[img]https://[/img]

Pampa Metals’ Large Portfolio of Greenfield Copper/Gold Targets Hosts an Abundance of Opportunity in Chile

It’s common knowledge that copper is king in Chile. The country is the world’s primary supplier of the red metal, producing 5.6 million tonnes in 2021 for more than 25% of the world’s production, and more than double that of the next largest producer, Peru, at 10% of the world’s production.

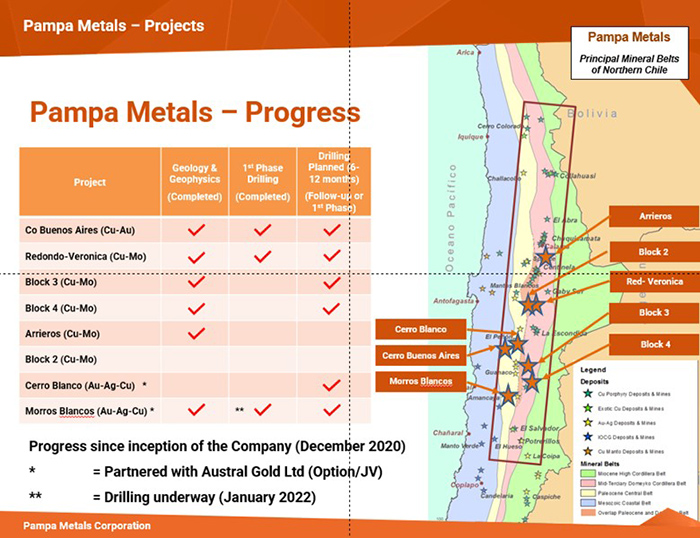

This is abundantly clear to the management of Pampa Metals Corp. (“Pampa” – CSE:PM), launched in December of 2020, which has a portfolio of 8 projects totalling 62,000 hectares in Chile’s prime mineral belts. To put it into perspective that’s, 620 square kilometres, or 85% the size of New York City, including its five boroughs, which totals 778 km2. With its massive land package – one of the largest controlled by a junior explorer in Chile – Pampa is focused on exploring for obscured or buried porphyry systems. These targets have often been overlooked historically because they’ve been obscured by post-mineral, gravel-filled basins, or ‘pampas’ (hence the name ‘Pampa Metals’) where the underlying geology is largely not visible or available for geologic mapping.

Meanwhile its also no secret that with the electrification of the world’s transportation and energy, copper is reaching new highs and entering a widely predicted super cycle. Gold is also reaching recent highs of $2,000 per ounce as inflation kicks in, record global debt accumulates, and conflict in Russia-Ukraine undermines confidence in fiat currencies.

Pampa Metals’ work so far has lead to identifying over 30 mineral targets: “We only started work a year ago on some previously identified targets, as well as some new targets that we generated,” says CEO Paul Gill. “We were hoping to eliminate some of these targets, but we have found most of them to be promising, and we have not eliminated any of the key targets at this point.

“We’ve completed some or all the following programs at five of Pampa’s projects: either drone-flown or ground magnetometry; different types of induced polarisation (IP)surveys; surface sampling where pertinent; trenching on one of our properties; and, perhaps most importantly, detailed geological mapping of available outcrops that has given us a very good geological understanding of our projects and targets. Additionally, we have carried out initial, wide-spaced drill tests of 4 targets at 2 projects. Three of these targets require further drill follow-up. Now its about integrating these different data sets, and at this point we’ve delineated around 10 targets over these 5 core projects. Additionally, an option and joint venture agreement with Austral Gold (“Austral”) giving Austral the right to earn into 2 additional Pampa projects, has resulted in detailed surface exploration work been completed at both projects, and one of several targets is currently being drill tested by Austral.

Outside of Pampa’s wholly-owned portfolio of projects, Pampa has an option to earn into 8 project areas controlled by an artificial intelligence company, VerAI Discoveries (“VerAI” - more on that follows).

“All of this takes a bit of time and effort (and money) to work over, but should we hit any significant mineralization at any one of these targets, Pampa becomes a prime takeover target, and because of the structure of the company, we’d be taking off like a rocket.”

