It's no secret that ISIS and other terrorist groups are wreaking havoc in the Middle East and are responsible for terrorist attacks around the world. While many countries have pitched in to fight these groups through military action in Syria and Iraq, one of the best ways to try to stop them is through cutting off their sources of funding. Oil smuggling is one of the leading sources of illicit funds for terrorist groups in the Middle East, given their proximity and access to the resource and the fact that oil is highly fungible. Since oil is hard to track, it is a favorite tool of not only terrorists, but other criminal organizations which extract black market revenues through tax evasion and subsidy abuse. Through their illicit activities, these criminals also damage the environment when they add adulterants to fuel.

SICPA Security Solutions SA is a private billion-dollar Swiss company that provides secured identification, traceability and authentication solutions and services to governments, central banks, high-security printers and industry. Best known as the company that protects the majority of the world's banknotes, it has decided to enter into the fuel marking industry through the acquisition of Global Fluids International [GFI] late in 2015. GFI's Petromark is the most advanced and fully integrated marking, mixing and tracing system for hydrocarbons, lubricants and bio fuels for governments and the oil industry. GFI was purchased by SICPA from a microcap Canadian publicly traded company called Eurocontrol Technics Group Inc. (OTC:EUCTF) (EUO.V). Rather than an outright buyout, the transaction is more like a partnership as EUO receives a guaranteed earn out payment for the next six years and its subsidiary Xenemetrix has exclusive rights to sell the hardware to support GFI's Petromark business during that time.

I believe that this arrangement and the fact that EUO trades at a discount to the present value of the minimum guaranteed cash flow from this sale transaction leads to an outstanding investment opportunity. Fuel marking is an under-the-radar industry with tremendous growth potential as it promises to increase the tax revenue, decrease crime and clean up emissions of every country that enacts such a program. This industry up until now has been home to a very small group of private companies. Eurocontrol Technics Group offers risk-tolerant investors a chance to invest in this growth opportunity at nano-cap prices while also providing a safety net of a balance sheet that would be the envy of any company in the $10 to $20 million market cap range.

In order to understand the EUO investment thesis, one must understand the fuel smuggling problem and the tracking solution.

How do terrorists and criminal elements extract funds from oil?

As mentioned above, oil smuggling is a favorite for criminal elements as oil is hard to track and easy to replace. Extraction of illicit profits through oil can happen in two ways - tax evasion and subsidy abuse. Both directly impact government finances as well as the various societal problems that come with it.

The most common form of tax evasion occurs when fuels for motorized vehicles such as gasoline or diesel are mixed with other non-taxed petroleum then sold at the pump. The consumer pays the fully taxed price but the government collects only part of the tax while the person implementing the scheme keeps the difference. Fuel that has been stolen is very easily "laundered" using this method as unlike money which can be traced by serial numbers, once the stolen petroleum is mixed in with the legitimate stuff, it can no longer be traced.

Tax evasion is also high when neighboring countries have significantly different rates of taxes on fuel. Criminals will smuggle in petroleum from the low-tax country into the high-tax country and sell it at the post-tax price. Consumers exhibit this type of behavior, legally, all the time in border towns. For instance, gas prices in the Niagara region are always a few cents cheaper than the rest of the Province of Ontario because residents can cross the border and get cheaper New York State gasoline if this wasn't the case. The variance is just low enough to discourage people from making the effort of crossing the border just to fill up their tanks. If the regular "Joe" has an incentive to save a few dollars on a personal tank of gas by doing this, imagine the incentive of criminals and terrorists to do this on a large scale across borders of various countries in order to collect millions of dollars in the scheme.

Governments subsidize fuels for certain purposes, such as heating the home, as part of their social service to their citizens. Upon a subsidy, the criminals will exploit the price difference that takes place between the subsidized and unsubsidized fuels. Again, this can take place across borders, where government money for subsidized fuels for its citizens ends up in the hands of the smuggler and the fuels end up in the neighboring country.

