When you take into consideration all the items high lighted below and add in the costs it would take for any of the other companies in the map area below to become producers..it would take them years and years not to mention 100`s of millions to build a mine and mill from the ground up...so when I look at gold price and cost involved to start up a mining operation..8 cents a share is a sale not to mention more drilling and more gold ounces to be added...now we need management to produce ...it`s time to sell or develope MTO... into a profitable mining operation with a chance then to become a true mid tier producer once Barry gets up and running more devlopment would help in controlling AISC which in turn will help move the company to the next stage...IMHO...

Valuation Commentary:Metanor Resources Inc. (TSX-V: MTO) (US Listing: MEAOF) (Frankfurt: M3R) is a successful commercial junior gold producer at its 100%-owned Bachelor Gold Mill in stable, mining-friendly, Quebec. Gold recovery rates at the mill are >96%, and in 2015 the Company produced >40,000 ounces of gold. With a current market capitalization near-$32.5 million Canadian (trading at only ~7.5 cents), MTO.V presents a significant opportunity for shareholders as its primary asset, the Bachelor Mill, has a replacement value of several times the Company's current market cap and is increasingly being viewed as a coveted strategic asset being the only mill within 200km in a gold-rich district. Metanor's total infrastructure is valued (estimated replacement value) at between CDN$150M to $200M. Of note, Eric Sprott recently increased his equity position in MTO.V, last purchasing shares on the open market 'above' the current trading price, and there is strong potential for MTO.V to excel near-term as the Company exhibits enhanced attractiveness as a potential take-over candidate in an area undergoing consolidation. The math on the inherent asset value seems to indicate Metanor is substantially undervalued and apt to trade higher, especially as the Company affirms the serious potential for production on a second front; possibly even totally supplanting Bachelor ore, beginning in Summer-2017 from a new 347,000 oz Au In-Pit resource (in all categories) at the Company's 100%-owned Barry deposit (located ~116 km by road from the Bachelor mill) under an improved higher-grade (2+ g/T) model. Barry is a game-changer as it will allow Metanor to process ore at its Bachelor Mill that is NOT subject to a streaming agreement. The Company is rapidly advancing toward reopening mining its nearby Barry open-pit, having received a positive preliminary economic assessment study (PEA) this September-2017 with NPV of $53.5M, IRR of 198% before taxes, and all-in production cost of $1,114/oz (US $891/oz).

Fig. 1 (below) Primary asset: 100%-owned Bachelor Gold Mill

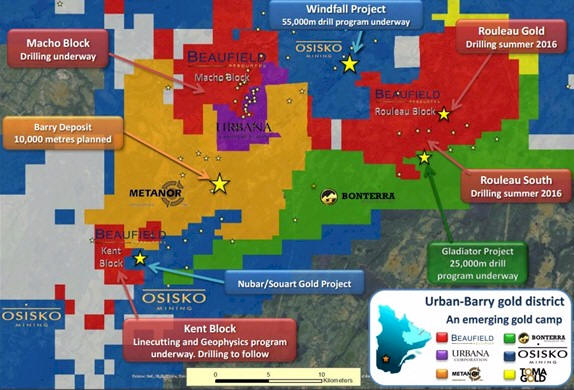

Urban/Barry mining camp undergoing consolidation, Metanor holds key assets:

On September 22, 2016 Metanor announced a positive PEA on Barry. Metanor's Barry project now appears destined to become the first to achieve a steady gold production scenario amongst a handful of players (include Osisko Mining Inc.'s prolific Windfall Property, Bonterra Resources' Gladiator Deposit, Beaufield Resources' Macho claims, and Urbana) whose gold system collectively is part of a new mining camp in the Barry-Urban township of Quebec.

Fig 2. (above) Urban/Barry Mining Camp - The Barry deposit lies at the center of mineralized trend, with critical exploration targets. The main pit extensions over a 4 km potential strike. Exceptional targets are proximal Windfall Lake and on trend with the successful results of Beaufield / Urbana. To the ENE, in close proximity to the Bonterra claims and on trend with promising early stage results have been reported by Bonterra.

Significant cash flow without high development costs at Barry open pit:

With open-pit production pegged to begin in Summer-2017 and ramp-up expected to attain 37,573 ounces/annum for year two, Metanor will become a cash flow machine at Barry with all-in production cost projected at only $1,114/oz (US $891/oz) -- the estimate was made with all manner of assumptions conservatively (as proper PEA's ought to be) considered, including dilution and using a gold price of only C$1,560/oz -- the financial analysis using higher gold prices of C$1,710/oz would generate a NPV at $78.07 million with an IRR of 246% before taxes. Spot gold is currently (as of October 6, 2016) near C$1,660, and many believe substantially higher gold prices are in the cards. Under the base PEA we are looking possibly C$15M+ in positive cash flow per annum from Barry, under current gold prices we are looking closer to C$23M+ per annum in positive cash flow. Important to note is that Metanor will pay no taxes for at least the first 2 - 3 years with its loss carry forward on the books, plus there is no streaming agreement on the Barry project.

The next step for Metanor is to drill and complete a complete a feasibility study. Metanor has a 8,000 meter drill campaign on its Barry property underway. The objective is to increase the mineral resources around the pits at Barry and to increase their quality by converting mineral resources from the inferred category to the indicated category. To date geologists have identified a total in-pit resources of 347,350 ounces at 2.07 g/t in 5.24 million tonnes. The last compilation on the pit area showed that the resources are open in many areas. There is in excess of 1 million ounces identified in the published NI43-101 in all categories. The initial operation presented in the PEA is a small operation, however there is no shortage of gold at Barry and the operation is scalable for ounces