Strong Economics Supported by $23.1B EBITDA over a 14-year Mine Life in Canada's Mining Friendly Jurisdiction of Quebec

VANCOUVER, BC / ACCESSWIRE / February 7, 2024 /Temas Resources Corp. ("Temas" or the "Company") (CSE:TMAS) is pleased to report positive results of an Independent Technical Report and Preliminary Economic Assessment ("PEA") for the wholly-owned La Blache Ti-V-Fe Project located in the Cote Nord region of Quebec.

Project economics were estimated assuming market demand supports constant prices of USD $2,200/tonne ("t") for titanium dioxide (97.8% purity TiO2), USD $14,200/t for vanadium pentoxide (V205) and USD $125/t iron oxide (Fe2O3). The PEA to be filed on SEDAR will present a complete description and list of assumptions. Capital and operating cost estimates were prepared based on current and expected long-term pricing assumptions and to a PEA level +/- 35% level of accuracy.

Tim Fernback, President of Temas Resources comments, "We are extremely pleased with the strong economics presented in this PEA on the La Blache Titanium-Vanadium-Iron Project in Quebec. Titanium has been trading well above our assumptions of USD $2,200 per tonne for over three years at over USD $3,000 per tonne since August 2022, and we believe this trend will continue due to the increasing demand for TiO2, major global supply coming to end of life, and lack of both brownfield expansion and new projects coming online in North America. The PEA further increases our confidence in the Project and showcases our proprietary, environmentally friendly extraction technology. With a current market cap of CAD $5M, I am excited to engage with all our stakeholders to unlock the value of this highly robust Project as we advance the asset forward."

PEA HIGHLIGHTS

| Parameter | Units | Value |

| Post-tax Net Present Value (NPV8) | CAD $ Billion | 6.8 |

| Post-tax IRR | % | 55.1 |

| Initial capital cost (Capex) (including 15 % contingency) | CAD $ Billion | 1.2 |

| Capex payback from commercial production | Months | 25 |

| Pre-production Development | Years | 2 |

| Life of Mine ("LOM") | Years | 14 |

| Gross Project Revenue | CAD $ Billion | 37.2 |

| Net Revenue (Revenue less transport offsite) | CAD $ Billion | 31.8 |

| EBITDA (Operating Profit) | CAD $ Billion | 23.1 |

| Net Project Cash Flow (pre-tax) | CAD $ Billion | 21.8 |

| Net Project Cash Flow (post-tax) | CAD $ Billion | 15.9 |

| Average Annual Gross Revenue | CAD $ Billion | 2.7 |

| LOM average annual EBITDA | CAD $ Billion | 1.6 |

| Net operating margin | % | 62.0 |

| Average Post-tax Operating Cost per tonne of concentrate | CAD $/t | 278.04 |

| Weighted average revenue per tonne of product (net shipping) | CAD $/t | 633.49 |

| LOM Sustaining Capital (including 15% contingency) | CAD $ Billion | 0.6 |

| LOM average gross production of concentrate | Million tpa | 3.58 |

| Profitability Index (NPV8 / Initial Capex) Post Tax | Ratio | 5.71 |

| LOM Capital Intensity Index (Initial Capex/ROM tonnage) | CAD $ / tpd capacity | 49,801 |

| LOM average C1 cost / tonne run-of-mine production (incl. royalty, no tax) | CAD $/t | 79.24 |

| LOM average AISC / tonne run-of-mine production | CAD $/t | 85.05 |

| LOM average C1 cost / tonne concentrate (incl. royalty, no tax) | CAD $/t | 170.23 |

| LOM average AISC / tonne concentrate | CAD $/t | 182.72 |

| Average annual production TiO2 | Ktpa | 660 |

| LOM mining production (Mill Feed) | Mt | 108 |

| LOM mining production (Mill Feed + Waste) | Mt | 486 |

| LOM average grade TiO2 | % | 12.2 |

| LOM average grade TiO2 Equivalents | % | 16.8 |

Note:

All values in this news release are reported in CAD unless otherwise noted.

Assumed prices for LOM: USD $2,200/t TiO2, USD $14,200/t V2O5, USD $125/t Fe2O3.

Units expressed in metric tonnes.

