Among the 37 US states that have legalized the distribution of medicinal marijuana, 19 allow the recreational use of cannabis. Transaction volume is rising at American dispensaries, which has proven a powerful driver of revenue growth for multi-state operators (MSOs). However, it also presents an increased need for cannabis reform at the federal level.

Measures to eliminate limits on cannabis firms' access to federally chartered financial institutions have already passed the House of Representatives, but Senate Democrats want to introduce more encompassing and far-reaching legislation now that support from Republican politicians and conservative voters is steadily rising. Political pressure is likely to ratchet up further, following the cannabis industry's concerted effort to expand their lobbying abilities in Congress.

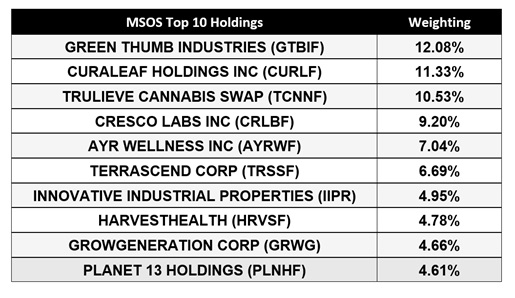

Related ETF & Stocks: AdvisorShares Pure US Cannabis ETF (MSOS), Curaleaf Holdings, Inc. (CURLF), Green Thumb Industries Inc. (GTBIF)

Connecticut is the Latest State to Cut the Red Tape

Thirty-seven states now allow medical marijuana and, with this month's addition of Connecticut, nineteen also allow recreational use. Connecticut could generate $500 million to $600 million in combined recreational and medical sales by the end of 2023, according to Cantor Fitzgerald analyst Pablo Zuanic. The state's municipal sales tax on such purchases is expected to be 3%.

Zuanic has named US MSOs Curaleaf Holdings and Green Thumb Industries as key beneficiaries of the new law. Of the four cultivation licenses issued in the state, Curaleaf and Green Thumb own one each. Out of 18 existing medical dispensaries currently operating in Connecticut, Curaleaf has four while Green Thumb owns two. Per Barron's, those dispensaries will become hybrid stores that sell recreational cannabis as well, once remaining regulatory hurdles are cleared in 2022.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on June 30.

Overall US transaction volume from new consumers has supported unexpectedly high growth rates early this year. As Marijuana Business Daily notes, mature state markets such as Colorado, Oregon and Washington state are averaging 26% YoY sales growth in 2021. Meanwhile, newer states like Illinois, Massachusetts, Michigan and Pennsylvania are averaging 136%. A key part of that robust data may be driven by growing accessibility to legal cannabis sales, as the total number of retail stores and dispensaries in the United States grew nearly 21% through 2020, according to Cannabiz Media.

Political Pressure on Federal Prohibition Grows

While the US Democratic Party undoubtedly has the most support for cannabis reform within its ranks, there has been a notable shift among American conservatives toward the easing of restrictions on cannabis. As Politico notes, Montana, South Dakota and Mississippi have all recently passed legalization referendums.

As MRP noted last month, Alabama's Republican governor, Kay Ivey, signaled her willingness to sign legislation that would embrace medical marijuana in the state. On May 17, Ivey followed through on that position, making distribution of cannabis products legal for medical purposes in oral tablet, capsule or tincture; gel, oil, cream or other topical preparations; suppository; transdermal patch; nebulizer; or liquid oil for administration using an inhaler.

Survey data from Pew Research released in April found that, overall, 91% of American adults now believe marijuana should be legal for either medical or recreational use. That statistic lines up with opinion of Texans, as nearly nine out of ten voters in the traditional Republican stronghold say marijuana should be legal in some form, with just 13% still backing prohibition, according to a new poll. As Marijuana Moment highlights, a collective 60% said they support legalizing cannabis for any purpose, up significantly from just 42% a decade ago.

The Secure And Fair Enforcement Banking Act (SAFE) passed the US House of Representatives in April. MRP has followed the development of this banking reform bill since its initial introduction back in 2019, noting that SAFE would allow banks to legally handle the proceeds from a state-legal cannabis business by prohibiting certain federal banking regulators from taking adverse actions against banks and credit unions that provide services to "cannabis-related legitimate businesses." In particular, the Act would direct the Financial Institutions Examination Council and federal banking regulators to develop additional guidance for banks and credit unions, as well as relax requirements on financial institutions to file Suspicious Activity Reports ("SARs") for transactions with cannabis-related legitimate businesses.

The current bill, now referred to as SAFE 2.0, carries a significant amount of bipartisan support, having passed the House by a final recorded vote of 321-101 last month. That included 106 Republicans (exactly half of the 212 Republicans in the chamber) voting for approval. SAFE's re-introduction in the Senate on March 23 came by way of Senators Jeff Merkley (D-OR) and Steve Daines (R-MT), along with 6 of 29 additional co-sponsors being Republicans.

