Property vs IVANA COAM can earn up to a 50% indirect interest in the Property by spending up to

US$35M and

advancing Ivana through to completion of a feasibility study,

and to drill key exploration targets located in adjacent areas of the Property.

Following a positive feasibility study, COAM can earn an additional 1% upon its decision to fund the capital cost of the Project and further 29% interest by funding 100% of the estimated capital costs to achieve commercial production.

Wango - key exploration

targets located in adjacent areas.

not identifying key adjacent areas --------> diminishes value.

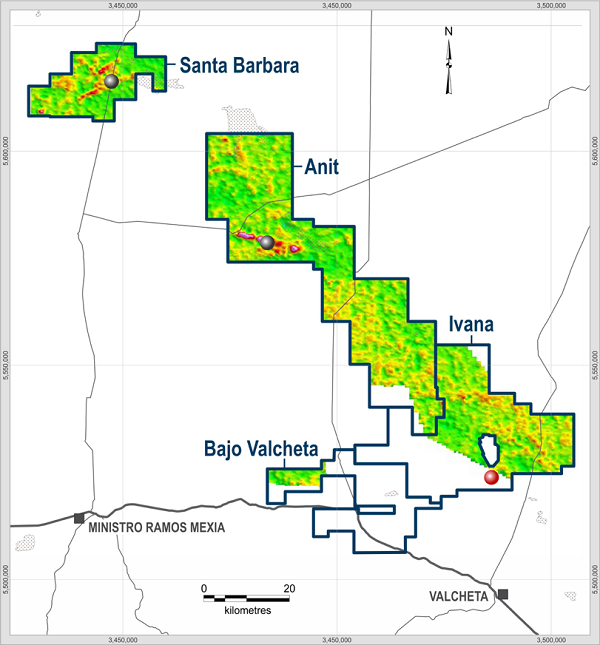

How ? . if my satellite maps are in the zone - #2 image shows a 10 km zone

close to Ivana where i placed an X to represent Ivana. Adjacent could point to

target zone upper left corner image # 2

Goes from indirect interest to, parties enter into a shareholders' agreement (

phase 3 )

To.... ( phase 4 ) MCA and JVCO enter into a call option agreement which, among other things, will provide JVCO with

the right to conduct exploration and drilling activities on certain prospective areas and exploration targets (the "

Exploration Targets") and a five year option to acquire the Exploration Targets (the "

Call Option") at a price determined by reference to the amount and type of resources and reserves in respect of such properties at the time of exercise of the Call Option

Wango - From Ivana to adjacent targets to ---------------> certain prospective areas.

If i read into this.... would it not mean all of Armarillo ?

What would make more impact on share price and value for shareholders ?

Simply stating -----------> COAM is interested in

all 3 zones of Armarillo. By doing so.... creates more value upfront for shareholders vs just Ivana as focal and

mystery unnamed target zones.

Why is this important ? Read the 2012 tech report.

Anit and Santa Barbara have just as good grades.

Secondly ? If junior is carried by COAM.... what will the junior do to value of JV if it ventures off

exploring mord lands ? -------------> dilutes the JVCO. More shares out.

Solution ? Revise the JVCO..... 51% - 60% maximum for COAM.

Mention all 3 targets.... Ivana, Anit, Santa Barbara - positively bolsters present value

Then... spinout all of Armarillo ( 3 target zones mentioned above )

= preserves value for shareholders. 1:1 sponco. Or.... mention all of Armarillo 3 claims.

COAM buys all 3. Or..... COAM buys all of Armarillo...? COAM dishes out $15 million to bring Ivana to fesability and Anit and Santa Sana to pea.

Then full buyout of all Armarillo.

Where else is there uranium at surface - world over ? Vantage junior and shareholders.

Then junior can go off exploring two new claims.

Fresh share structure. --------------------------------------------------------------------------------------------------------

If satellite maps show

yellow and green mineralization at surface...

AND IF..... it's uranium.

Junior should've expanded all 3 targets since 2019.

Simple bore holes at surface. ( not hard to do )

Why only... Ivana ?

JVCO PRESS

https://ceo.ca/@newswire/blue-sky-uranium-announces-transaction-to-advance-the

An opinion.

Buy out is best..... vs 4 phase.