Source: Shutterstock

Source: Shutterstock Over the past year, insiders sold CA$191k worth of Northern Lights Resources Corp. (CSE:NLR) stock at an average price of CA$0.35 per share allowing them to get the most out of their money. After the stock price dropped 40% last week, the company's market value declined by CA$574k, but insiders were able to mitigate their losses.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Northern Lights Resources

Northern Lights Resources Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the insider, Kerem Akbas, sold CA$77k worth of shares at a price of CA$0.36 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is CA$0.06. So it is hard to draw any strong conclusion from it. Kerem Akbas was the only individual insider to sell over the last year.

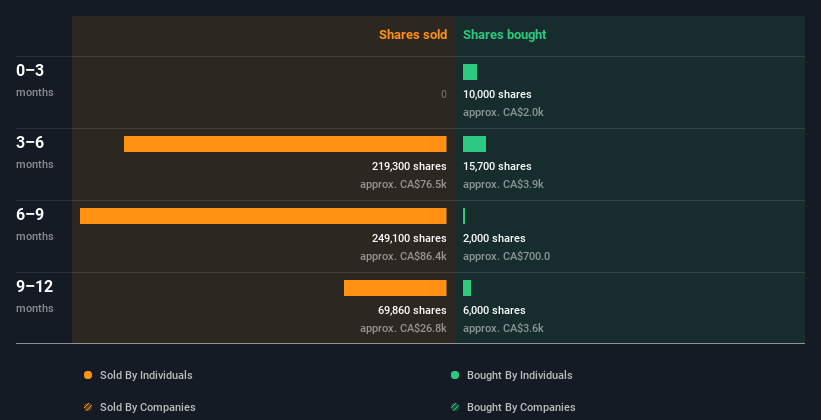

Kerem Akbas sold a total of 538.26k shares over the year at an average price of CA$0.35. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

CNSX:NLR Insider Trading Volume May 27th 2022

CNSX:NLR Insider Trading Volume May 27th 2022 I will like Northern Lights Resources better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Have Northern Lights Resources Insiders Traded Recently?

We've only seen a tiny insider purchase valued at CA$2.0k, in the last three months. So it is hard to draw any conclusion about how insiders are feeling about the stock, from these recent trades.

Does Northern Lights Resources Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Northern Lights Resources insiders own about CA$964k worth of shares (which is 112% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Northern Lights Resources Insider Transactions Indicate?

Insider purchases may have been minimal, in the last three months, but there was no selling at all. The net investment is not enough to encourage us much. It's great to see high levels of insider ownership, but looking back over the last year, we'd need to see more buying to gain confidence from the Northern Lights Resources insider transactions. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To that end, you should learn about the 6 warning signs we've spotted with Northern Lights Resources (including 4 which are potentially serious).

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.