The environment also becomes a victim of these illicit acts. For instance, if one of the schemes is to add subsidized kerosene used for heating into diesel or if waste by-product is added, this will result in vehicles emitting more pollutants into the atmosphere with no way to trace it back to the perpetrator.

The loss of tax revenue due to fuel smuggling can be significant, especially for small developing nations in need of that revenue. For instance, Algeria alone was losing $1.3 billion in tax revenue annually back in 2013 while the Philippines is currently losing an estimated $750 million annually. It impacts developed nations as well as over $4 billion in tax revenue was lost across Europe in 2013, including nearly $1 billion in Poland, $1.7 billion in the United Kingdom and 600 million Euros in Greece, along with lost profits for refineries across the continent.

Why SICPA chose GFI's covert PetromarkTM system for attacking the fuel fraud problem

Outside of catching a criminal trying to smuggle fuel across a border at checkpoint, the only way one is going to be able to spot fuel fraud is if the petroleum is marked in some way to give it a "fingerprint". Fuel marked for different purposes has traditionally been marked through a colored dye. The problem with this technique is that it can be easily spotted and either imitated or removed by the people who are involved in the illicit trade.

Advanced fuel marking technologies are based on invisible markers and even if criminals are able to detect them, they are either too hard or too costly to try to remove or imitate. But the most effective marking process is one that is completely covert throughout the full supply chain. The criminals are unaware of its existence, so they get caught in the act of fuel fraud.

The Soreq Nuclear Research Center in Israel developed the Petromark technology, which eventually became the intellectual property of EUO's former subsidiary GFI. At the start of the supply chain, fuel meant for a certain purpose, say, as gasoline or diesel for motorized vehicles, is covertly marked by an invisible marker, say, at 4 parts per million. Detectors which are provided by EUO's subsidiary Xenemetrix are then used to do spot checks at points of distribution, for instance, at a gas station. If the detector reads that the marker is down to 3 parts per million, the gasoline has been diluted by 25% with some other kind of adulterant at some point along the supply chain and the authorities are able to have a more focused investigation into who is tampering with the fuel.

When it comes to marking technologies that are more advanced than dyes, there are not a lot of choices out there. SGS Group is the largest fuel marking program operator and it uses technology from Authentix. Tracerco, a subsidiary of Johnson Matthey, also operates a program in Brazil. What sets Petromark apart from the other two is that it is the only technology that is ISO 17025 accredited, meeting the highest standards for production of testing and calibration results while the full final forensic result is immediately available in the field where the test is conducted.

In December 2014, SICPA approached EUO with interest in the company's GFI and Xenemetrix subsidiaries. Between that time and August 2015 when the deal was first announced, SICPA did extensive due diligence on the technology to ensure that it worked as needed while the two sides proposed a number of potential transactions. SICPA is a billion dollar private company with business connections at high levels of government while Eurocontrol Technics traded at less than $10 million in market cap at the time of negotiations. The fact that EUO was able to come to the table as an equal partner shows just how good this technology is. Fuel marking is not an industry in which the average investor will become an expert overnight. But one can surmise by the actions of SICPA, a global leader in security technologies, that GFI is truly the most advanced and accurate system of the few available for fuel marking.

The cash flow generated by the deal already provides solid basis for an investment into EUO

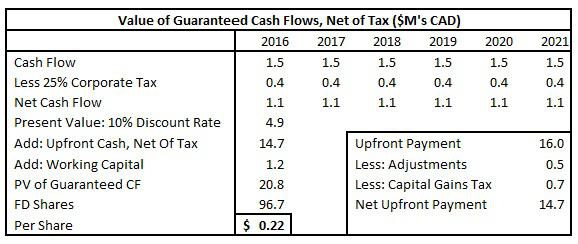

EUO receives the following guaranteed minimum payment schedule as part of its agreement with SICPA for the sale of GFI (all figures in Canadian dollars):

Cash consideration payable to the Company by SICPA on closing of $16 million (less the $250,000 deposit received by the Company and $286,000 in transaction payments, and assuming that, on closing, GFI has positive working capital of $1,000,000), subject to a working capital adjustment.

