Dear Friends and Investors, |

The anticipation is hanging thick in the air. |

In fact, at any moment tiny Idaho Champion Gold Mines (ITKO.CN; GLDRF.OTC) is going to release drill results that could be among the most impactful in recent memory. |

And the reported drill-core visuals have already yielded some very encouraging signs. |

The good news for potential shareholders is that the market seems to be overlooking this high-stakes development…and thus Idaho Champion shares are still trading near long-term lows.

As you’re about to see, that situation might not last much longer. |

Building Upon A History Of Production |

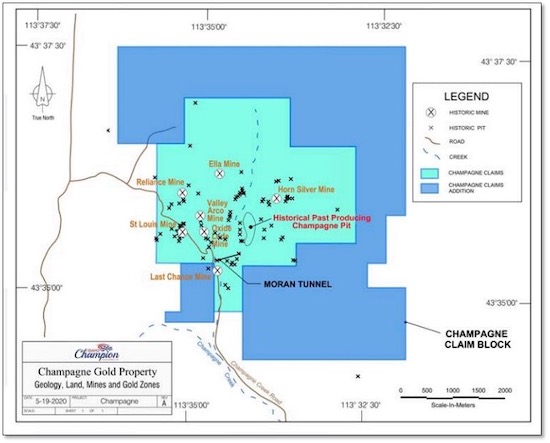

Idaho Champion was initially attracted to its Champagne project in Idaho by its history of open-pit gold-silver production with Bema Gold, and by the possibility that much more mineralization remained to be found. |

But once the company’s geologic team got on site and began surveying the old Bema pits and other historic workings on site…they realized that Champagne had district-scale potential. |

In response, Idaho Champion staked a large area of ground around its original interest.

The newer ground is shown in royal blue in the map below; it surrounds the teal of the original land package. |

|

The company also bought a package of historic data that Kinross owned on the project.

That drilling data showed something interesting; When Bema had looked to add to the resource it was mining at Champagne, it kept its drill holes shallow, only looking for more of the “scoopable” oxide gold-silver near the surface.

In fact, a large number of the holes had been drilled to an arbitrary depth of just 15 meters, or about 50 feet!

When decades-low gold and silver prices eventually shut Champagne down in the ’90s, the project’s true potential at depth remained very underexplored. |

The Massive Anomaly That Could Be The Mother Lode |

Idaho Champion began rectifying that oversight last year with an RC and core drill program to test the areas under and around Bema’s old pits.

This resulted in assays that indicated the mineralization underneath the pit areas was offset by a newly-interpreted fault that cut off the deposit at depth.

Then came the results of an induced polarization survey at Champagne — and the anomaly outlined to the northwest of the pit areas lit up like a Christmas tree. |

| |

As the above 3-D image of the area indicates, there is a massive chargeability anomaly to the northwest of the mined areas (noted by the drill maps drill hole pin marks) at Champagne.

And get this: The anomaly is a whopping two kilometers long and could extend to as much as 600 meters in depth.

And it could well be the source of the near-surface mineralization mined on the project over the years. |

Idaho Champion’s management posits that if Bema had run this IP survey on the project back in the ’90s, it might still be mining here. |

The mounting geological evidence of a major find at Champagne was so compelling that Rob Kell, a geologist with decades of experience, came on site as a consultant last September and eventually signed up as the company’s chief geologist.

Having helped discover and develop major porphyry-style deposits for Anaconda, BHP and Newmont, Kell liked how the data was coming together at Champagne.

Simply put, if a drill program on that massive, buried anomaly hits significant mineralization, it could catapult ITKO’s share price higher.

We won’t have to wait long to find out, because Idaho Champion has completed its drilling…reported very encouraging signs…and is now awaiting the assay results. |

Precisely What They’re Looking For |

Just a few days ago, Idaho Champion announced that they completed their initial drill program, comprising 10 diamond-core drill holes totalling 3,432 meters, on the large geophysical anomaly.

Moreover, they also completed two additional geophysical survey lines, potentially extending the anomaly another 1,000 meters to the north.

But the best news came from the geologists’ analysis of the drill core they were pulling out of the ground…. |

|

| The drill core looks good: This cross section of the third hole drilled on the large geophysical anomaly shows a vein with pyrite and sulfosalt minerals. |

While the company, and the market, are still awaiting the detailed assay results, Idaho Champion’s geological team has already reported that visual analysis of the drill core, as well as instrumental readings, are highly encouraging.

It gets complicated, but it’s best to quote the company itself on these exciting early notes: |

“These holes…encountered intervals of fracture veinlets and narrow veins of pyrite, galena, sphalerite, chalcopyrite, and dark grey sulfosalts that crosscut the volcanic rocks and the porphyry dikes.

“(Drill Hole 3) passed through a more significant vein, possibly the St. Louis Vein at 63 meters depth, which consists of subequal amounts of pyrite and sulfosalts. Deeper parts of the vein systems appear to be zoned towards silver-copper rather than lead-zinc minerals.

“While assays are pending, semi-quantitative analysis by field-portable X-ray fluorescence (XRF) indicated that the veins are enriched in silver, lead, zinc, and copper.” |

Taken together, the company notes that these early holes have outlined a new mineralized corridor covering about 800 meters in strike north-south and 300 meters in width, atop the large anomaly.

This is a large-scale target, to be sure. And the results so far look like just what they’re targeting. |

| |

Yes, this is a drill-hole speculation…because results from the first holes on Idaho Champion’s massive geophysical target are expected at any time.

But backstopping the company is the value of the Champion project at large (where drilling has already confirmed the company’s theory that significant mineralization remains)…and its high-potential Baner project in north-central Idaho (where exploration continues).

For now, of course, all eyes are on the potential monster lurking just to the northwest of the previous mining at Champagne. |

Good drill results here could quickly launch Idaho Champion’s share price, and those results are on the way. |

For those considering a high-potential speculation like this, the time to do your due diligence is now. |