MINERAL RESOURCES

The basis for the PEA is the Mineral Resource Estimate ("MRE") prepared by Samer Hmoud, (P.Geo. PGO), currently holding Special Authorization from OGQ, under the supervision of QP Jacques Dumouchel, P.Geo., OGQ.

The updated Mineral Resource Statement generated for La Blache is as follows:

| | Units | Semi-Massive Oxide | Massive Oxide | TOTAL |

| Resource Category | | Inferred | Inferred | Inferred |

| Resource | Mt | 99.7 | 108.8 | 208.5 |

| TiO2 | % | 6.3 | 17.8 | 12.3 |

| V2O5 | % | 0.1 | 0.3 | 0.2 |

| Fe2O3 | % | 22.0 | 59.4 | 41.5 |

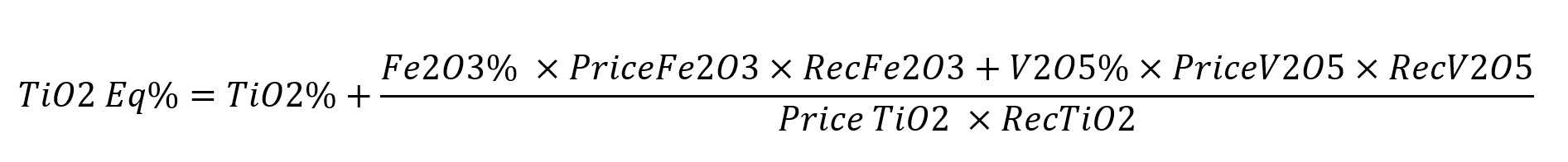

| TiO2 Eq | % | 8.3 | 24.3 | 16.7 |

| Contained TiO2 | Mt | 6.2 | 19.4 | 25.6 |

| Contained V2O5 | Mt | 0.1 | 0.3 | 0.4 |

| Contained Fe2O3 | Mt | 21.9 | 64.6 | 86.5 |

Reported at a cut-off grade of 4.9 % TiO2, at a minimum mining block size of 10x10x10 meters ("m"), considering 3.51:1 strip ratio, bench height 5m, pit slope of 45° processing and selling technical parameters and costs benchmark against similar projects and a selling price of USD $2,200/t (TiO2), USD $14,200/t (V2O5) and USD $125/t (Fe2O3). All figures are rounded to reflect the relative accuracy of the estimates. Mineral Resources are not Mineral Reserves and do not have a demonstrated economic viability. The contained TiO2 represents estimated contained metal in the ground and has not been adjusted for metallurgical recovery and may have discrepancies due to rounding.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

SUMMARY OF PRELIMINARY ECONOMIC ASSESSMENT

Project economics were estimated assuming a constant price of USD $2,200/t for titanium dioxide (97.8% purity), USD $14,200/t for vanadium pentoxide and USD $125/t iron oxide. The PEA will present a complete description and list of assumptions. Capital and operating cost estimates were prepared based on current and expected long-term pricing assumptions and to a PEA level +/- 35% level of accuracy.

In summary, the Project has a post-tax LOM net project cashflow (pre-finance) of CAD $15.9 billion which returns a pre-tax NPV8 of CAD $9.4 billion, post-tax NPV8 of CAD $6.8 billion and an IRR of 55.1%. The following table presents the summary LOM cash flow resulting from the Technical Economic Model.