Growing dissent toward the federal cannabis prohibition has even reached the judicial branch of government as Justice Clarence Thomas, perhaps the most conservative justice on the bench, denounced the government's inconsistent approach to marijuana policy this week. In a written statement regarding the court's decision on Gonzales v. Raich in 2005, Justice Thomas noted his belief that "A prohibition on interstate use or cultivation of marijuana may no longer be necessary or proper to support the federal government's piecemeal approach. . .the federal government's current approach is a half-in, half-out regime that simultaneously tolerates and forbids local use of marijuana."

Thomas was among the three dissenters in the 16 year old case, which upheld federal laws making marijuana possession illegal, but his recent statement on the suit came unexpectedly. Thomas and fellow Justice Stephen Breyer (who joined the majority at the time) are the only two remaining on the bench from the Gonzales v. Raich decision, suggesting that a similar case could play out very differently if it were to reach the nation's highest court.

Corporate Cannabis Forms the Newest Lobbying Operation

Along with the SAFE Banking Act, the MORE Act (Marijuana Opportunity Reinvestment and Expungement Act), is also in the mix, representing legislation that would deschedule cannabis from the Controlled Substances Act and enact various criminal and social justice reforms, including expungement of prior marijuana convictions. As JDSupra notes, this bill was passed by the House of Representatives in 2019 and reintroduced by Rep. Jerry Nadler (D-CA) on May 28 of this year.

Though Senate Majority Leader Chuck Schumer (D-NY) supports the full legalization of cannabis, he has also noted that piecemeal legislation like SAFE and MORE does not go far enough on its own. Schumer has promised to present a more comprehensive bill this year that deals more thoroughly in making sure "the communities that have been most affected by these draconian laws get the benefits here. And we want to make sure that there are reinvestment initiatives and it doesn't all go to the big shots, that smaller businesses and minority businesses get a chance to be involved once marijuana is legalized."

Political pressure is undoubtedly ratcheting up on lawmakers to move forward on cannabis measures, and a lot of that pressure is now speaking politicians' native tongue: the language of lobbying.

A decade ago, a handful of pro-pot companies and interest groups spent less than a half million dollars on federal lobbying. By 2019, there were dozens of supporters, and they spent more than $8 million to hire about 130 registered lobbyists, according to a Wall Street Journal analysis of public lobbying disclosures.

Cannabis has certainly begun to go corporate as WSJ reports Curaleaf recently hired Edward Conklin, who formerly oversaw state and federal government affairs for McDonald's Corp., as its lead lobbyist. Meanwhile, Bloomberg Law notes the Drug Policy Alliance has ramped up its own lobbying effort by bringing in the high-powered law and lobbying firm Arent Fox.

Speaking of corporate attitudes on cannabis reform, ecommerce behemoth Amazon.com Inc. struck their own blow against the current federal framework, recently endorsing the cannabis sector by saying it will support the federal legalization of marijuana. Along with eliminating testing for cannabis metabolites as part of its drug screening program for positions not regulated by the US Department of Transportation, a statement from the country's second largest employer said earlier this month that "our public policy team will be actively supporting The Marijuana Opportunity and Reinvestment and Expungement Act of 2021 (MORE Act) — federal legislation that would legalize marijuana at the federal level, expunge criminal records and invest in impacted communities".

Theme Alert

At this point, the US has likely crossed the point at which legalization and proliferation of marijuana is no longer a matter of "if", but "when." Due to that shift, as well a global changing of attitudes toward deregulation of the cannabis industry, MRP expects activity and revenues in the space to continue ramping up in the coming months and years.

In that same vein, we recently re-calibrated our LONG Cannabis theme to focus in on the US Industry – particularly American MSOs, which may have much greater potential to dominate their domestic market when its full potential is realized. Going forward, we will track this theme with the AdvisorShares Pure US Cannabis ETF (MSOS).

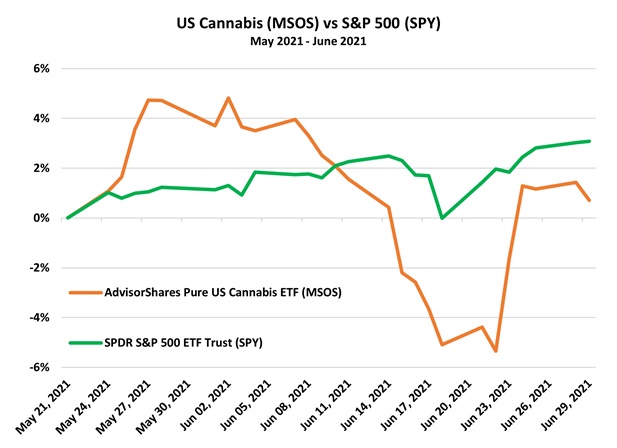

Since we added LONG US Cannabis to our list of themes just over a month ago, the MSOS has returned 1%, slightly underperforming the S&P 500's 3% return over the same period.

Originally published June 30, 2021.