To enhance its opportunities in Chile, Pampa is taking advantage of proprietary artificial intelligence (AI) technologies as an additional target generator. Pampa has engaged in a fortuitus and opportunistic agreement with VerAI Discoveries Inc., a Boston based group, which has accumulated 8 prospective properties encompassing 18,000 ha, with potential targets generated by AI. The VerAI ground is located in similar areas to the real estate held by Pampa. VerAI uses high-resolution geophysical data as the principal data source to generate its targets. With a minimal exploration spend of $500,000 in year one, Pampa has the option to designate 1 or more projects (Designated Project – “DP”) from the VerAI portfolio and can subsequently earn a 51% interest in each DP selected by spending at least US$1 million on each DP over the next 2 years. At 51% on any VerAI property, Pampa can then opt to earn a further 24% (to 75%) by completing a Canadian NI-43-101 compliant Preliminary Economic Assessment (“PEA”) on the property over the next 2 years.

“It’s a win/win relationship in that VerAI has a novel and innovative technological approach to mineral exploration, that when combined with Pampa’s geological expertise and in-country expertise, will allow for efficient and effective follow-up of new, selected targets. We have also allowed VerAI to review limited portions of Pampa’s ground and produce some additional targets.”

As mentioned previously, Pampa has another option and joint venture agreement on two of its 8 core projects with its largest shareholder, Austral Gold. On these properties, the partners are targeting silver and gold. Austral can earn up to 80% in Cerro Blanco and Morris Blanco by completing a bankable feasibility study (BFS) while Pampa maintains a carried 20% interest. Austral is an ideal partner for Pampa to have in the region as Austral is already a successful gold-silver producing company with two mines and a processing plant in northern Chile.

“With the Austral deal, we’re winning either way,” says Gill. “Either Austral finds a gold deposit, and Pampa has 20% clear and we get significant value on that, or Pampa gets the project back and can work on exploring the very real copper potential of these projects.”

While Pampa Metals the company is new, the people involved are no rookies. The team hails from a few of the largest names in mining: CEO Paul Gill: Norsemont Mining in Peru, purchased by Hudbay; Adrian Manger, CPA: former senior executive BHP, including the $US1 billion development of the Spence copper mine in Chile; Timothy Beale, M.Sc.: COO and Director: geologist with BP Minerals, RTZ, Rio Tinto, Hochschild and Anglo American; Ioannis (Yannis) Tsitos: former BHP geophysicist, explorer, deal-maker; Julian Bavin, M.Sc: former Executive at Rio Tinto and geologist at Exeter Resources which sold to Goldcorp.

PM.V stock is tightly held with 43 million shares outstanding with about 25% held by management together with its largest shareholder and JV partner on two projects, Austral Gold. With an enviable land position in the right place, a seasoned team with all the right connections, and fresh targets, the stock is poised to pop as a significant discovery may be just around the corner.

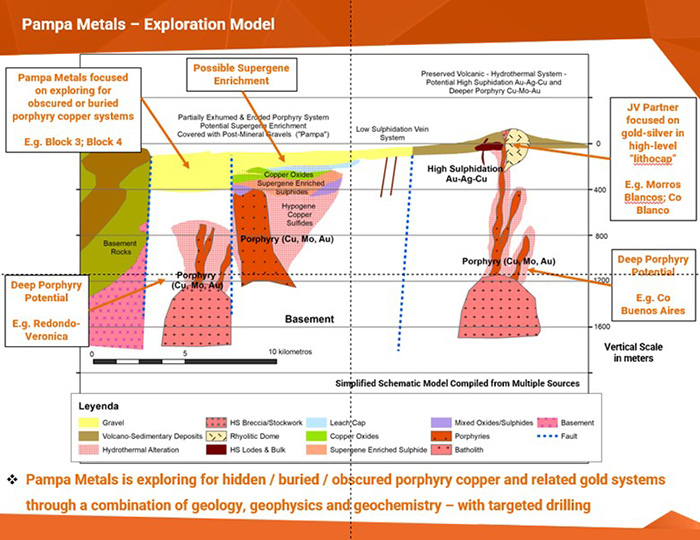

From a geological perspective, Gill and Pampa are targeting porphyry systems in three general settings in northern Chile:

1. Deep porphyry beneath extensive, post-mineral “pampa” deposits, with no surface expression. These can be completely covered under the young, surface gravel and volcanic deposits. Exploration is focused on detailing geological evidence from the surrounding sierras, and geophysical exploration to look through the pampa deposits, followed by drill testing of interesting targets. The Arrieros project, Block 3, parts of Block 4, and parts of Cerro Buenos Aires correspond to this model.

2. Supergene enriched porphyry, beneath extensive, post-mineral “pampa” deposits, with no surface expression. Similar to style 1), but where the porphyry deposit has been partially eroded to mineralised levels prior to the deposition of the young gravel and volcanic “pampas”, and with meteoric processes leaching and enriching copper minerals into a “supergene enrichment blanket”. These supergene enriched deposits can be highly attractive due to the enhanced copper grades. Exploration is similar to style 1), and the same projects mentioned in style 1) could yield such deposits.