Post-closing earn-out payments equal to 5% of the net revenues earned by GFI from contracts entered into by it following the execution of the Purchase Agreement and during the period ending six years from the closing of the transaction, with a minimum guaranteed of $1.5 million per year for the six years earn-out period (total payment of at least $9,000,000).

Additional post-closing payments equal to 5% of the net revenues earned by GFI from contracts signed during the fourth through sixth years following closing paid until the third anniversary of such contracts.

The cash flow portion of this deal is easy to model. EUO received $15.5 million ($16M less the two deductions) in upfront cash and will receive six years of a guaranteed minimum earn-out payment of $1.5 million each year. EUO had a $10.2 million accumulated deficit as of Q3 2015. Assuming the first $10.2 million of the upfront payment is protected from taxation, I estimate that the Company will incur $0.7 million ($16M less $10.2M multiplied by a 12.5% tax rate) in capital gains taxes on the sale and $0.4 million in corporate tax at a rate of 25% each year on the $1.5 million earn-out payment:

Because these cash flows are guaranteed from a billion dollar company, I believe using a low discount rate of 10% is appropriate for this part of the model. The present value of the cash portion of this deal is $19.6 million. Adding in EUO's working capital of $1.2 million leads to a $20.8 million present value of cash/working capital at the corporate level, or about $0.22 per share when using a fully diluted share count of 96.7 million.

These numbers are subject to working capital and intra-company eliminations, but given that EUO trades at around $0.17 per share, I believe that there is enough of a cushion to confidently state that the stock is trading at a significant discount to cash.

The market for PetromarkTM and resulting cash flows for SICPA and EUO

The investment thesis on EUO is already made just from its strong cash position, however, EUO management led by CEO Bruce Rowlands has stated that the biggest upside from this deal comes from the exclusive partnership developed with SICPA. Mr. Rowlands believes that earn-out payments will far exceed the $1.5 million annual minimum over the life of the nine year agreement. Xenemetrix continues to have exclusive rights to sell the detectors to GFI as before, except now GFI is expected to grow exponentially as it is backed by a well-connected heavyweight in the global security industry.

Potentially every government in the world would be interested in Petromark, particularly as SICPA has already developed relationships with high ranking government officials through its tax reconciliation programs on alcohol and tobacco and its bank note security ink businesses.

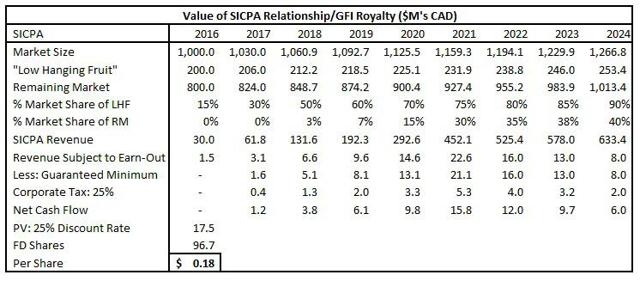

Prior to the sale of GFI, EUO had about a $7 million revenue run rate between GFI and Xenemetrix based on contracts with three small countries - Uganda, Tanzania and Albania - which did not include the logistics portion of the marking process. These three countries combine for just 0.1% of the world's total oil consumption so I believe that the market size for fuel marking will be in the billions when including logistics. Upon discussion with Mr. Rowlands, he is of the view that the global market is reasonably at least $1 billion USD annually with "low hanging fruit" (countries that are easy target markets for Petromark due to high levels of corruption/crime) to be $200 million USD annually. I have used this market size estimate as a baseline for SICPA's revenue potential and have added a 3% annual growth rate. The chart below is still presented in Canadian Dollars even though the contracts signed will very likely be in U.S. Dollars. Although the USD is close to a 40% premium over the CAD right now, the volatility of the currency and oil markets has led me to assume a long term exchange rate at par. This conservative assumption simplifies the model and provides more upside to my price target for those who wish to consider exchange rate differences.

