FAR EAST

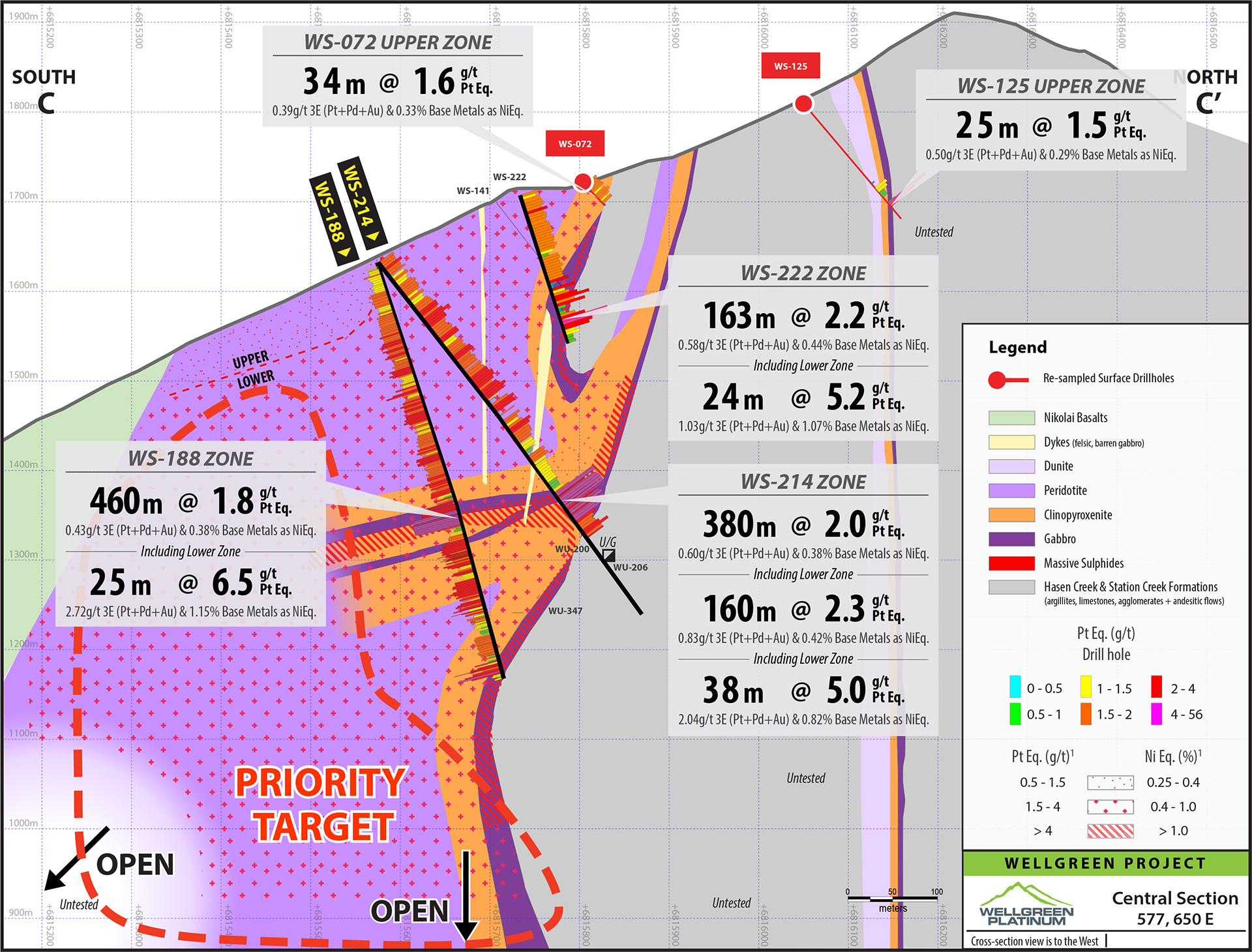

Lots of ore below the 2023 ( 1125m pit depth )

I provided overlays ( how i envision the deposit )

If pit shell runs towards north west and scales to over 1760 m

Just how much ore can be mined if.... pit jumps over ug mine.

Inset image ( 2023 pit shell )

Good 350 m of ore below pit shell.

I'm glad the image included elevation measurements.

Bottom scale - 100m increments ( first image )

Good 800 m wide

First Image relays Pt Eq 2 - 4 grams in red - along drill intercept.

CENTRAL ZONE

Step back more drills - even thicker intercepts - based on, image.

Very similar to, Far East.

I decided to crunch a few numbers using a different mine model.

1.8% Ni fetches $72 / Con with 20% Fe

2023 cost to mine per tonne including transpot = $30 / t

$72 - $30 = $42 profit

Since Nickel and iron are sold per 2000 lb ton.

I recalculated the 437 million tonnes

adjusts to 480 million tonnes

Using 54% Ni recovery

takes 13 tons to achieve 1.8% grade ( 26 lbs Ni )

36,976,923 million con tonnes ( 2000 lb ) can be created

x $42 profit per 1.8% nickel con

= $1.55 billion

13 tons of ore processed with 10% iron

= 2,860 lbs iron

- iron content in 1.8% nickel con ( 20% Fe ) 400 lbs

= 2460 iron pounds remaing

$125 profit ( 460 pounds over standard ton )

x 36,976,923 million ( 13 ton lots )

= $4,997,115,375 billion

7 million oz plats recover 50% ( promised they would work on this 2016 )

3.5 million oz

x $1000

= $3.5 billion

Capture these 3 groups of minerals

= $10 billion ( far better than current pfs )

sell the remaing minerals to

another cdn junior ( jv ) who pulls / works the remaining, cu, mg, co, cr, ti

quite attractive

ores already out of ground could be a great business for another, right ?

Cheers...