ARCA:GBTC - Post Discussion

Post by

thegreenmile656 on Dec 16, 2022 8:32am

Futures Tumble Ahead Of $4 Trillion Quad Witch, 2nd Biggest

https://www.zerohedge.com/markets/futures-tumble-ahead-4-trillion-quad-witch-2nd-biggest-ever-opex

Futures Tumble Ahead Of $4 Trillion Quad Witch, 2nd Biggest Ever OpEx

by Tyler Durden

Friday, Dec 16, 2022 - 08:06 AM

A miserable week for global stocks - which wrongfooted traders as risk first soared after a weaker than expected CPI only to tumble more than 7% just two days later - was set to end with even more selling on Friday after hawkish signals from the Fed and the ECB sparked worries about higher-for-longer interest rates leading to a possible recession: the latest economic data signaled a slowdown in US growth; data from France showed that it faces a greater recession risk, with its PMI falling to its lowest level in two years. Similarly UK companies are steeling themselves for an economic contraction, with both the manufacturing and service sectors experiencing a slump in the fourth quarter. Economists now see a 60% probability of recession in the US and an 80% chance in Europe. Equity analysts have cut 12-month earnings estimates for the regions to the lowest levels since March and July, respectively.

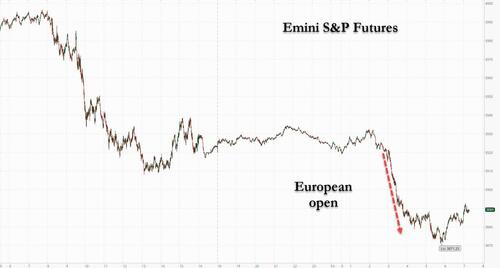

Not helping matters is today's massive, $4 trillion quad-witching option expiration, which as we previewed yesterday threatens to become a liquidity-draining vortex just as CTAs are forced to dump stocks. potentially leading to outsized price moves. With the S&P 500 stuck for weeks within 100 points of peak gamma at the 4,000 strike, the sheer volume provides a positioning reset that could turbocharge market moves. Given the backdrop of hawkish central banks and slowing growth, worries are mounting the expiration will act as an air pocket.

Finally, bitcoin plunged back under $17K following news that accounting firm Mazars has paused work for all crypto clients globally, according to Binance, which was a customer of the auditing firm.

Between all that, it is perhaps surprising that S&P futures are down only 1% while contracts on the Nasdaq 100 dropped 0.62% by 6:56 a.m. in New York. The overnight selloff accelerated when Europe opened as European peripheral bonds blew out amid fears that the ECB's aggressive tightening and QT will crash the European bond market. The dollar fluctuated and Treasuries dropped across the curve. Oil trimmed a weekly gain, sliding more than 2% amid renewed fears that the Fed is pushing the US into a crash-landing.

The S&P 500 index, already on track for its biggest annual slump since 2008, erased another $1.1 trillion in market capitalization in the past two days after both the Fed and the ECB took a more hawkish tone than expected about how much further rates will need to rise to tame inflation. The MSCI ACWI Index, the global equities gauge, headed for a 1.4% retreat this week.

“The worrying aspect for markets is the rate hike finishing lines are still unknown, and we have the two most dominant central banks in the world climbing the mountain into very restrictive territory,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Hiking interest rates into a dimming macro environment will undoubtedly trigger a recession. The question is just how profound.”

Ann-Katrin Petersen, senior investment strategist at BlackRock Investment Institute, said on Bloomberg Television that central banks were starting to acknowledge they will have to crush growth and will likely engineer recessions to tame inflation.

Among notable moves in US premarket trading, Adobe shares are up 3.7% in premarket trading, after the software company reported adjusted fourth-quarter earnings that beat expectations. Analysts said the report speaks to positive demand for creative design software despite economic uncertainties. Guardant Health shares sank after following disappointing results from a study of its blood test for detecting colorectal cancer in average-risk adults. Here are some other notable premarket movers:

• Amazon (AMZN US) falls 1.3% in premarket trading as JPMorgan cut its price target on the stock to $130 from $145 primarily due to AWS revenue deceleration and margin compression amid challenging macro conditions.

• Meta Platforms (META US) rises 1.7% in premarket trading as JPMorgan raised the recommendation on the stock to overweight from neutral, citing increased cost discipline and a more favorable revenue outlook.

• Lanvin (LANV US) shares surge 56% in US premarket trading, following a volatile New York trading debut for the luxury group that saw its stock bounce between a gain of as much as 130% and declines of more than 50%.

• Stocks exposed to cryptocurencies drop in US premarket trading, as the price of Bitcoin fell below the $17,000 level after the Binance exchange said French auditor Mazars Group had paused work for all crypto clients globally. Hut 8 Mining (HUT CN) -4.6%, Block (SQ US) -2.1%.

"Recessionary fears raced back to the top of the agenda and any thoughts of a Santa rally have all but evaporated, with previous hopes of peak inflation and interest rates being soundly rejected,” said Richard Hunter, head of markets at Interactive Investor. “Comments from the ECB in particular that ‘we are not slowing down, we are in for the long game’ were in direct contrast to what markets had been pricing in over recent weeks.”

The slump this week also kept the S&P 500 from overcoming a technical downtrend in place since the start of the year, which has put an end to the past three bear-market rallies. The index didn’t convincingly break above its 200-day moving average, and is now close to testing its 50-day moving average, two other closely watched technical thresholds.

Be the first to comment on this post