Authentix and Tracerco, as mentioned above, are the only two competitors that offer an advanced marking system. As shown through the ISO certifications and through SICPA's due diligence, Petromark appears to be the superior technology. Combining that technology with SICPA's previously built relationships should ensure that it can dominate this market. Mr. Rowlands does not believe that these two competitors pose a significant threat to GFI's business (though CEOs have an incentive to make or believe such claims) so it is just a matter of building awareness about Petromark and presenting business cases to each country to demonstrate the massive positive impact of the program relative to the cost. For instance, Mr. Rowlands has stated that the Petromark program in Albania resulted in an $11 million increase in tax revenues in September 2014 compared to September 2013, the first month the program was put into place in the country as a result of the legal (marked) market growing by 20%.

I believe that SICPA will be successful in capturing a substantial market share from the "low hanging fruit" countries; 50% of the market by 2018 and 90% of it by 2024. This would mainly comprise countries in Northern Africa, the Middle East and Eastern Europe which are susceptible to smuggling from terrorists or other criminal elements, have access to cheap oil and therefore present the most profitable opportunities for cross-border oil smugglers and the nations' governments rely heavily on oil for their economic growth and tax revenues.

As it makes sense to focus on these easier targets first, I don't expect much market share to come from the rest of the world in the first few years. However by 2024, I assumed that SICPA will have captured 40% of the market from countries not in the "low hanging fruit" category. This would result in over $600 million in annual revenue for SICPA in nine years. While this seems like a very large target, SICPA has already developed substantial business relationships through its aforementioned alcohol and tobacco tax reconciliation programs. I believe that SICPA will be successful in selling its oil marking program alongside its current offerings to its existing client base of sovereign nations across the globe.

(click to enlarge)

Some may even argue that my numbers are too conservative in the early years. For instance, another investor uncovered the European Union tender process for the "fiscal marking of gas oils and kerosene". If SICPA was to procure such a contract, it would likely blow away my numbers in the first three years. I have no evidence to suggest that SICPA will procure this contract, so investors should view this or any other large potential contract as untapped upside until it has been signed.

5% of SICPA's revenue would be subject to EUO's earn-out payment for the first six years along with an additional 5% earn-out payment for three years on contracts signed in the fourth through sixth years of the agreement. That means EUO has potential to earn an earn-out payment for up to nine years, albeit on a quickly diminishing base as shown between 2022 and 2024.

Subtracting the guaranteed minimum which was already modeled in the previous section and subjecting the cash flows to a 25% corporate tax rate leads to an $0.18 fully diluted per share present value of the earn-out payment portion of the business for EUO, using a 25% discount rate.

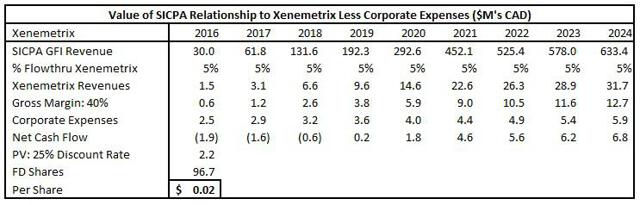

Petromark requires that the government implementing the program purchases a certain amount of detectors. Every program needs at least one, but if a country wants to keep tight tabs on the integrity of gasoline sold at gas stations within its borders, it will have to order dozens or perhaps more than a hundred detectors. Xenemetrix will continue to be the supplier of detectors for GFI which was one of the biggest considerations for EUO doing this deal. While it gives up GFI for 5% in earn-out payments and $16 million in upfront cash, the vendor relationship with Xenemetrix doesn't change, except for the fact that GFI is projected to become a lot bigger, a lot faster. Xenemetrix revenue to this point has trended towards about a million dollars a year. As SICPA will offer the Petromark system to numerous countries already in its Rolodex, I expect revenue to substantially increase as new programs will require new detectors.

Xenemetrix revenue represented about one-sixth of EUO's total revenue for 2015, with GFI accounting for the rest. I estimate that roughly 5% of SICPA's GFI revenue generated will result in revenue for Xenemetrix as well when governments need to buy or upgrade the hardware. This is substantially lower than the ~15% of "flow through" that Xenemetrix saw through GFI previously, but keep in mind those revenues excluded logistics at that time.

