Up to 40% refundable tax credit for clean hydrogen

Budget 2023 also announced the details of the Clean Hydrogen Investment Tax Credit, incentivizing investments made in clean hydrogen production.

The proposed Clean Hydrogen Investment Tax Credit will cost $5.6 billion over five years, starting in 2023-24. The Clean Hydrogen Investment Tax Credit is anticipated to cost an additional $12.1 billion between 2028-29 and 2034-35.

The levels of tax credits will range from 15% to 40% of qualified project expenses, with the projects that produce the cleanest hydrogen receiving the most support. It also proposes to provide a 15% tax credit for the equipment required to convert hydrogen into ammonia.

------------------------------------------------------------------------------

Remember the Brine value chart ?

See the .... NH3 ?

That stands for - ammonia.

Wink.

It's how hydrogen is placed into reserves underground.

Hydrogen combined with Nitrogen.

See how silly pulling lithium out of oilbrines is...?

Like i said...there's a far larger story in play.

https://twitter.com/garquake/status/1612642742466740224?lang=en Finance Minister Chrystia Freeland has quite the ambitious plan for Canada’s transition towards a green energy future— so ambitious in fact, that she wants to prematurenly spend over $2 billion of Canadian taxpayers’ funds to buy shares of a company that doesn’t even exist yet.

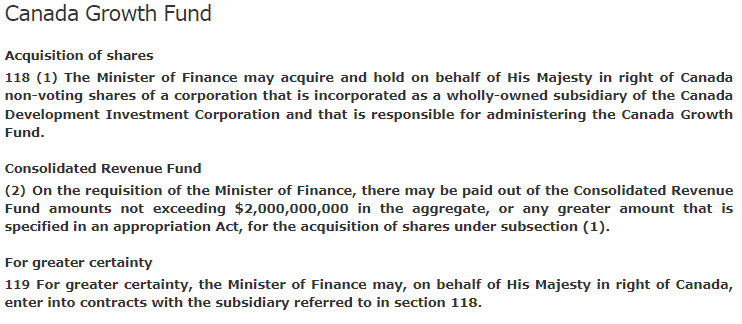

Neatly tucked away in the Liberal government’s 172-page budget bill is a clause that will grant Freeland the authority to spend $2 billion “or any greater amount” from the Consolidated Revenue Fund, to purchase shares of a non-existent company. That’s right, you read that correctly: as per Part 4 of Bill C-32, “The Minister of Finance may acquire and hold on behalf of

His Majesty in right of Canada non-voting shares of a corporation that is incorporated as a wholly-owned subsidiary of the Canada Development Investment Corporation and that is responsible for administering the Canada Growth Fund.”

The vague company is owned by the Canada Development Investment Corporation, a government-owned company reporting to the Minister of Finance that raises private capital via the Canada Growth Fund (CGF). The CGF, for its part, was first unveiled in the Fed’s 2022 April budget with the intention of curbing emission-intensive industries to meet climate targets whilst growing the economy. The Liberals are planning to equip the fund— which isn’t set to go live until sometime in 2023— with $15 billion in initial capital, that will be loaned out at a low cost to businesses participating in green initiatives.

Snippet from Bill C-32. Full text found here.

Snippet from Bill C-32. Full text found here. So, what does that mean for Canadian taxpayers? Well, no one really knows, because the aforementioned non-existent subsidiary doesn’t have a name yet— let alone isn’t even incorporated. We don’t know what purpose the company will serve in the context of green technology, who will sit on the board— or if it will even have a board at all. To further drive home the ambiguity, Part 4 goes as far as failing to provide information on the function and mandate of the subsidiary, its governance structure, or how it will report to Canadians.

More importantly, Part 4 doesn’t provide details as to how the $2 billion will be spent. “Since the corporation does not exist, what does the minister intend to do with the $2 billion? Will she retain the money until the corporation is created, or will she invest it — and if so, where?” Questioned Senator Elizabeth Marshall. “Of equal concern is the provision in the bill that provides the minister with the authority to draw down, as the bill says, ‘ . . . any greater amount that is specified in an appropriation Act . . . .’ There is no dollar limit affixed to this greater amount,” she pointed out.

https://thedeepdive.ca/chrystia-freeland-wants-2-billion-for-non-existent-green-corporation/

Fiddle with lithium in dirty brines ? Or... get down to business.

Keep hydrocarbons in tact to utilize as, retaining hydrogen reserves.

Keep majority of salts in, brines.

Use small portion of salts to blend with peaceriver water

for the production of, clean, green, infinite hydrogen.

Heat

Electricity

Fuel ( petrogen )