Hit home. Source mining.com

Copper appears to have begun its rally early, with 2024 initially expected to witness a surplus of the red metal, but instead prices are notching fresh months-long highs with stocks at record lows and major operations facing disruptions.

Earlier this week, the price surged to its highest point since late-January last year, when it tipped over US$9,400 ($14,404) per tonne. This week it climbed to US$9,450 per tonne. While it has come back slightly, several industry watchers see further gains on the horizon.

Since bottoming at around US$7,077 per tonne in mid-July 2022, the copper price has surged nearly 34%.

Typically following Chinese New Year is a period of restocking by the world’s largest consumer of copper, China. But that has not come to pass, according to Sam Spring, President and CEO of New South Wales-focused explorer Kincora Copper (ASX:KCC).

“You’ve seen a real squeeze start to happen and the copper price reflecting that,” Spring tells Mining.com.au.

“This year was generally regarded to be a surplus but it appears we’re in a deficit, and that deficit really has been driven by a few supply shocks.”

Record-low inventories and significant production forecast downgrades have hastened copper’s rally.

Headquartered in Vancouver, Canada and dual-listed on the ASX and TSX Venture exchanges, Kincora owns an extensive package of tenements in New South Wales’ Macquarie Arc.

“I think that is a pretty interesting scenario that has really been driven by the supply side and that is one reason we have always been bullish on the copper price – as long as demand continues to grow at that 2-3% per annum, which seems like a pretty stable baseline, it’s hard to see where in the medium term the supply side is able to meet that sort of demand,” Spring tells this news service.

“I think we’re just starting to see that structural secular longer term story starting to unfold probably 12 months ahead of schedule.”

One of the major disruptions to supply was the government-ordered shutdown of one of the world’s largest copper mines, Cobra Panama, which contributed over 330,000t of production in 2023.

Asia-Pacific based investment firm Tribeca Investment Partners says in its recent ‘Global Natural Resources Strategy Insights’ publication the mine represents 1.7% of world refined copper supply, and Tribeca expects it will be idle until at least mid-2025.

This has been further exacerbated by lower-than-expected 2024 guidance from other major producers, including Rio Tinto (ASX:RIO) and Anglo American, respectively 150,000t and 160,000t lower than consensus estimates, according to Tribeca.

“This was on the back of a number of supply issues in 2023,” Ben Cleary, Portfolio Manager for Tribreca says in the Strategy Insights brief. “ The total effects of recent curtailments have been to take more than 5% of global production offline. This has given rise to significant supply-demand deficits of approximately 4%.