According to EUO's most recent financials, Xenemetrix has achieved a gross margin of around 40%. I assume that will continue. I have included all of EUO's corporate expenses in this section rather than parceling out these expenses to every section as there would be no difference to the valuation by doing so. Corporate expenses are on pace to be $4 million for 2015. After discussions with the company, I believe that corporate expenses including research and development will be in the $2.5 million range for 2016 and will grow 10-15% each year. Much of 2015's expense has been for research and development in preparation for both remaining subsidiaries to launch products this year.

(click to enlarge)

A 10-15% growth rate in expenses may seem too low for a company with such aggressive revenue increase assumptions, but I believe it is appropriate for two reasons:

1. Much of the revenue will come through SICPA, either as a direct earn-out payment or through servicing the hardware needs of GFI's new clients signed up by SICPA. EUO will need less money compared to other companies for expenses like marketing to fuel growth.

2. Bruce Rowlands has demonstrated austerity to achieve profitability in 2015 and I believe he has the mindset to grow while minimizing expenses. Upon speaking with him, one of the primary reasons why he wishes to hoard the cash received in the SICPA deal is to use it as leverage - he believes that EUO's strong balance sheet will tip negotiation power in EUO's favor, which will only lead to better deals and cost efficiencies for the Company.

When using a 25% discount rate, this leads to a 2 cent value per share. Keep in mind, this is net of all the Company's corporate expenses so those costs are no longer a burden in the next section. When looking at a rolled up P&L of all these distinct pieces, I expect EUO to have a negative EPS in 2016, excluding the one-time accounting benefit of the upfront cash portion of the deal. 2017 should return to profitability based on the earn-out revenue, increased detector sales for Xenemetrix and increased cash flows from sales of new products starting in 2016.

Xenemetrix and XwinSys: The "cherry on top" of the EUO pie

By now I should have clearly demonstrated the value that EUO holds purely from the deal signed with SICPA. Xenemetrix and XwinSys can be considered the "cherry on top" as just two bonus reasons to buy into this Company at less than 20 cents. They are two not-well-known but exciting technologies on the verge of standing on their own merits.

Xenemetrix specializes in the design, development, production and marketing of Energy-Dispersive X-Ray Fluorescence [ED-XRF] systems. ED-XRF spectroscopy is one of the simplest, most accurate and economic analytical methods for the determination of the chemical composition of many types of materials. It can be used to measure a wide range of atomic elements, from sodium to uranium with detection limits as sensitive as a few parts-per-million. In addition to elemental analysis, ED-XRF can be used to measure the thickness and composition of multi-layer thin films.

While Xenemetrix is best known as the hardware provider for the Petromark technology, the subsidiary has done considerable research into the expansion of the ED-XRF technology into many different industries, from marine to construction. Much like how ED-XRF allows for immediate material composition analysis of fuels during the Petromark process, it can do the same for underwater vessels or for machinery at a construction site. Rather than wait for a period of time for lab results, business and military users can get immediate on-site analysis of these materials. Given the wide variety of elemental analysis it can perform, it can be used to measure far more than just oil. This includes agricultural and pharmaceutical products, rubber and textiles, metals, alloys, cement and glass as well as monitoring the pollution levels of solid and liquid waste.

In addition to the numerous materials that Xenemetrix's ED-XRF technology can measure, XwinSys is developing a similar solution for the semiconductor and related microelectronics industries. This subsidiary is developing synergistic combinations of the ED-XRF technology and automated 2D and 3D image processing technologies for the purpose of developing a fully automated metrology system aimed at the semiconductor market back-end. This will help chipmakers detect defects and other inconsistencies in their chips in a reliable and efficient way.

