Now that the price of gold has bottomed, here is the case for $34,000 gold.

Gold To Skyrocket vs Monetary Base

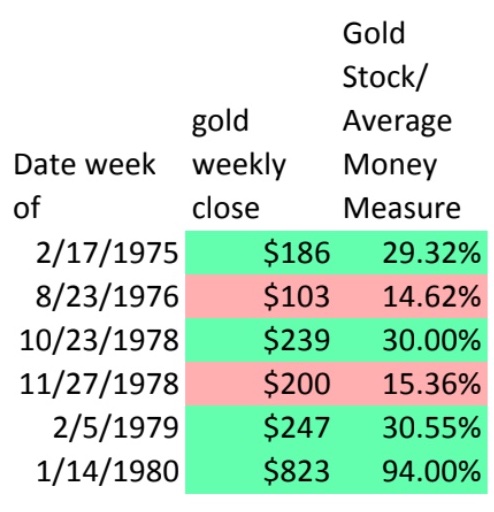

April 1 (King World News) – Email from KWN reader Kevin W: This is a look at the cyclical bull run that ended in all-time weekly highs occurring in February 1975, with an ensuing 50% correction ending in August 1976. Then gold surged to new all-time highs in October 1978, with an ensuing swing low of minus 20% that ended in November 1978, renewing with new all-time highs in February 1979, and finally ending with the end of the secular bull peak in January 1980. Take a close look at what the monetary aggregates and interest rates were doing along with the price of gold. And take notice of the 8,132 tonnes of gold the US possessed vs the Monetary Base, M1, M2, and Total Federal Reserve Bank Credit.

Gold vs Monetary Base 1975-1980

(Gold-Backing In Percentage Terms)

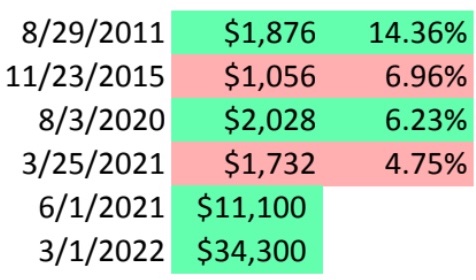

Now look at the cyclical bull run that ended in all-time weekly highs occurring in August 2011, with an ensuing 50% correction ending in November 2015. Then gold surged to new all-time highs in August 2020, with an ensuing swing low of minus 20% that ended in March 2021…

Billionaire Eric Sprott Buying

To find out which company billionaire Eric Sprott just bought a 12% stake in click here.

Gold will now proceed to new all-time highs and finally end the secular bull peak with a price level in gold that takes the value of the 8,132 tonnes of US gold relative to Monetary Aggregates vs what they were at the secular bull run peak of January of 1980. $11,100 would put Gold vs Monetary Base at 30.55%, similar to 1979. At $34,300 Gold vs the Monetary Base will equal what it was in 1980 (94%).

Gold vs Monetary Base 2011-2022

(Gold-Backing In Percentage Terms)

$11,100 Gold vs Monetary Base = 30.55%

$34,300 Gold vs Monetary Base = 94%

$34,000+ Gold

After a 20% swing low decline from the all-time high in the gold price, US Gold vs Monetary Base is only 4.75%. By all accounts, gold is so severely underpriced relative to the Monetary Aggregates that a 5 to 20x market price is totally on the cards if the central planners are perceived to lose control…

To learn about one of the most exciting silver plays in

the world click here or on the image below

Higher interest rates are a negative vote of confidence for the Fed, the dollar and all fiat. With the huge increase in M1 and M2 that has already occurred not to mention the recent relief and stimulus plans that with take effect immediately, my money is on gold, nothing else. The price of gold will likely get unimaginable on the upside $34,000+.

To listen to one of Egon von Greyerz’s best interviews CLICK HERE OR ON THE IMAGE BELOW.