| Metric | CAD $ Millions | USD $ Millions |

| Gross Revenue | 37,223 | 27,573 |

| Deductions (Off-Site Shipping) | 5,454 | 4,040 |

| Net Revenue | 31,769 | 23,532 |

| Operating Costs | 8,076 | 5,982 |

| Total LoM Project Capital excluding Closure | 1,638 | 1,214 |

| Start Up Project Capital excluding Working Capital | 1,012 | 750 |

| Start Up Project Capital including Working Capital | 1,195 | 885 |

| Start Up Plant and Infrastructure Capex | 261 | 193 |

| Start Up Mine and Equipment Capex | 186 | 138 |

| Start Up Capitalized Pre-stripping | 296 | 219 |

| Sustaining Capital | 626 | 464 |

| Owners and Indirects excluding Working Capital | 339 | 251 |

| Pre-Production Contingency | 113 | 84 |

| Sustaining Capex Contingency | 130 | 96 |

| Working Capital | 183 | 135 |

| Closure Cost | 300 | 222 |

| Project Free Cashflow (EBITDA) | 23,067 | 17,087 |

| Corporation Tax (Canada and Quebec) | 5,868 | 4,346 |

| Royalties | 461 | 342 |

| Net Project Cashflow (post-tax, undiscounted) | 15,887 | 11,768 |

| NPV8 (pre-tax, discounted 8%) | 9,454 | 7,003 |

| NPV8 (post-tax, discounted 8%) | 6,830 | 5,059 |

Exchange Rate: 1.35 CAD : 1.00 USD

SENSITIVITIES

The following table shows the pre-tax and post-tax NPV8 at varying discount rates.

The base case discount rate of 8% returns a pre-tax NPV8 of CAD $9.4 billion (USD $7.0 billion) and post-tax NPV8 CAD $6.8 billion (USD $5.0 billion) post-tax.

