contains relatively highly drainable porosity and permeability. The company’s results from the Southeast section indicate that they continue to make progress on expanding the current resource as drilling and pumping testing continues. For these reasons, the ongoing exploration campaign started the year on a positive note.

Orocobre CEO, Richard Seville explains the Olaroz pumping station to investors (November 2017)

February update from the Joint Venture

In February the Joint Venture provided the market with additional positive results in both the Northwest and Southeast zones of the Cauchari property. Drilling activity at SE CAU11 intersected sediments comprising halite, clay, and some sand 405 meters at depth. At 480 meters in depth, an important interval of sand-dominated material was encountered allowing for the identification of a deeper sand unit that the company’s exploration team had been searching for. In short, this means that the company has identified an extension to the resource that will now allow for a potentially significant increase in the natural resource estimate. Pumping tests conducted at CAU11 show a sustainable a flow rate of 19 liters per second for 48 hours, which is encouraging for future brine production. Collectively, the drill results for SE CAU11 show the potential to expand on the current resource at depth along with excellent flow and lithium grade. In addition, brine from these holes continues to show low magnesium-to-lithium ratios averaging 2.6 to 1 and 2.4 to 1, which is in line with results from other drilling activity in the region by other operators.

Piping network used to transport brine at Olaroz. (November 2017)

Piping network used to transport brine at Olaroz. (November 2017)

Results from SE-CAU08 were also delivered to the market, showing further advancements in the exploration campaign. Based on the drill results, SECAU08 intersected a series of clay, silt, and some sand and halite, with significantly less halite than what was recognized in SE-CAU09 and SE-CAU10. The drilling activity did not encounter the same deeper sand units as recognized in the region. Due to the physical limitations of the drill equipment it is unclear if the sand units end at SE-CAU08 or whether instead they continue to extend at depth.

Going forward, the company continues to drill holes NW-CAU17 and NW-CAU18 in the Northwest section, which are expected to be completed in February. In the Southeast section, core holes have advanced to depths around 400 meters, indicating that additional results will delivered to the market in the near term.

Impact to shareholders

The impact to unlocking shareholder value at Cauchari is exceptionally positive. The drill results in the Southeast section indicate that the resource could be expanded well beyond the 500,000 T LCE resource estimates produced by Orocobre. It is my opinion that the Northwest section was the most strategic in delivering upside potential to the project, so for the Southeast zone to produce additional positive results is very encouraging. It is in my opinion that the targeted 2.5 million T LCE resource estimate target could now be on the low side. There could be a build up between 3 to 3.5 million T LCE between the Southeast and Northwest zone as additional drill results emerge.

In 2017, Chinese investment group Nextview acquired Toronto-based Lithium X (OTC:OTCPK:LIXXF), which is actively developing its flagship project, the Sal de los Angeles Project in the Argentina region of the Lithium Triangle. The purchase price was $265million of $2.61 per share, which gave Nextview access to a mineral resource exceeding 2 million tons of lithium carbonate equivalent. This translates into roughly $132 T LCE in ground or 1% of market price for lithium carbonate. This does not take into account the company’s cash on hand, marketable securities, interests in other projects, or byproduct credits that will be recognized at Sal de los Angeles. This information is important for lithium investors as it is the most recent and significant acquisition in the junior lithium exploration space, providing a clear valuation to companies in the exploration stage.

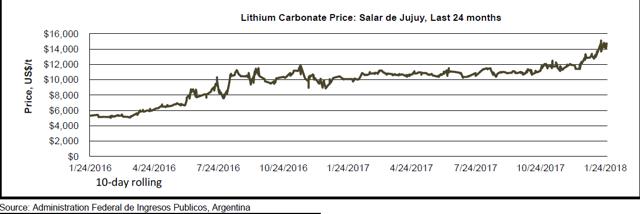

It is important to note that $130/ T LCE, is now less than 1% of market value for lithium carbonate, as prices have increased in Q1 2018 to around $15,500 T LCE as illustrated in the graph below “Lithium Carbonate Price; Salar de Jujuy, Last 24 months”

In a base-case scenario, the 2.5 m T LCE deposit that Advantage Lithium is targeting at Cauchari translates into $325 million in value, with 75% to Advantage and 25% to Orocobre. Based on Advantage Lithium’s outstanding float of around 140million shares, the value per share is approximately $1.80 / share, representing a significant upside from current trading price levels. Based on ongoing drilling results there is indication of a significantly larger deposit, which could amount to 3.5 million T estimate. This size deposit significantly changes the game for Advantage Lithium as it would represent $455 million in value to the Joint Venture with 75% Advantage Lithium and 25% Orocobre, quickly placing Advantage Lithium in the range of $2.50 - $3.00 per share. Although it is still too early to determine if the resource estimate will return higher than the target of 2.5million, there is good indication that something significant is sitting at depth in Cauchari.

Author's note: If you enjoyed this article than be sure to receive future material by clicking on the "Follow" tab at the top of this page or on my profile.

Disclosure: I am/we are long OROCF, AVLIF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.