3. A largely intact porphyry system where the upper parts of the system are preserved and exposed on a hill or sierra. The upper parts of these systems have good potential for gold and silver deposits, and these deposits are of specific interest to JV partner Austral Gold, at Pampa’s Cerro Blanco and Morros Blancos projects, both subject to the option and JV agreement between Pampa and Austral.

Of course, there are variations on the above themes. Porphyry deposits in Chile are generally copper rich, but also often contain economic amounts of molybdenum and sometimes gold.

In the interest of brevity for the reader, the table and image below provide an outline of the where Pampa’s exploration expenditure has been focused to date.

Pampa completed its maiden drill programs from July to October 2021, which focussed on its Redondo-Veronica and Cerro Buenos Aires properties, targeting large-scale porphyry coppers with a total of 4,000 metres of relatively shallow reverse circulation (RC) drilling. The drilling so far has presented a clear line of site to mineralized porphyry systems at Redondo-Veronica (2 targets), which has deep porphyry potential associated with significant geological and geophysical anomalies. The plan now is to follow-up with deeper core drilling to depths of >>500 metres vertical and beyond.

At Cerro Buenos Aires there are clear indications of a porphyry system at the Cerro Chiquitin target associated with breccias, porphyries and quartz veining. Follow-up drilling will be required using the new vectors to hone-in on the porphyry centre.

“The bulk of the drilling so far has been RC drilling and now it’s time to do some diamond core drilling,” says Gill. “The drilling to date was wide-spaced and reconnaissance in nature, but we believe that results have shown where to follow up with more directed drill testing to find the mineralized cores of these large systems.”

At its Block 4 project, Pampa Metals recently completed a trenching program over the quartz veinlet stockwork and porphyry zone. Follow-up IP surveying and/ or drill testing are being evaluated pending the release of assay results, expected shortly. “We are very excited about this new porphyry discovery – still at the early exploration stage” says Gill.

On a macro level, Chile is prospective for porphyry copper deposits due to the long-lived “subduction zone” between the Pacific and South American tectonic plates, which has created the conditions for injections of magmas that ultimately give rise to these deposits. A similar situation occurs between the Pacific and North American tectonic plates. Chile, however, is almost uniquely blessed with the number, size and grade of these giant deposits, which can occur all the way from British Columbia in Canada, through the western US, and through Mexico, Central America and South America, all the way to Chile. This is a key portion of the often described “Pacific Ring of Fire”. Many of the biggest porphyry copper deposits occur in northern Chile, which is a desert with few towns and cities, and a long tradition of major mining investment with pretty much all the major copper mining companies operating there.”

The company is currently looking to raise additional funds to progress its exploration programs, including further drill testing focused on diamond drilling. “District-scale exploration like this can be capital intensive, that’s why we need further funding and why we’re joint venturing some projects, so we can focus on our highest priorities. What we’re hoping for is to come back with a discovery drill hole that boosts the company and allows us to finance in a significant way. Right now, we need to complete a three-to-five-million-dollar financing to ensure the drill rig is optioned for a full year with one drilling company that will move around to the various properties as things progress.”

Investors can look for a steady flow of news in the coming weeks and months ahead: Block 4 trenching results will be released in early March. Morros Blancos drilling results are expected from our JV partner later in April focused on gold and silver. Pampa has also initiated preliminary exploration on the 8 projects subject to the agreement with VerAI. Of course, results from these programs will guide the future exploration priorities.

“Most companies have only one or two targets on one property, but Pampa has multiple targets on multiple properties and has much more optionality to make a discovery,” says Gill. “Any one of these projects has the potential to yield a significant discovery with a blue sky valuation. We are exploring in elephant country for major deposits. Copper in particular has amazing fundamentals for price support, with precious metals also at near record highs, and Pampa is poised to benefit from the valuation increase associated with a company transitioning from exploration to discovery.”

Legal Disclaimer/Disclosure: The content contained in this article is a paid publication. No information contained within should be construed as investment advice to buy or sell any mentioned securities. The author’s opinion does not necessarily reflect that of FinancialPress.com. Associates of Financial Press may own shares of the companies mentioned in this article. A licensed financial advisor should be consulted prior to making any investment decision.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of one thousand nine hundred dollars for Pampa Metals Corp. advertising from FinancialPress. There may be 3rd parties who may have shares of Pampa Metals Corp. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.