| Discount Rate | Pre-Tax NPV (CAD $ Million) | Post-Tax NPV (CAD $ Million) |

| 5% | $12,726 | $9,241 |

| 8% (base case) | $9,454 | $6,830 |

| 10% | $7,825 | $5,629 |

| 12% | $6,519 | $4,667 |

| 15% | $5,012 | $3,556 |

| | | |

| Discount Rate | Pre-Tax NPV (USD $ Million) | Post-Tax NPV (USD $ Million) |

| 5% | $9,427 | $6,845 |

| 8% (base case) | $7,003 | $5,059 |

| 10% | $5,796 | $4,170 |

| 12% | $4,829 | $3,457 |

| 15% | $3,713 | $2,634 |

Exchange Rate: 1.35 CAD : 1.00 USD

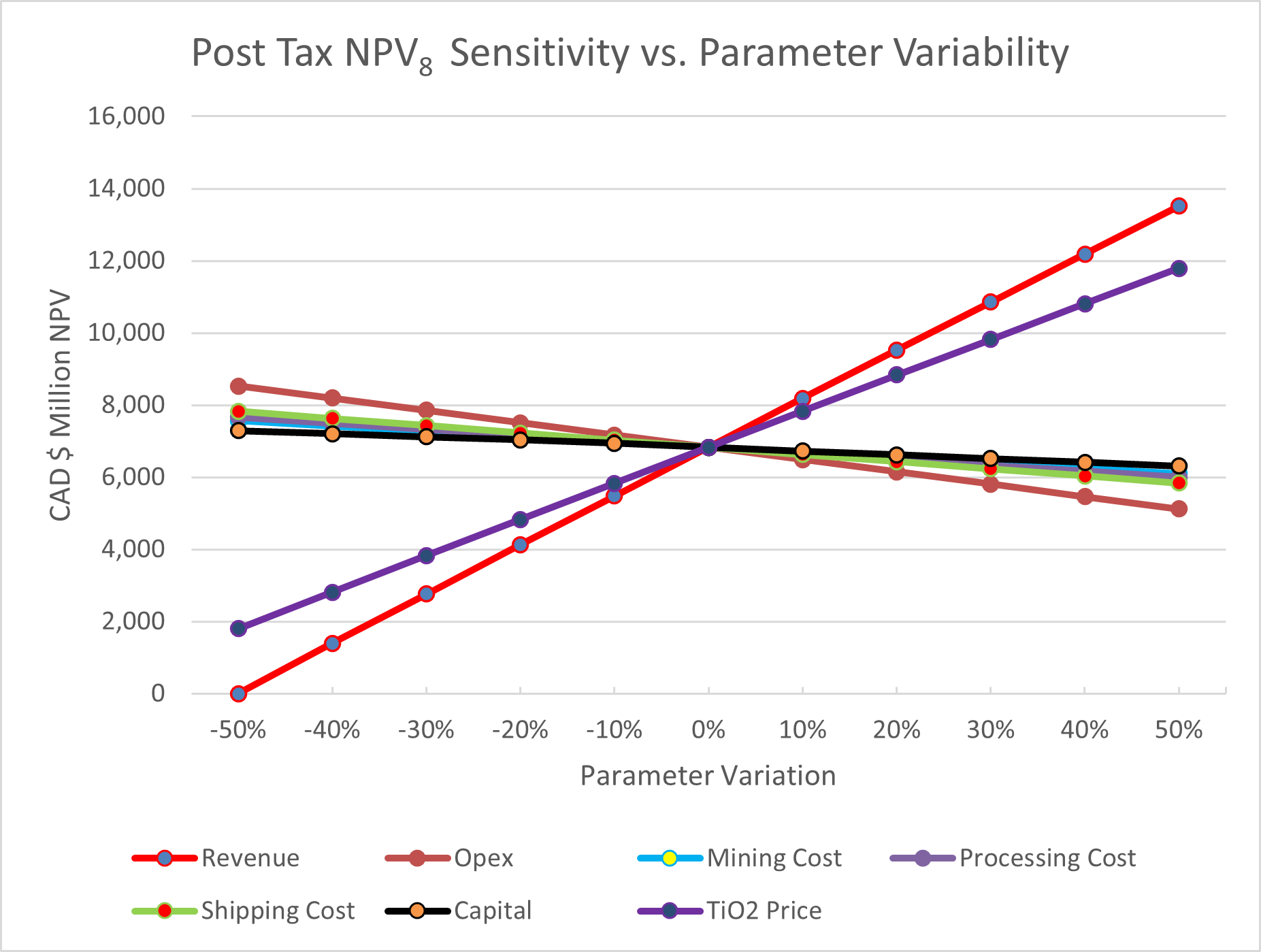

The following table and figure show the effect on the post-tax NPV8 at varying revenue, Opex, Capex, and material price levels (from -50% to +50%):

| Sensitivities: Post Tax NPV8 (8% discount rate) |

| (CAD $ 000,000) |

| Variable Parameter | -50% | -40% | -30% | -20% | -10% | 0% | 10% | 20% | 30% | 40% | 50% |

| Revenue (All Metals) | 0 | 1,393 | 2,762 | 4,125 | 5,478 | 6,830 | 8,182 | 9,524 | 10,854 | 12,185 | 13,515 |

| Opex (All) | 8,524 | 8,191 | 7,851 | 7,511 | 7,170 | 6,830 | 6,490 | 6,149 | 5,809 | 5,464 | 5,116 |

| Mining Cost | 7,559 | 7,413 | 7,267 | 7,121 | 6,976 | 6,830 | 6,684 | 6,539 | 6,393 | 6,247 | 6,101 |

| Processing Cost | 7,664 | 7,497 | 7,331 | 7,164 | 6,997 | 6,830 | 6,663 | 6,496 | 6,329 | 6,163 | 5,996 |

| Shipping Cost | 7,824 | 7,626 | 7,427 | 7,228 | 7,029 | 6,830 | 6,631 | 6,432 | 6,233 | 6,034 | 5,836 |

| Capital (All) | 7,289 | 7,204 | 7,118 | 7,033 | 6,936 | 6,830 | 6,725 | 6,620 | 6,516 | 6,411 | 6,306 |

| TiO2 Price Only | 1,799 | 2,812 | 3,823 | 4,827 | 5,829 | 6,830 | 7,831 | 8,833 | 9,818 | 10,803 | 11,788 |