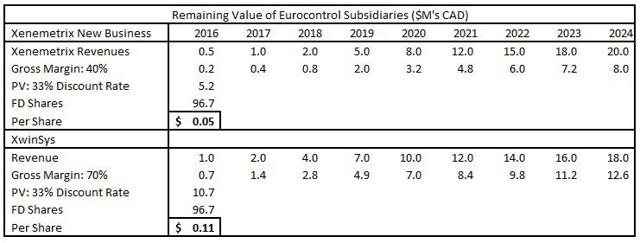

Xenemetrix and XwinSys technologies appear to have unlimited potential. Mr. Rowlands and the Company's philosophy is that "anything that can be measured, should be measured" and that philosophy can be applied to anything from preventing fraud and criminal activities to ensuring consistency and minimizing defects in the manufacturing process. The irony with that quote is that the wide-range of potential uses for these technologies and the fact that they are all in the pre-revenue stage outside of servicing GFI make it very difficult to come up with a realistic forecast. EUO's target market on the marine industry alone is expected to surpass a billion dollars with 55,000 active merchant ships that could benefit from ED-XRF, but I'm not prepared to go with such a high forecast just yet.

I like the enthusiasm and knowledge of EUO's management led by Mr. Rowlands, but I'm not going to jump the gun on an aggressive forecast until EUO has had some success in penetrating the market with these leading edge technologies. Shown in the chart below is what I believe to be a sufficiently conservative forecast, a risk-weighted revenue assumption of $20 million by 2024 for each of Xenemetrix's "new" (non-GFI-related) business and XwinSys.

(click to enlarge)

I assumed that Xenemetrix will continue to achieve a 40% gross margin while discussions with the Company led me to believe that a 70% gross margin on XwinSys is achievable. On top of conservative revenue numbers, I used a very high discount rate of 33% to come up with a present value per 96.7 million fully diluted shares of 5 cents on Xenemetrix and 11 cents on XwinSys.

My one-year target on EUO is $0.55 CAD per share

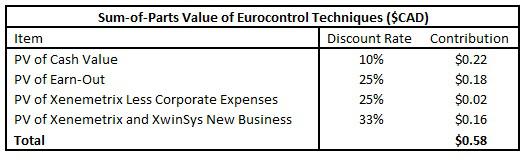

Based on the sum of the four pieces computed above, EUO has a fair value of $0.58 per share:

I have rounded that off to a $0.55 target. Investors can reasonably expect at least a $0.40 stock price just from the relationship with SICPA while completely discounting any future speculative revenues from Xenemetrix or XwinSys.

Conclusion: EUO offers investors a stake in a major partnership, two leading-edge technologies and an experienced management team for less than its cash value

When an investment thesis is put together, especially on a penny stock, one has to consider the risks. What differentiates EUO from the typical microcap is that it is trading at a discount to its guaranteed cash flows but also has promising technologies. An investor can find plenty of companies trading below cash value, but their business prospects may be so poor that they are essentially shells paying management salaries out of shareholder's pockets. Also, one can find plenty of interesting technologies but those companies have no funds nor a solid plan to try to capitalize on them.

EUO, led by Bruce Rowlands, has lived and breathed this "precise measurement technology" industry for a decade. Up until about a year ago, this Company and its dealings with developing nation governments to try to stop fuel fraud has been largely characterized by protracted sales cycles. With the rise of terrorism and the partnership with SICPA, GFI's Petromark technology will have unprecedented access to government decision-makers, but EUO is still highly misunderstood and in my opinion, underestimated.

An investment thesis is made purely from the fact that EUO trades at less than its cash. But a long term investment thesis is held when after buying in, investors decide to do research into these subsidiaries and try understand why SICPA chose EUO's subsidiary GFI. After investors have a conversation with Bruce Rowlands, I believe they will come to the same conclusion as I did - this man knows the Petromark tag and trace measurement technology industry better than pretty much anyone else in the world. There is no one better suited to leading this Company into a dominant market player in conjunction with SICPA.

Update: Eurocontrol announces share repurchase plan

While I had put the finishing touches on this article, EUO announced a share repurchase plan of up to 8.7 million shares last Friday. As it seeks to buy back shares on the open market at substantially lower prices than my target, I consider this plan to be anti-dilutive which will increase the Company's per share valuation.

Disclosure: I am/we are long EUCTF.