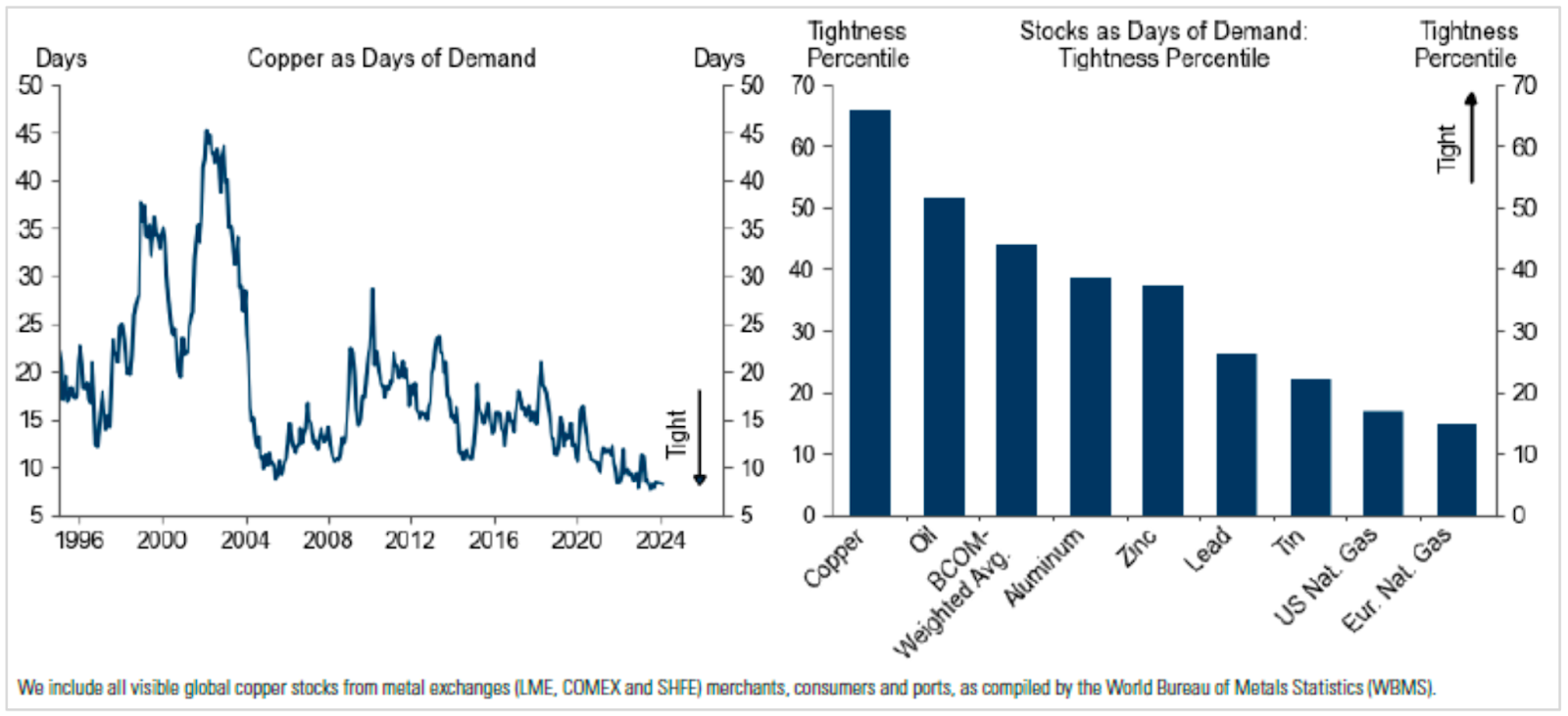

Also notable is that global copper stocks are at 30-year lows in terms of days of demand. This highlights upside risk to the commodity price given the increased pricing power it affords producers.”

Sources: EIA, IEA, WBMS, Goldman Sachs Global Investment Research

Data from geospatial intelligence firm Earth-i’s SAVANT real-time copper monitoring index also shows a significant decline in global copper smelting capacity in the first quarter of 2024.

An average of 12.5% of global copper smelter capacity – covering 90% of the world total – was inactive in the first quarter of 2024, up from a more usual 9.3% and 8.7% in the same period of 2023 and 2022 respectively, Earth-i says.

That number was also higher than the already elevated 11.5% average registered in the first two months of the year.

Earth-i attributed the increased inactivity largely to developments in top producing nation China, where inactivity rose to an average of 8.5%, compared with 4.1% in Q1 2023 and 4% in Q1 2022. In March alone, inactivity in China was around 9% while it stood at 17.7% on a global basis.

Cleary notes falling copper treatment charges point to smelter shutdowns.

“Copper treatment charges (TCs) (the fees paid by miners to smelters for processing copper concentrate) are near all-time lows at US$10/t,” he says.

“TCs are a key driver of smelter revenue, along with refined copper prices, by-products, and physical premiums in some regions. Falling TCs usually reflect tight mined supply or a glut of smelting capacity. Both of these are likely to be drivers at the moment.”

Analysts from the likes of Bank of America and Citi predict prices will average over US$10,000/t by the end of this year and US$12,000/t by 2026. Tribeca, meanwhile, sees the copper price hitting US$15,000/t in the coming years.

Copper is one of the fund’s largest exposures with over 40% net long positions to various global producers and developers.

“Copper is materially supply constrained, has record-low inventories and is in the early stages of significant demand growth from electrification,” Tribeca says.

https://mining.com.au/copper-on-us15000-trajectory-as-supply-disruptions-hit-home/