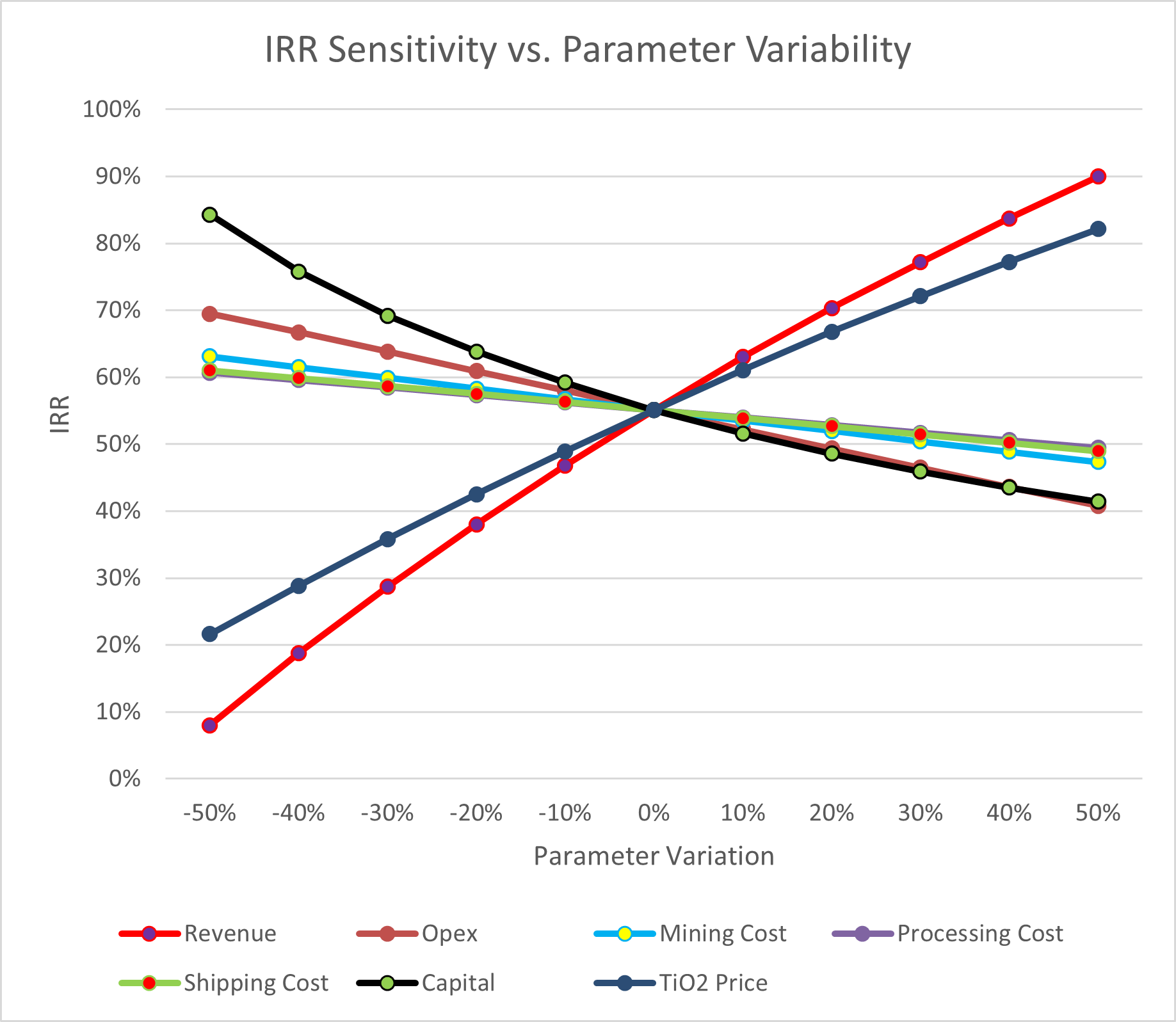

The following table and figure illustrate the projected Post-tax Internal rate of Return ("IRR") sensitivity of the Project to Operating Cost and Capital Cost variations.

| Sensitivities: Post Tax IRR |

| |

| Variable Parameter | -50% | -40% | -30% | -20% | -10% | 0% | 10% | 20% | 30% | 40% | 50% |

| Revenue (All Metals) | 8% | 19% | 29% | 38% | 47% | 55% | 63% | 70% | 77% | 84% | 90% |

| Opex (All) | 69% | 67% | 64% | 61% | 58% | 55% | 52% | 49% | 46% | 44% | 41% |

| Mining Cost | 63% | 62% | 60% | 58% | 57% | 55% | 54% | 52% | 50% | 49% | 47% |

| Processing Cost | 61% | 60% | 58% | 57% | 56% | 55% | 54% | 53% | 52% | 51% | 49% |

| Shipping Cost | 61% | 60% | 59% | 58% | 56% | 55% | 54% | 53% | 51% | 50% | 49% |

| Capital (All) | 84% | 76% | 69% | 64% | 59% | 55% | 52% | 49% | 46% | 44% | 41% |

| TiO2 Price | 22% | 29% | 36% | 42% | 49% | 55% | 61% | 67% | 72% | 77% | 82% |

MINING

The geometry and depth of the mineralization identified at La Blache is ideal for an open pit operation with semi-massive mineralization recoverable in what has previously been treated as pre-strip waste rock. It is envisaged that mining will be through conventional means in a large single open-pit operation featuring:

- 45° pit slope walls with 5m benches and a 3.51:1 strip ratio

- A single large waste dump near to the pit.

- A single large tailings storage facility near to the waste dump.

The conceptual mine plan underlying the preliminary economic assessment envisages an annual Run of Mine ("ROM") average of 7.7 million tonnes (LOM total of 107.7 million tonnes) to produce a total of approximately 9.2 million tonnes of TiO2, 40.6 million tonnes of Fe2O3, and 152 thousand tonnes of V2O5 over the 14-year LOM.

PROCESSING

All ROM production is to be delivered to the processing facility where it will be crushed and then ground to ~210 microns and then run through Temas's proprietary, low temperature, chloride leach process which will be applied to extract the elements of interest.

Temas conducted a pilot plant metallurgical test program in 2022 (see July 28, 2022 news release), which demonstrated the operational potential of the technology. The recovery grades and content defined by this pilot plant program are used to define the operational expectations at site and the team that conducted the work (Process Research Ortech) assisted in the site design. The process flowsheet consists of crushing, grinding, two-stage leaching in mixed chloride lixiviant, solvent extraction, followed by precipitation and calcination to obtain a high purity TiO2 product.

The iron-rich liquor separated early in the process can be recovered by pyrohydrolysis, where the chloride leachate is recovered and returned to the process. In a similar fashion, the V2O5 is removed as a byproduct using solvent extraction during the finishing stages of the TiO2 extraction process. The performance of the metals in both the pilot plant and previous studies were used to form the design and performance expectations in the PEA

CAPITAL and OPERATING COSTS

A breakdown of the capital and operating costs used in the economic analysis are presented in the tables below.

Project Capital Costs over Pre-Production and LOM

| Project Capital | CAD $ Million | USD $ Million |

| Capital Expenditures (excluding sustaining) | 1,312 | 972 |

| Pre-Production Capital (excludes closure and reclamation) | 1,195 | 885 |

| Direct Capital Expenditures | 744 | 551 |

| Processing Plant | 95 | 70 |

| Infrastructure | 166 | 123 |

| Mobile Equipment | 186 | 138 |

| Capitalized Waste Movement | 296 | 219 |

| Owners and Indirects excluding Working Capital | 156 | 115 |

| Working Capital | 183 | 135 |

| Pre-Production Contingency | 113 | 84 |

| Sustaining Capex Contingency | 130 | 96 |

| Closure and Rehabilitation | 300 | 222 |

| Total Sustaining Capital Costs | 626 | 464 |

| Contingency Sustaining CAPEX | 130 | 96 |

| Total All CAPITAL | 1,938 | 1,436 |

Unit Operating Costs

| Cost Category | Units | CAD $ | USD $ |

| Mining | $/t mined | 6.75 | 5.00 |

| Mining (accounts for strip ratio of 3.51) | $/t feed | 30.46 | 22.56 |

| Processing | $/t feed | 40.50 | 30.00 |

| G&A Cost | $/t feed | 6.75 | 5.00 |

| Shipping Cost | $/t feed | 50.63 | 37.50 |

| Shipping Cost | $/t concentrate | 108.76 | 80.56 |

| Royalty (2%) | $/t feed | 4.28 | 3.17 |

| Tax | $/t feed | 54.46 | 40.34 |

Unit Costs per tonne Run of Mine mill feed processed

(Capex, Opex, Tax, Royalty) | $/t feed | 143.20 | 106.08 |

Unit Costs per tonne Run of Mine mill feed processed

(Capex, Opex, Tax, Royalty, Shipping ) | $/t feed | 187.08 | 138.58 |

Unit Costs per tonne of concentrate production

(Capex, Opex, Tax, Royalty, shipping) | $/t concentrate | 401.90 | 297.71 |

KEY CONCLUSIONS

Exploration activities undertaken to date, in conjunction with the results of previous exploratory works, have outlined significant mineralization which, in the opinion of the Authors, justifies further activities. Studies should be undertaken in order to assess the potential of project development and, ultimately, mine construction.

The PEA reports an Inferred Mineral Resource Estimate for the Project which consists of both semi-massive oxide and massive oxide material, for a total MRE of 208.5 Mt with an average grade of 12.3% TiO2.

The conceptual LOM plan in the PEA includes the mining and processing of both semi-massive oxide and massive oxide material for a total of 107.7 Mt with an average grade of 12.2% TiO2

The report shows the potential of the Project by demonstrating a post-tax NPV8for the Project of CAD $6.8 billion and an IRR of 55.1%. It should be noted that there is a significant amount of future work to be undertaken in order to mitigate the risks before entering the mine construction phase. The authors of this PEA recommended appropriate actions and activities needed to properly assess and address these associated risks.

A future work program will be discussed to define the necessary studies towards the Pre-Feasibility Study ("PFS") stage, Feasibility Study ("FS") stage and ultimately, the mine construction phase in accordance with Quebec regulatory requirements standards and with community engagement and consultation.

SUMMARY OF PRELIMINARY ECONOMIC ASSESSMENT

The PEA was prepared independently by ERM, under the supervision of QP Nigel Fung, P.Eng. (PEO); and the MRE under the supervision of Jacques Dumouchel, P.Geo (OGQ).

The PEA was prepared in accordance with the requirements of National Instrument 43-101 and is based on the Mineral Resource Estimate for La Blache with an effective date of February 7, 2024, (see "Mineral Resource" above).

CAUTIONARY NOTE

The PEA summarized in this news release is considered preliminary in nature, contains numerous assumptions and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will be realized. No Mineral Reserves have been estimated for La Blache. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are that part of the Mineral Resource for which quantity and grade, or quality are estimated based on limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred Mineral Resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Mineral Resources are captured within an optimized mine plan (within the constraints of a PEA) and meet the test of reasonable prospects for economic extraction.

The effective date of the PEA is February 7, 2024, and a technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") in support of the PEA will be filed on SEDAR within 45 days of this news release.

QUALIFIED PERSONS

Nigel Fung, P. Eng is a Qualified Person as defined by NI 43-101, he is independent and has reviewed the technical information of the PEA that forms the basis for this news release and has approved the disclosure herein.

Jacques Dumouchel, P. Geo registered with the OGQ, is the Qualified Person as defined by NI 43-101 for the Mineral Resource Estimate and is independent of the Company. He has reviewed the technical information that forms the basis for this news release and has approved the disclosure herein.

Rory Kutluoglu, P. Geo is a Qualified Person as defined by NI 43-101 and has reviewed and approved the technical information contained within this press release.

On behalf of the Board of Directors,

Tim Fernback, President & CEO

About Temas Resources

Temas Resources Corp. (CSE: TMAS) (OTCQB: TMASF) is focused on the advanced La Blache and Lac Brule Iron-Titanium-Vanadium projects in Quebec. The critical metals the Company is exploring for are key to our national mineral independence. Additionally, the Company invests in and works to apply its green mineral recovery technologies across its mining portfolio to reduce the environmental impact and carbon footprint of metal extraction through advanced processing and patented leaching technologies.

All public filings for the Company can be found on the SEDAR+ website www.sedarplus.ca. For more information about the Company, please visit www.temasresources.com.

For further information or investor relations inquiries:

Tim Fernback

President and CEO

tfernback@shaw.ca

or

KIN Communications Inc.

Tel: 604-684-6730

tmas@kincommunications.com

Cautionary Note Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "ForwardLooking Statements" within the meaning of applicable securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forwardlooking statements or information. These forward-looking statements or information relate to, among other things: the exploration, development, and production at the Company's mineral projects; the use of proceeds from the Financing; and acceleration of the Warrants.

Forwardlooking statements and forwardlooking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of public health pandemics; costs of exploration and development; the estimated costs of development of exploration projects; the Company's ability to operate in a safe and effective manner.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forwardlooking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the speculative nature of exploration and development; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forwardlooking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forwardlooking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE: Temas Resources Corp.

View the original

press release on accesswire.com